Algorithm and Portfolio Stats: 06/17/2024 - 06/21/2024

Our algorithm had its best week yet - up roughly 1.25% since Monday. This brings it back up to positive cumulative returns. We’re still down from our overall high earlier this month, but I find it really difficult to be upset with this week’s performance. In any case, our largest draw down from our March - June back test lasted 14 trading days, with a magnitude of just over 2%. We’re safely below both of these levels (8 trading days and a maximum of about 1.65%, respectively) so performance is pretty safely within expected bounds at the moment.

We entered a total of 156 trades this week (91 long, 65 short, across 109 unique tickers). Let’s examine some of our significant trades from this week.

This week’s big winner is PHM. We made 1.27% from a strong trade on this Friday afternoon. Right away, I’m a big fan of our entry here. We see a few candles of MACD increasing, momentum with a breakout and, most importantly, both the Kijun-Sen and Tenkan-Sen lines slope upwards sharply. These are all signs of a successful breakout play with the TK-cross system, and a successful breakout is exactly what we got here. Our system automatically closes out its positions at the end of the day, but I wouldn’t be surprised if this position keeps going up after Monday’s open. If you were watching the algorithm’s notifications on Friday, you probably didn’t have much reason not to take this one.

Our worst trade of the week was on AMAT, costing us 0.74% between 2 entries. I’ve analyzed this one previously, but let’s go over it again. I actually like our first entry. Most of the signs we look for on a short position are present, with relatively few red flags. This was a trade that just didn’t work out. Our second entry, however, I find pretty questionable. The main reason I’m not a fan is that price action is too close to the Tenkan-Sen line, which we use as a moving stop. This is a low-risk, low-probability-of-success play. Those kinds of trades aren’t inherently bad or anything, but if you’re taking one, you’re betting on quick action - and with the relative lack of momentum here, there’s little reason to see that happening. It’s unfortunate these didn’t work out, but a skilled trader likely could have cut their losses pretty substantially.

The last trade I want to talk about is KMX. This trade was a winner - returning 0.99% between 2 entries, but it could have been better. If you had taken this and ignored the initial stop signal, you could have instead made a whopping 1.7%! Officially, I’m going to say that I probably wouldn’t have done this. But this goes to show: our algorithm isn’t perfect. We always advise doing your own due diligence and reaching your own conclusions before entering or exiting a trade. If you’ve got experience trading, you can turn a lot of losing signals into winners, and winners into bigger winners.

Now then, let’s examine our portfolio’s performance this week.

Our portfolio’s had a tough week - underperforming SPY by 0.61%. As always, it came down to tech, and as usual, it mainly came down to NVDA. This obviously isn’t good or intended, but we aren’t expecting to beat SPY every week. The portfolio is about long term success. For the time being, we’re sticking with our long-market strategy going forward.

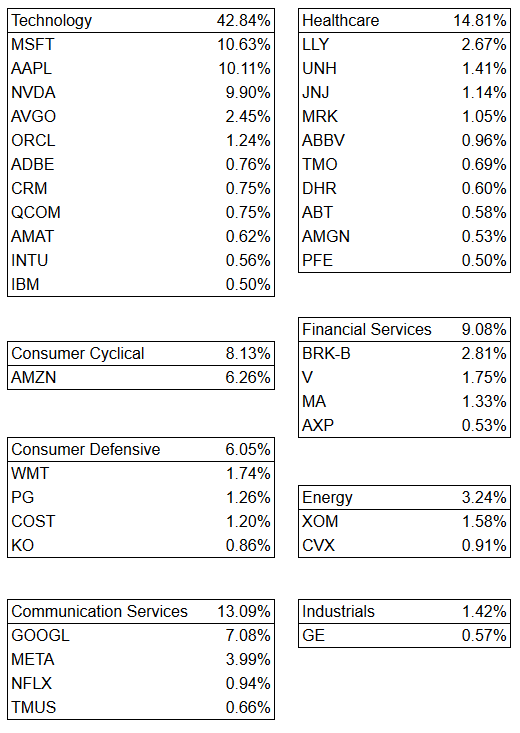

This week’s allocations and exposures are pretty similar to last week’s. We’re over-exposing to tech and the overall market, under-exposing to all other sectors.

As always, our allocations this week are included below. All tickers with allocations below 0.5% are excluded for brevity.

That’s all I have for you tonight. As always, thank you for reading and happy trading!