ONEQ vs. QQQ: Comprehensive Comparison and Analysis

This article will compare two popular NASDAQ ETFs: the Fidelity NASDAQ Composite Index Tracking Stock (ONEQ) and Invesco’s QQQ Trust (QQQ).

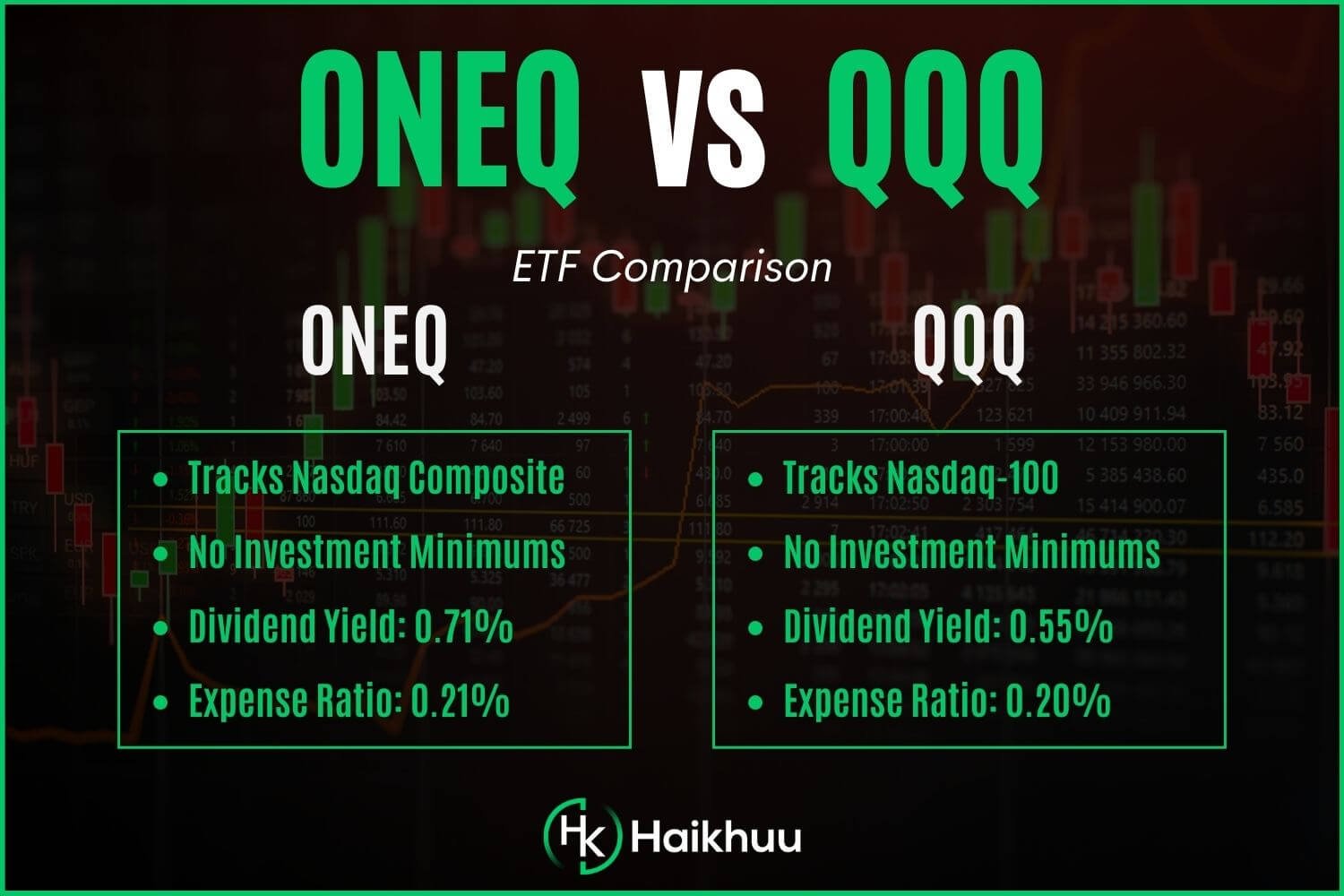

ONEQ vs. QQQ Overview

ONEQ tracks the Nasdaq Composite Index

QQQ tracks the Nasdaq-100 Index

ONEQ – Fidelity NASDAQ Composite Index Tracking Stock

Launched in 2003, Fidelity’s ONEQ ETF tracks the NASDAQ Composite Index, providing investors with extensive exposure to over 2,500 holdings across various sectors. These include the technology and consumer discretionary sectors and healthcare, industrials, and more.

QQQ – Invesco QQQ Trust

Invesco’s QQQ, launched in 1999, tracks the NASDAQ-100 Index and hence provides exposure to the 100 largest (excluding financials) domestic and international non-financial securities listed on the NASDAQ Stock Market.

Expense Ratio Comparison

QQQ - 0.20%

ONEQ - 0.21%

Managing ETFs incurs costs, which are passed on to investors as expense ratios. QQQ has an expense ratio of 0.20%, which is slightly lower than ONEQ’s expense ratio of 0.21%.

Though the difference seems minimal, it can add up over time, especially for large investment amounts held over longer durations.

Dividend Yield Comparison

As for the dividend yields, ONEQ offers a dividend yield of around 0.71%, while QQQ offers a slightly lower dividend yield of about 0.55%.

Holdings Comparison

When it comes to holdings, QQQ has a more concentrated portfolio, predominantly in the technology sector, featuring around 100 holdings, including tech giants like Apple and Microsoft. The top ten holdings account for more than half of its portfolio.

On the contrary, ONEQ offers far greater diversity, with over 2,500 holdings spread across various sectors, including tech, healthcare, and consumer discretionary. Its broader diversification serves as a hedge against sector-specific risks and may offer more stability during volatile market conditions.

Performance Comparison

Comparing the performance of ONEQ versus QQQ is essentially a look at broader tech exposure and concentration.

