Algorithm and Portfolio Stats: 02/19/2024 - 02/23/2024

Let’s start with the bad news - the Day Trade Bot has had a fairly unsuccessful week. If you’d taken every trade it called since the start of the month, you’d be down about 0.58%. This is a substantial magnitude for this system, and coupled with the sheer consistency of losses over the last week, it’s looking pretty unlikely that we stick with this next month. As such, we’re continuing to focus our development time on the plan B algorithm.

At this time, development is progressing nicely on our plan B system. The biggest obstacle we’ve faced with it thus far has been a rewrite of our back testing databases, to include premarket and aftermarket data. We won’t be sending trade notifications outside of market hours, but we will incorporate this data in our analysis. We intend for this to help mitigate the high-volatility of our technical indicators during the opening stretch each day. Additionally, we’re significantly expanding the warning signs the system looks at for potential fake-outs. These changes have all been completed, but we have 2 others in the works right now, both of which we’re hoping to have ready to roll out for March.

First, we’re looking to incorporate more dynamic stop and exit prices. As it stands, our bot can exit a position for 3 reasons: the stock hits its stop price, its stock hits its exit price, or the technical outlook is no longer positive. The third option is the most flexible, but for the sake of accuracy to back testing, can only be done at the end of a 5 minute candle. This exposes us to unnecessary losses if a position has turned bad 1 minute into a 5 minute candle. By dynamically adjusting our stop loss and target exit after each candle, we can help mitigate this issue. The downside here is that when notifications are sent out, with a stop loss and target exit price included, the bot may choose to ignore these, holding for greater losses or larger profits.

Secondly, we’re looking to incorporate re-entries. If the conditions are initially fairly strict to enter a trade, but we exit, should the bot be allowed to re-enter it shortly thereafter with more lenient requirements? At this time, our thought is: yes. This one is likely going to require reworking our back testing and live notification engines, but if we find it increases profitability we’re happy to do it.

We want to note that this algorithm is designed to be cherry-picked. When looking over the worst trades of the last week, almost all of them have been pretty clear fake-outs, but regardless we aren’t satisfied with this level of performance. Frankly, we won’t be satisfied with our algorithm until a user can follow it more or less blindly and still make a consistent profit. As always, this is not financial advice. We never recommend taking a position without doing your own due diligence. At the same time, we strive for a high level of quality with our output, and will continue working to improve our algorithm.

Now then, let’s go over some of our notable trades this week.

The best trade we saw this week was a long on MPWR. We entered right as the markets closed on Wednesday, and following a major gap-up overnight, exited near the open for a return of 2.87%. But then, we only really succeeded here because of a strong overnight movement. Let’s look at the best trade of the week that didn’t get exited at open.

I’d like to highlight this trade on NUE, from Friday. We got in at $187.90, and held for most of the day, until it hit our target exit at $190.48, for a very clean 1.37% return. What I like about this trade, as with many of my favorites, is its consistency. The move upwards was incredibly smooth. Not only did the stock never approach our stop loss, it didn’t show a lot of other warning signs either. The price action was consistently above the Tenkan-Sen line, with the technicals never getting close to a TK-crossunder either. This trade went down exactly as we like to see, and makes me optimistic for our next algorithm, more conscious of potential red flags.

Our best short of the week went fairly similarly to our best trade overall. There wasn’t a significant gap-down overnight - it opened the following day pretty near to where it closed, but a highly volatile opening candle led to it hitting our target exit price. We made 1.9% from this trade, and it’s a case where I actually regret using a fixed exit price. Had we held until the TK-cross reversed, we would have held until roughly $120.50, for a return of nearly 3.5%!

Lastly, for the sake of thorough analysis, we should examine our worst trade of the week: a short on NEM where we lost 1.76%. I don’t think a human trader would have taken this one, given that the TK-cross is somewhat weak, and bullish momentum was already returning, I still wish we hadn’t notified it at all. Ironically, the cross after this trade (at roughly 11:30 EST) was a much stronger signal. Not only is there more momentum in the direction of the trade, the cross itself is very strong.

Overall, we made 215 trades this week: 120 longs and 95 shorts. Now, let’s examine some stats on our long term portfolio.

This week was another win for our portfolio! We finished the week up 2.55%, compared to SPY’s 2.39%. It’s a small win, but all wins are good wins.

