Algorithm Performance: 10/10/2022

Performance Rankings

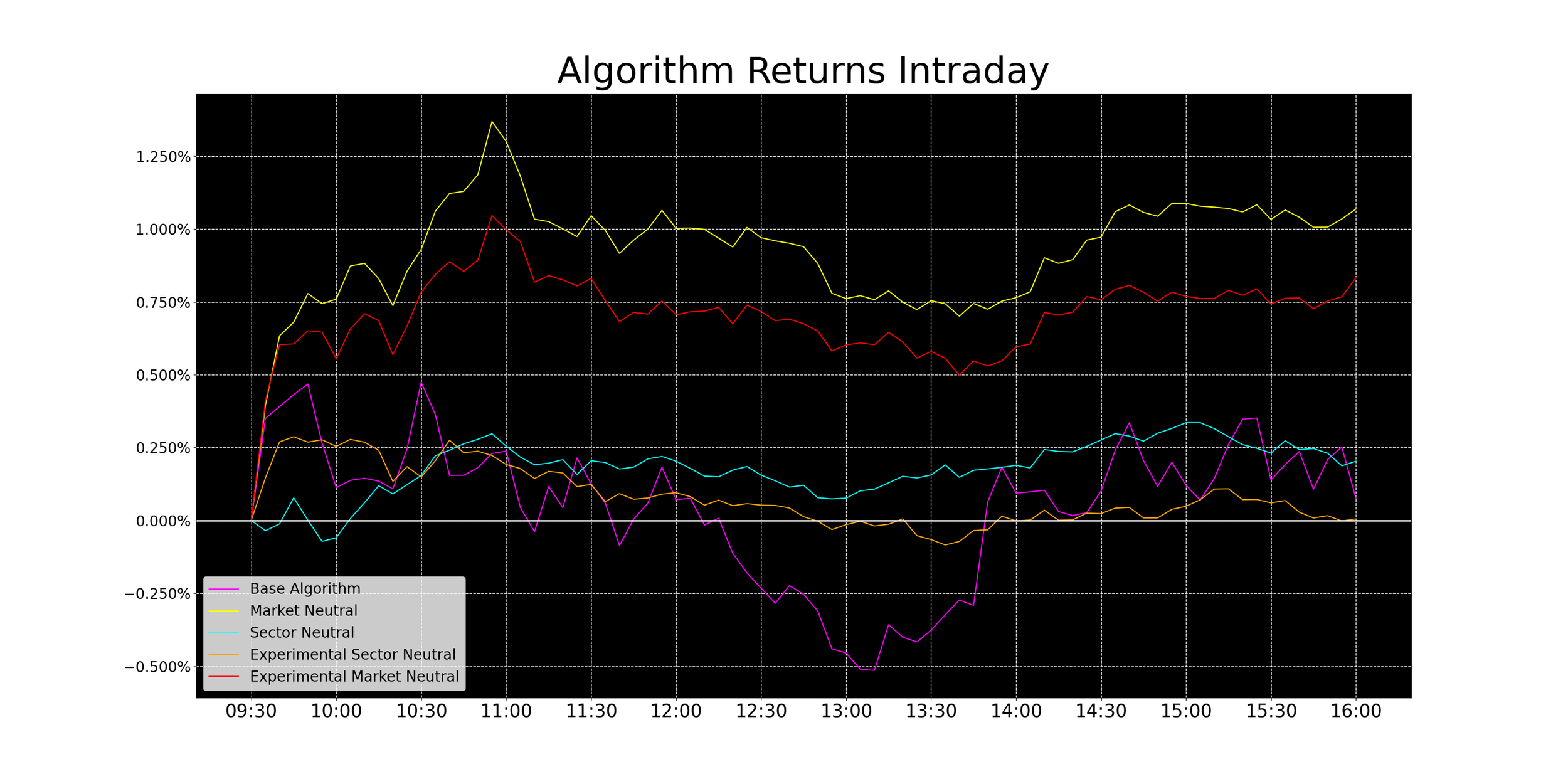

Market Neutral: +1.07%

Experimental Market Neutral: +0.84%

Sector Neutral: +0.2%

Base Algorithm: +0.07%

Experimental Sector Neutral: +0.0%

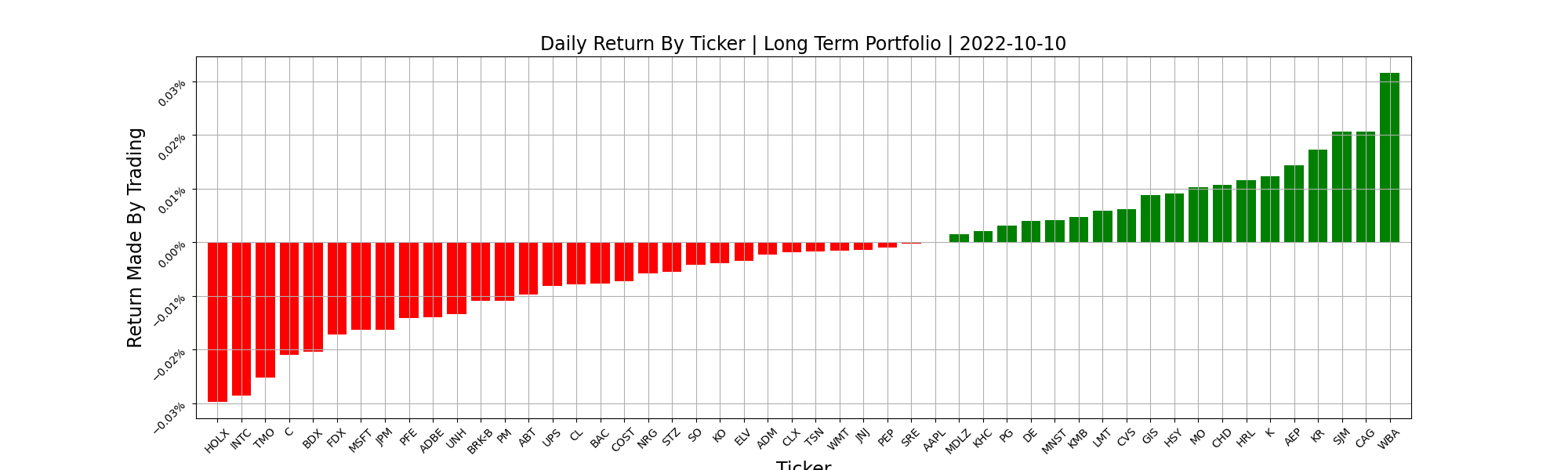

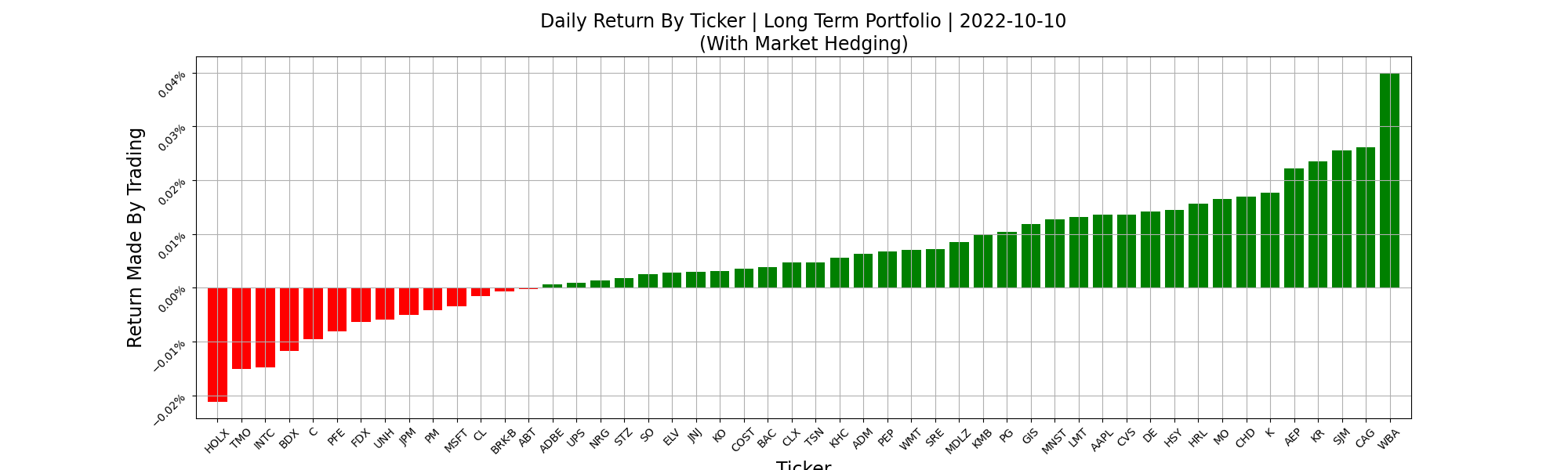

Long Term Portfolio: -0.23%

The Market: -1.08%

What Happened And Why?

Today was great for us! If you traded with our algorithms, it doesn’t matter which one - you crushed the market. SN tied its baseline, and ESN underperformed it by a bit. Those two aside, everything beat its baseline by a large margin.