In periods where tech stocks outperform, QQQ tends to do better. Conversely, in more uncertain periods, ONEQ’s broader diversification could potentially provide more stability and comparatively consistent returns.

However, remember that past performance is no guarantee of future results and both funds’ performances may be influenced by a variety of market conditions and factors.

Which Is Better For You?

The choice between ONEQ and QQQ is largely dependent on your investment objectives and risk tolerance. If you have a high-risk tolerance and wish to have concentrated exposure to high-growth tech stocks, QQQ might suit your needs. But, if you seek broader market exposure and higher dividend yield with a more balanced risk-profile, then ONEQ could be more appealing.

Choosing an appropriate ETF is a major decision and should be undertaken with comprehensive information and analysis. Both QQQ and ONEQ have their respective merits and potential considerations. Time spent understanding these funds can help ensure they align with your overall investment strategy.

If you want to learn more about investing in the stock market, you can join the HaiKhuu Trading Community!

HaiKhuu offers live trading calls with experienced traders, daily trading reports, and gives you access to thousands of experienced traders willing to help you learn.

Frequently Asked Questions (FAQs)

What is the difference between ONEQ and Nasdaq Composite?

ONEQ is an ETF that strives to replicate the performance of the NASDAQ Composite Index. The NASDAQ Composite is an index that includes all NASDAQ domestic and international listed securities. So in essence, ONEQ is a financial instrument you can invest in, whereas the NASDAQ Composite is a benchmark index that the ETF aims to mirror.

What is a good substitute for QQQ?

If you’re searching for an alternative to QQQ, ONEQ could very well be a viable option. It offers a broader exposure as it encompasses the entire NASDAQ Composite, giving investors access to a wider range of sectors beyond just technology.

How often does ONEQ pay dividends?

ONEQ typically pays dividends to its shareholders quarterly. However, the amount and frequency of these payouts may vary based on the fund’s performance and prevailing market conditions.