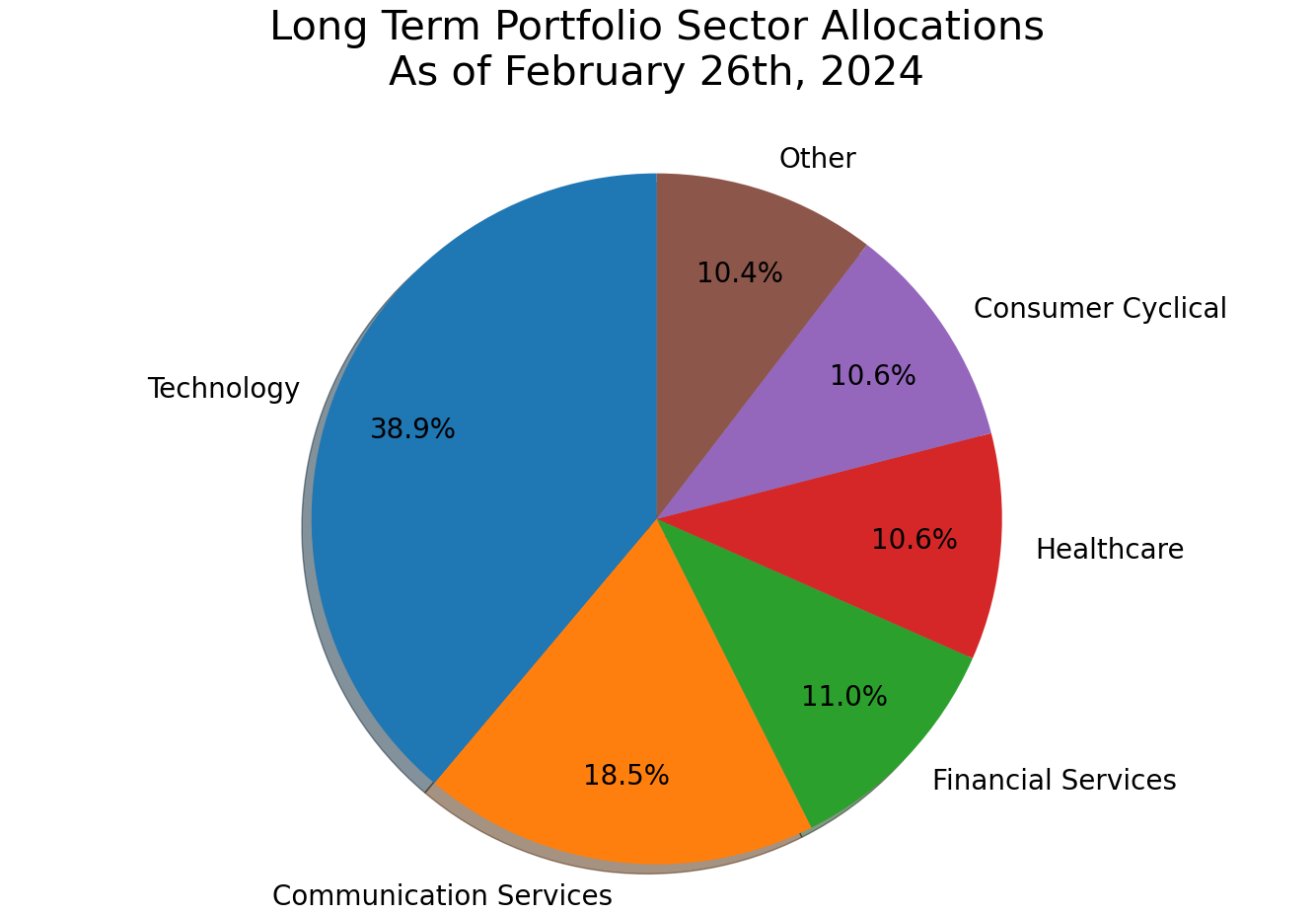

If we examine the frequency of of returns, our portfolio out-performed SPY, but also had a significantly higher volatility. As we’ll see below, this is largely because our portfolio has a greater overall market beta, as well as leaning pretty hard into tech. Being a significantly speculative sector, big tech allocations are going to lead to more volatility more often. Speaking of tech, let’s look at our breakdown of returns.

Looking at the sources of our returns, it’s pretty clearly tech. Tech stocks were some of the biggest winners in the market this week, and with a large swathe of our portfolio allocated into tech companies, we rode it til the wheels fell off. Looking ahead, these allocations will not be changing.

Looking ahead, our betas are going to remain fairly similar to last week’s. Our beta is a little over 1, but this is primarily due to us leaning into technology. If you’re more bearish on tech this week, you might do well to short some XLK to hedge that exposure. Alternatively, if you’re looking to go deeper into tech than the S&P 500 currently is, this might be the portfolio for you.

If you’re interested in following along this week, here are our main holdings. For brevity, I’ve omitted all stocks for which we’ve allocated less than 0.5%.

That’s all I have for you tonight. Thank you for reading, and happy trading!