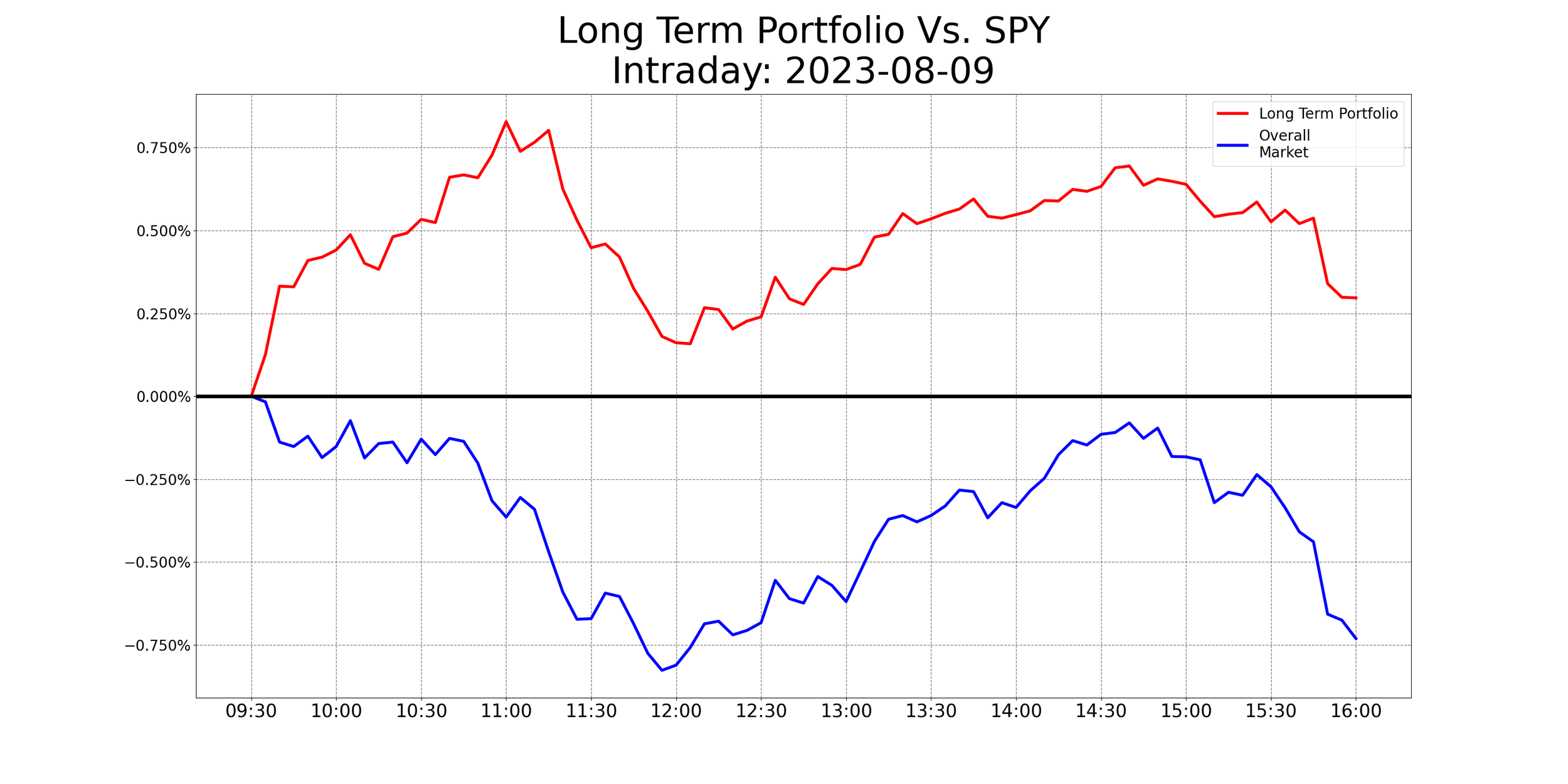

Algorithm Data: 08/09/2023

Market Neutral: +0.6%

Variable Market Neutral: +0.43%

Variable Sector Neutral: +0.4%

Sector Neutral: +0.35%

Long Term Portfolio: +0.3%

Base Algorithm: +0.25%

The Market: -0.73%

I’d like to end this report with an updated stance on the algorithm. Over the last ~4 weeks, the performance of our current system has declined, relative to the data we used to develop it - especially so since the middle of last week. Starting last night, the team and I have discussed the possibility of over-fitting and, having done some additional testing, we don’t believe that’s the case.

Our current system’s performance has declined in the last month. Initially, we suspected that the testing data set we used in developing the last update wasn’t representative. However, we have run backtests on our previous version of the algorithm - as well as an intermediate version from the development process. Both versions saw the same decline, and both reached lower levels of performance than our current system.

Based on this, we don’t think over-fitting is the issue. Rather, market conditions are at play here. When discussing things with Allen, I brought up the idea that the market had shifted - but in a different way from usual. Rather than choosing a different direction, the market has decided not to decide on a direction. Allen noted that this had been the case since the middle of last week: exactly when the algorithm began under-performing the most.

Tentatively, we expect this to be a short term issue, until the market has resumed a more clear direction. In the meantime, regretfully, we are putting a hold on the algorithm. The system has recently performed poorly, and we expect this to continue until market conditions change.

We apologize for any inconvenience this causes. We will continue to publish the algorithm during this time, but we do not currently believe in it (at least, not as much as we do the long term portfolio). Again, we expect this to be a short term hold. We will notify you when we resume normal algorithm activities.

Lastly, I want to reiterate that, in the long run, we believe our system will be successful. Our system is currently up roughly 250 bps relative to our portfolios this quarter, and roughly 980 bps since March 1. We consider this to be a minor setback in a much longer term project.