Algorithm and Portfolio Stats - 03/25/2024 - 03/29/2024

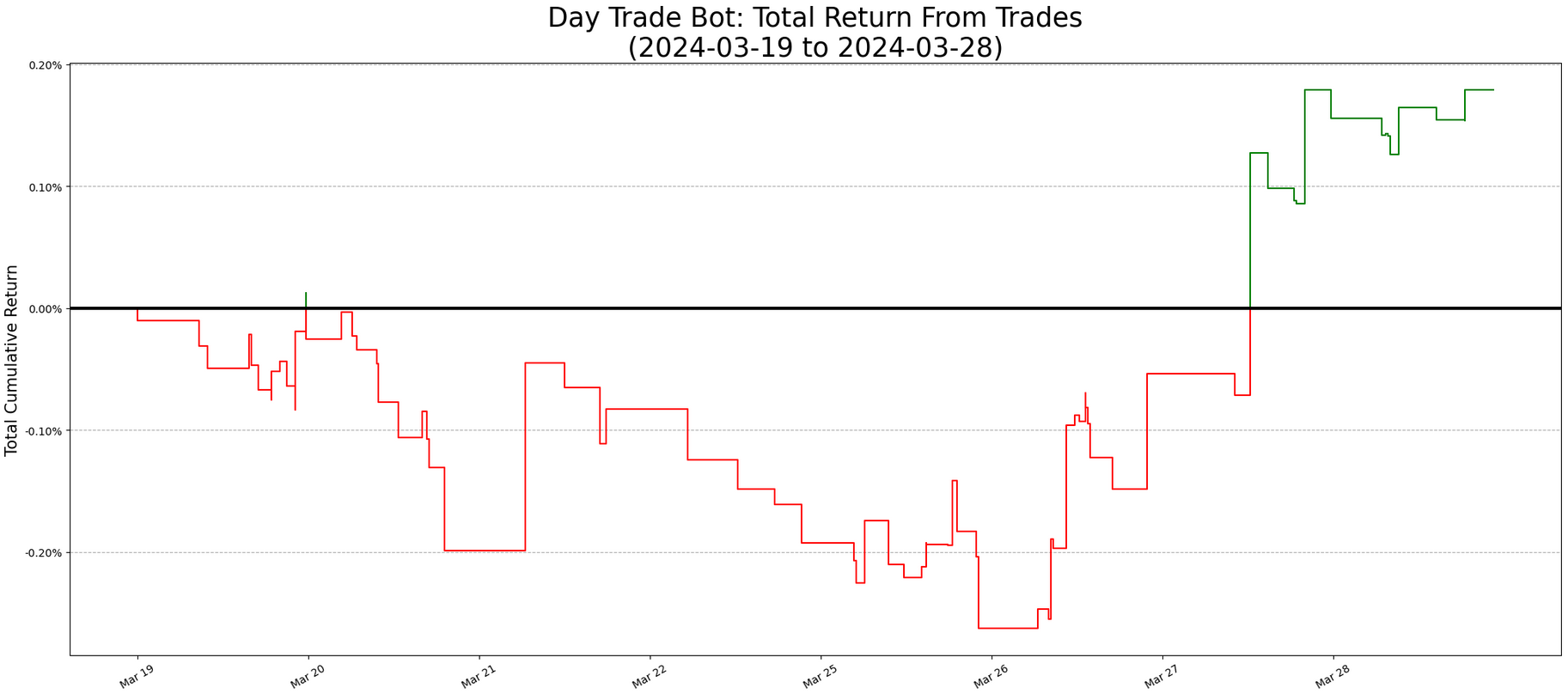

This week was a solid win for our algorithm, bringing our new system up to a positive return for the month of March. Granted, we launched it in the middle of the month, and so this only represents 8 days of market data, but every win is a good win. Throughout those 8 days, it recommended trades on an average of 5.88 tickers per day. So assuming equal allocations to all positions, and 17% capital allocations into each position, you’d be up 0.18%.

That doesn’t sound like much, and it isn’t - because this method of estimation is inherently pretty conservative. For one thing, it assumes that you’re taking every position that gets called out, with equal allocations to all of them - regardless of any red or green flags. So if you have experience trading, you had opportunities to beat it pretty constantly. Secondly, our method of estimating returns assumes that most of your capital sits idle for most of the day, and then when a trade opportunity comes up, you’re putting a small fraction of your portfolio into it.

The method we use to estimate overall returns from our system isn’t perfect, but it’s the best we have. We don’t include recommended allocations with our trade alerts, because we don’t want users to follow them blindly. We always encourage our users to do their own due diligence, and never take on a position without reaching their own conclusions first. As such, we have to make some assumptions about what fair allocations would have looked like here - so we choose to make conservative, but realistically achievable ones. We’d rather say “Our system made 0.18%, but you probably made more than that depending on how you allocated your capital” than “Our system made 1.05% - assuming you allocated 100% of your portfolio into every position, taking on whatever margin you needed in order to do that”.

Overall, I’m happy with performance over these last 2 weeks. More stability would have been great, seeing it over a longer time period would have been great, but every win is great to see.

We’re going to keep this current system running for the time being - likely until at least the end of April. At the same time, we have an experimental variation of the system we’ll be beta-testing on a staff-only server. This experimental version also performs well in backtests, but with more notifications each day - on average. Currently, our system is profitable, but would be more user-friendly if it called out more trade opportunities each day. If this experimental system performs well during the live test, we’ll likely do a full roll-out for it.

Now then, let’s look at our biggest winners and losers over the last week.

Our most profitable group of trades this week was on RCL, on Wednesday. It was a long position, with 1 re-entry, where we made a total of 1.72%. This is one of the best trades we’ve seen from this system, and overall, the gold standard of what we’re going for. I’ve analyzed this on a previous report, and I stand by my conclusions reached there. There was little reason not to take this trade. The Kijun-Sen line is somewhat flat going into it, but at the same time, the upward momentum is so strong that it largely negates that point of concern. The MACD looks great when we enter, and while it’s weaker during our re-entry, it’s still very positive. The cross is strong, the momentum’s great - I absolutely would have taken this.

Our biggest loser of the week was BLDR, specifically the 3 short positions we took on Tuesday. We lost 0.37% in total here. Overall, I don’t think the initial entry looks particularly bad. The Kijun-Sen line is pretty flat going in, but there’s enough momentum that I might have ignored that. I think both re-entries are much more questionable. The MACD fluctuates pretty hard between our initial exit and our re-entries, which suggests that there might not be enough momentum to sustain a downward push. On top of that, momentum going into the re-entries is far weaker than it was going into our initial entry. Even if you took all 3 of these, the total loss is fairly small relative to our winners from this week.

Let’s wrap things up by examining our portfolio.

This was a tough week for our portfolio, under-performing SPY by about 0.75%. It’s unfortunate, but not a major red flag. Our long term portfolio is just that: a long term strategy. It’s not designed to win every day, or even every week - but to beat SPY in the long run. One losing week does not a bad portfolio make, nor does it make us think there’s anything wrong with it.

Our biggest losers were our tech holdings but given they made up a plurality of our portfolio this week, and will continue to do next week, that’s not particularly shocking.

Lastly, I’ve included the contents of our portfolio below. We aren’t switching tickers this week, but we are re-balancing to maintain our market cap weighting. For brevity, all tickers with allocations under 0.5% are excluded.

That’s all I have for you tonight. Thank you for reading - and happy trading!