Algorithm Performance: 09/29/2022

Performance Rankings

Sector Neutral: +0.24%

Experimental Market Neutral: +0.17%

Experimental Sector Neutral: +0.12%

Market Neutral: -0.28%

Base Algorithm: -1.06%

The Market: -1.1%

Long Term Portfolio: -1.2%

What Happened And Why?

Technicals are back, baby! The market/sector hedged portfolio would have returned -0.42% and 0.04%, respectively. With that, all 5 of our algorithms beat their baselines today. Plain and simple, this was a great day for us.

There’s not much worth examining about performance today. The only big problem I have is that the base allocated pretty heavily into WBA (a big loser), and would have done much better if it hadn’t. The reasons for this would come down to which trading signals pointed to it, which I can’t go much into anyways. That part of our system is proprietary, so even if we did a deep dive I couldn’t say much. Instead, I’d like to go into what else the quant team is working on.

What’s In The Pipeline?

Currently, our system considers each trading signal in a vacuum. For example, let’s say we’re trying to trade AAPL. And let’s say Heiken-Ashi Candles and Ichimoku Clouds are showing buy signals. Our signal isn’t going to consider those signals together. It’s only going to look at how well AAPL usually responds to Heiken-Ashi buy signals, and how well it responds to Ichimoku buy signals. It makes no consideration for how well it responds to those 2 signals simultaneously.

We’d like implement a system that accounts for combinations of signals. Easy enough when we only consider 2, but our system includes 64 signals. So to accomplish this, we’ll need a formula to determine how similar one trading day is to another for a certain ticker. This is a kind of problem that’s fairly common in quant trading - the kind where the only way to know if a system works is to code it up and test it. I expect to spend a decent amount of time throwing things at the wall and seeing what sticks here.

If we find something successful here, it’ll show in every algorithm we have. I’ll drop an update in a future report if this is the case.

Tomorrow’s Outlook

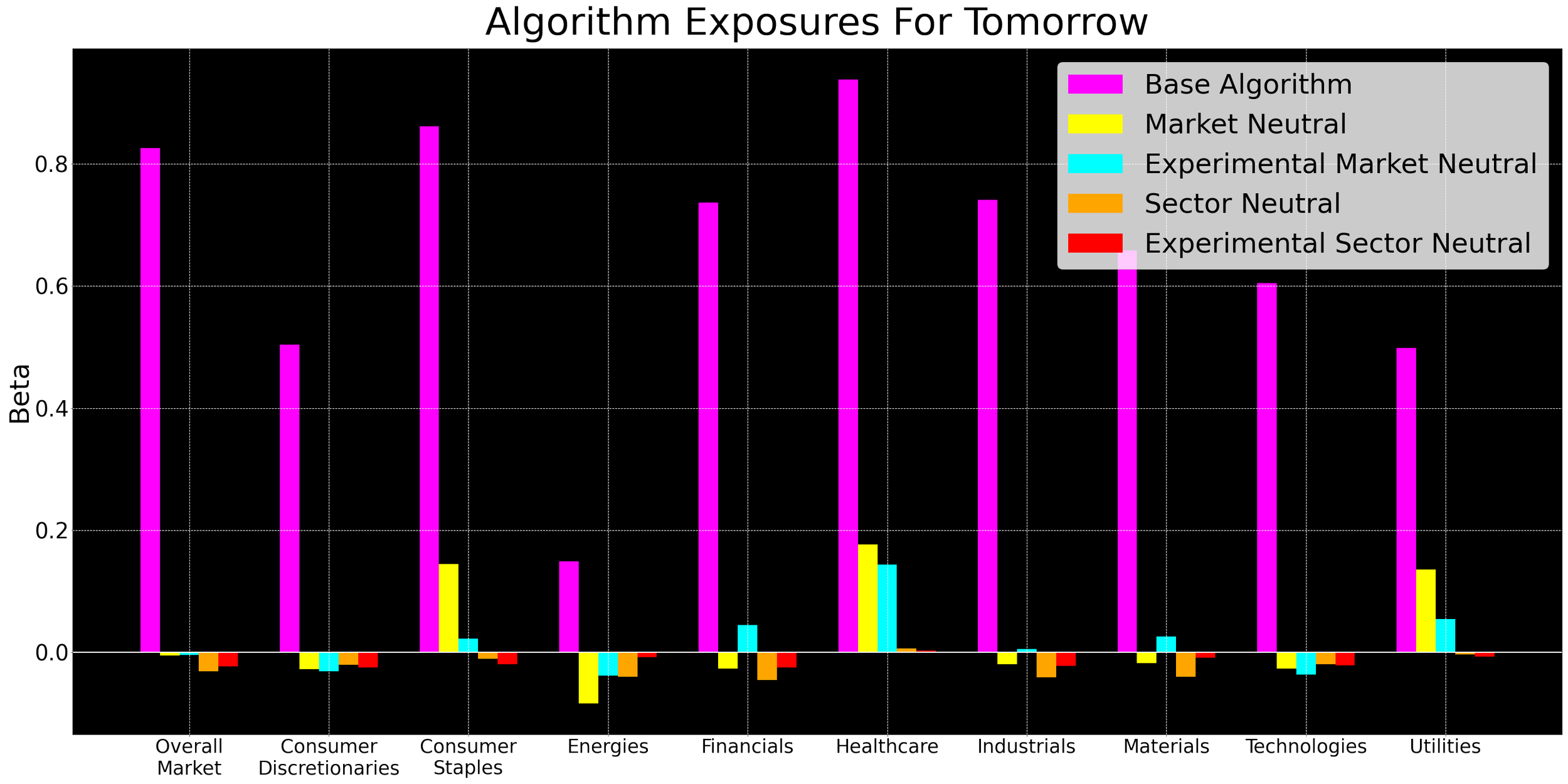

The full algorithm reports will be published tomorrow morning, once Allen has had a chance to vet its recommendations. In the meantime, here are our tentative exposures for the trading day tomorrow:

That’s all for tonight. Thanks for reading, and congrats to everyone who made money today. Let’s hope for a greener market tomorrow.

-Asher