Algorithm and Portfolio Stats: 06/10/2024 - 06/14/2024

We had a pretty tough week with the algorithm, and cumulatively, it’s down about 0.4% over the last 2 weeks. This is unfortunate to see, but it’s not out of expectations. With a Sharpe in the low 2’s range, we expect negative weeks, but for negative months to be relatively rare. In back tests beginning March 19 (the date we rolled out our new algorithms), our maximum draw down is just under 15 trading days. We’re currently on a draw down of 4 trading days (due to the issue on Wednesday), so we’re safely within expected bounds, and still expected to make relatively consistent returns in the long run.

We saw 150 trades this week - 53 long and 97 short - across 97 unique tickers. Let’s check them out.

Our big winner this week was WBA, just before closing out for the week. We made 0.81% on one entry here. This one isn’t really textbook - MACD and momentum could both be more consistent - but there’s a lot to like here. This mainly works as a breakout play. Right at our time of entry, the price action is testing the ~$15.45 level it’s hit previously during the day. What makes this appealing for a breakout play, in my opinion, is the size of the green candle we enter on. More consistent momentum going in would make this even more appealing, but overall I think this is a fairly kosher play.

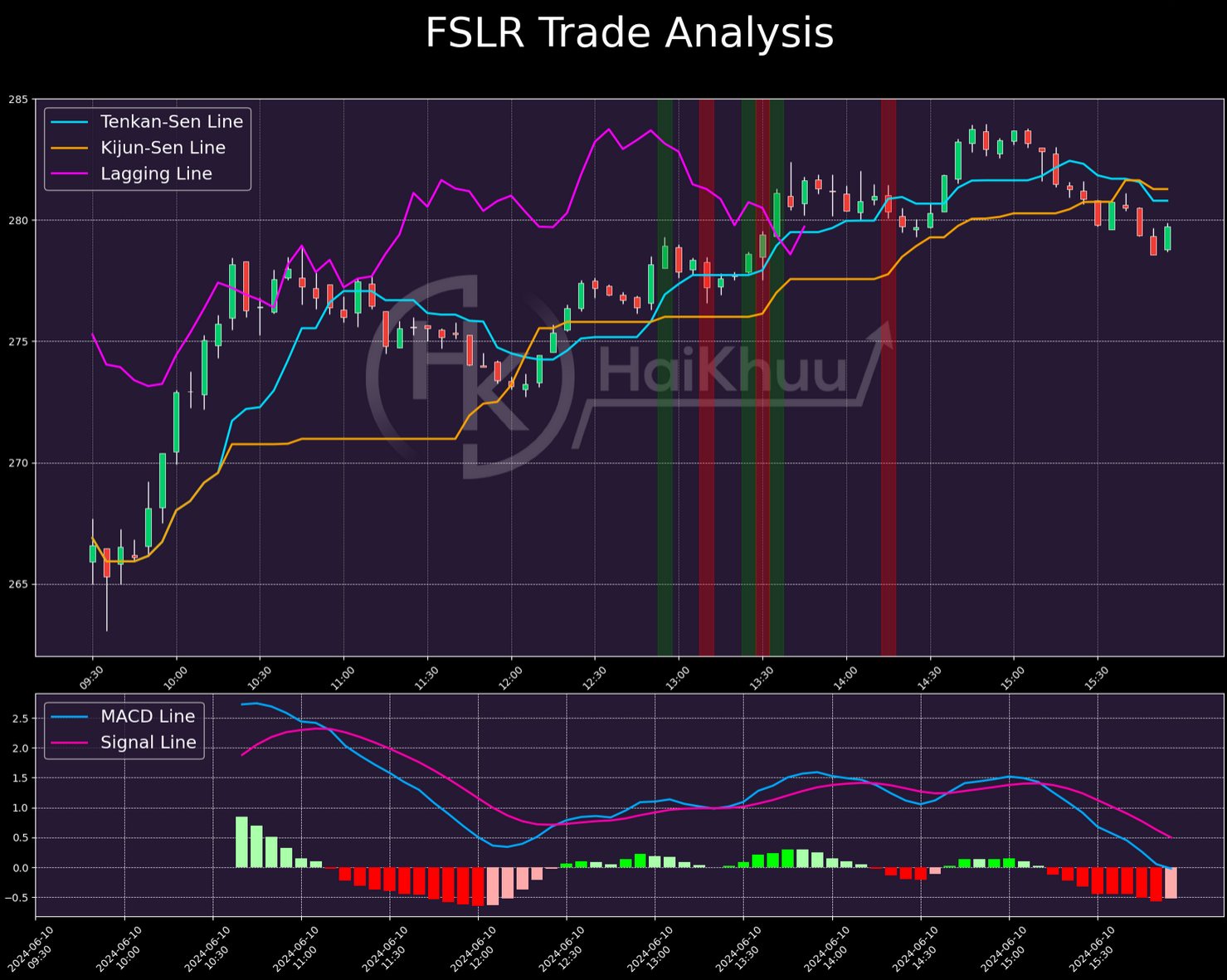

Our big loser for the week is FSLR. On Monday, we lost a little over 1% here. I’ve discussed this trade previously, so this is going to be a quicker summary, but I don’t think anyone felt the full loss of this trade. The initial entry is solid enough, but by the second, both MACD and momentum are significantly weaker. Add that to the rapid stop-out of our second position, and the third entry becomes highly unappealing. If you only took that first entry, you capped your loss to a more palatable 0.44%. This trade, to me, is a good example of why it’s important to never take the algorithm on faith alone; it’s important to always do your due diligence. For how effective the algorithm is in back tests, there will always be trades that human insight adds a great deal to - be that avoiding losses or doubling down into clear winners.

