Algorithm Performance: 09/01/2022

Performance Rankings

Base Algorithm: +1.21%

Long Term Portfolio: +1.09%

The Market: +0.9%

Market Neutral: +0.69%

Experimental Market Neutral: +0.49%

Sector Neutral: +0.16%

Experimental Sector Neutral: +0.09%

What Happened And Why?

Our base algorithm outperformed the market - which often doesn’t happen on days the market rebounds like this. I’ve gone into this in more detail in prior reports, but the short version is that our long term portfolio is playing pretty conservative right now. For this reason, we generally expect it to underperform when the market is up, but outperform when it is down. Ideally, the base algorithm should outperform the long term portfolio pretty consistently.

Given that the base algorithm uses modeling that the long term portfolio cannot, and is our only bullish portfolio, it makes sense to me that it was our top performer today.

I’d like to take a look at our hedgers and see if they’ve also measured up today. If we had applied market neutral hedging on our whole long term portfolio, we’d be up 0.53%, with sector neutral hedging: 0.08%. Of our hedgers, only Experimental Market Neutral underperformed a baseline for its category.

From the values of each sector and the overall market today, we can see why our sector hedgers lost to the market hedgers. The market performed well today, but not as well as the Utilities, Healthcare, and Consumer Staples sectors. Since our long term portfolio has a high beta to each of these sectors, we hedged against them heavily, for which we lost more than we lost by hedging the market alone.

Let’s look a bit into why Experimental Market Neutral underperformed today. While we can attribute this to bad luck (1 algorithm underperforming out of 5 is a great day), I’d like to see some concrete reasons. Unfortunately, I can’t give you a concrete reason today.

I did some digging into which trading signals each of our algorithms leaned into today (I can’t show those graphs, I’m afraid), and in the case of Experimental Market Neutral, there wasn’t any 1 signal that really dragged it down. I was hoping to see a single one accountable for most of our losses (or just missing good picks), but this wasn’t the case. Its distribution of returns attributable to each signal is fairly similar to that of the base algorithm and Standard Market Neutral’s. I have to attribute today’s underperformance to bad luck.

Upcoming Changes

I have some great news today. We’ve done some more troubleshooting on our cloud computer, and it looks like we’ve found the issue. From here on out, the trading bot will running on it and shouldn’t be crashing anymore. If you’ve noticed it shutting down mid-day lately . . . you’re right. With any luck, these kinds of issues should be a thing of the past from now on. We want to thank all of you for your patience during this transition.

Tomorrow’s Outlook

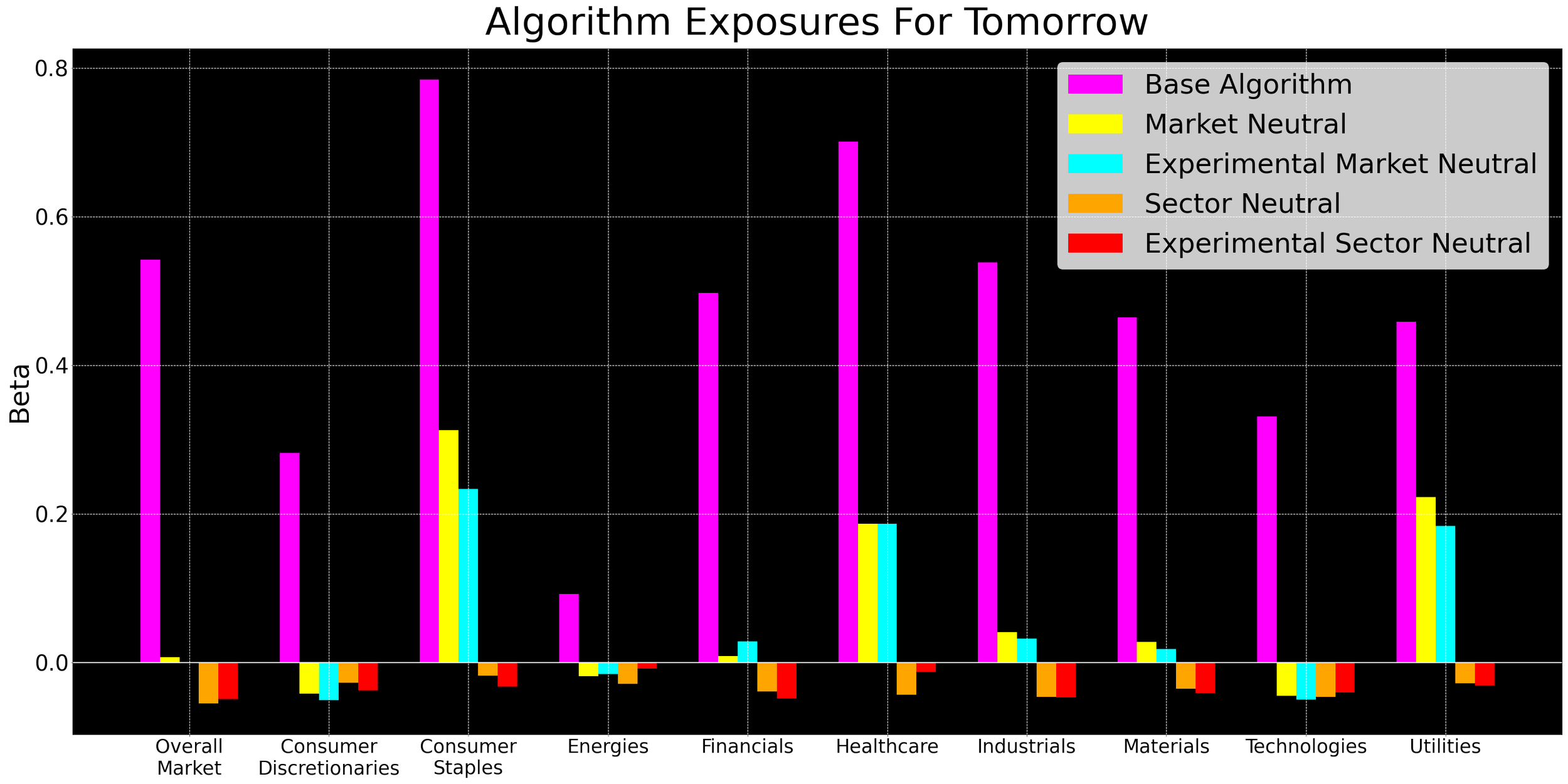

The full algorithm reports will be published tomorrow morning, once Allen has had a chance to vet its recommendations. In the meantime, here are our tentative exposures for the trading day tomorrow:

That’s about it. Congrats to everyone who made money today, let’s keep it going tomorrow.

-Asher