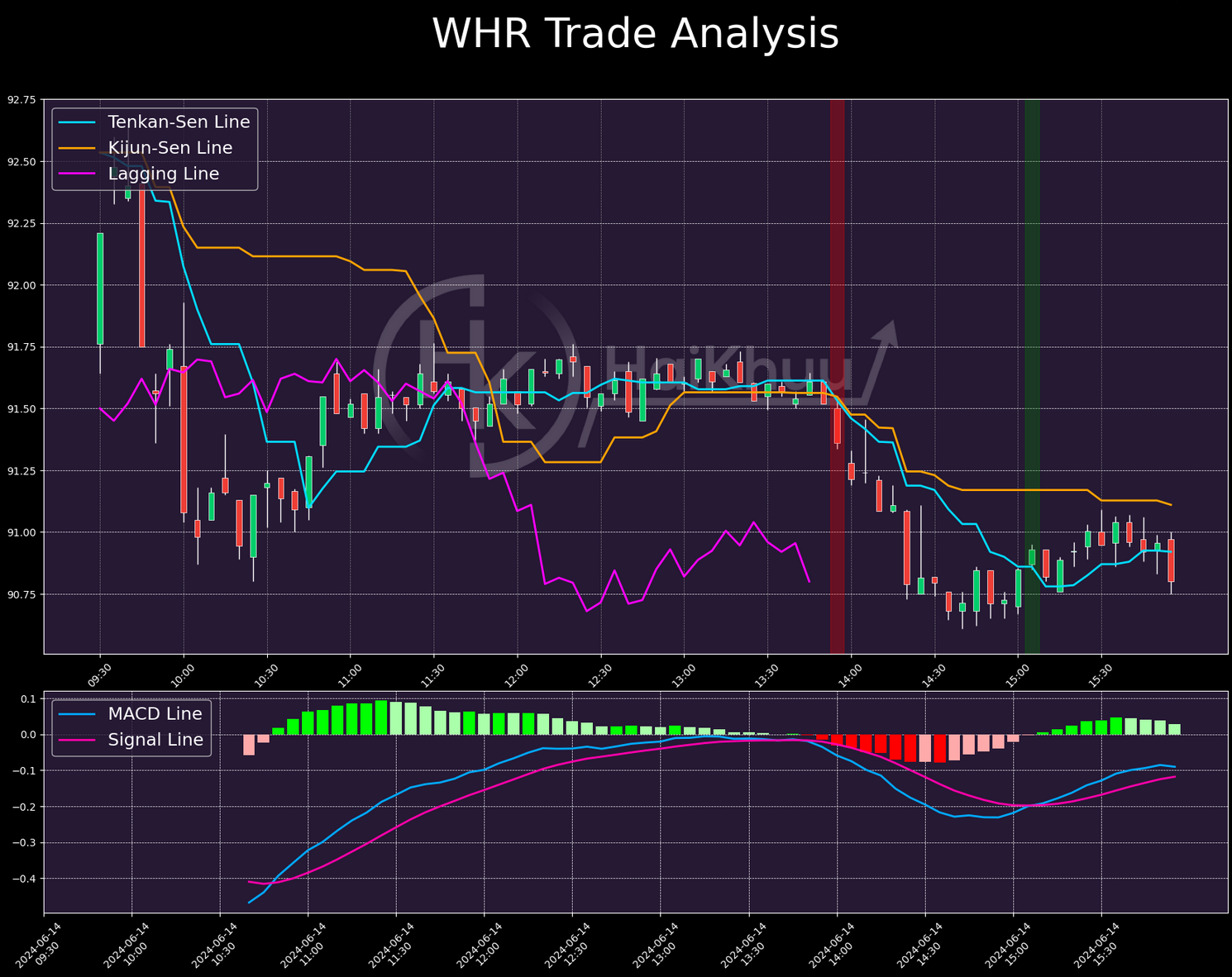

The last trade I want to discuss from this week is this short on WHR, also from Friday afternoon. We made 0.54% here. The price action is choppier than I’d like, but the cross is highly alluring. It’s not a strong cross, but with both lines sloping sharply downwards, it’s a big green flag. Add that to MACD on a downtrend for the last dozen candles, and you’ve got a winning formula. The question then becomes here, how choppy is too choppy? That’s unfortunately not a question we can answer mathematically at this time; it has to come down to your risk appetite. This trade worked out, but plenty of others have failed due to chop. As always, never take a trade you don’t believe in, and always determine your own risk tolerances ahead of time.

Now then, let’s discuss our portfolio.

Our portfolio’s on another great week - beating SPY by 0.97%. Once again, the tech sector was our big hero this week. It absolutely carried our portfolio, as well as the market as a whole.

Going forward, no major changes to our strategy. We’re staying long beta, and deep in tech. Momentum is good in the market, and we want to capitalize on it.

As always, our portfolio contents are listed below. All tickers with allocations below 0.5% are excluded for brevity.

That’s all I have for you tonight. As always, thank you for reading and happy trading!