Let’s take a quick look at what went wrong with our sector hedgers today.

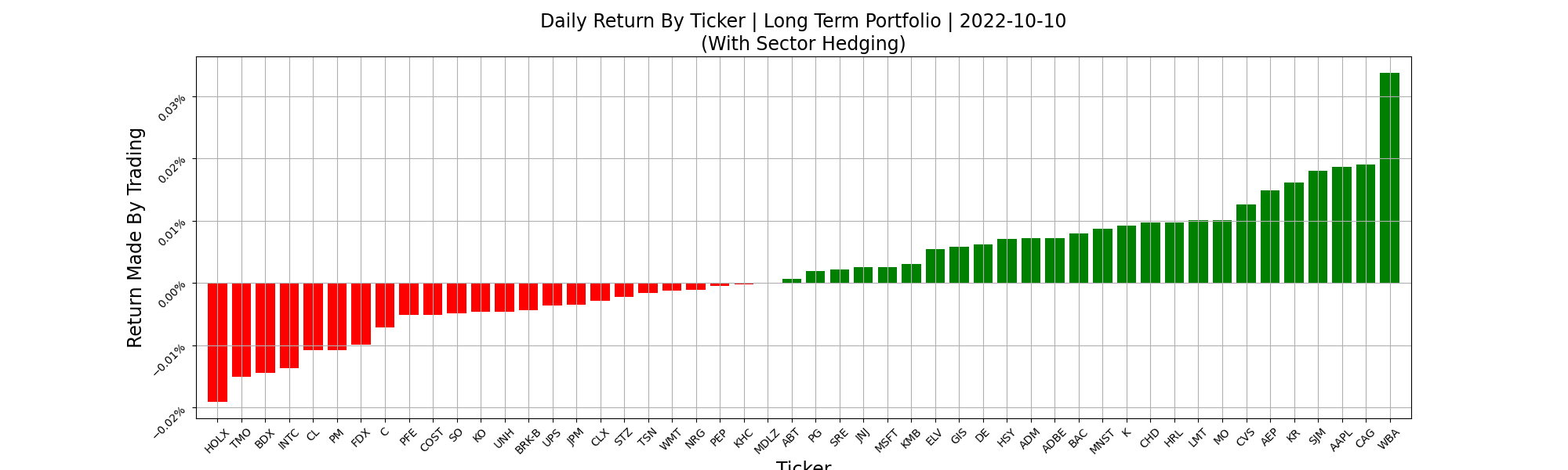

The first reason is that sector hedging was less effective than market hedging. We don’t see this too often, but it does happen. Sector hedging most tickers today would have beaten the market, but you would have done better with our portfolio if you only market hedged. This is the first reason the market hedgers beat the sector hedgers today.

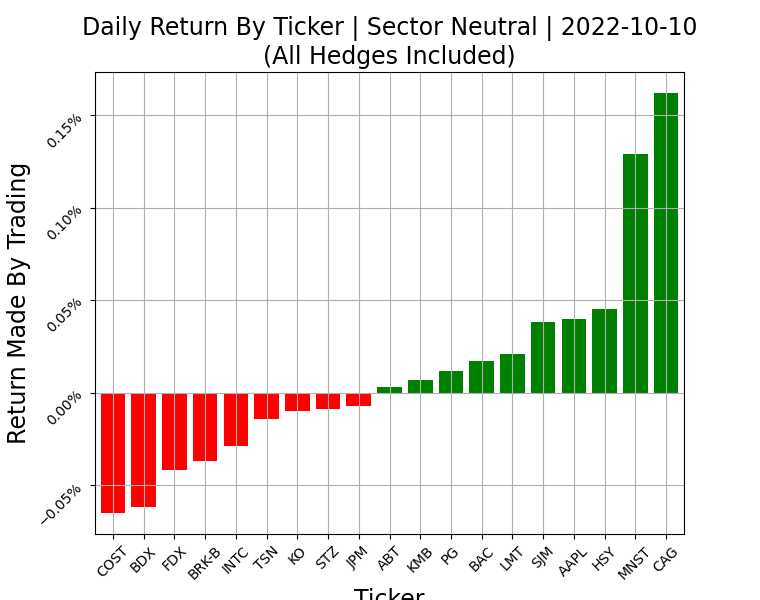

Looking at a break down of the sector neutral systems, you’ll notice SN has a pretty similar distribution to the long term portfolio, sector hedged. Its performance was almost an exact match to the LTP with sector hedging, so this is to be expected. As a consequence, there are no major outliers to investigate as a cause of its performance. Its modeling didn’t fail today, it just didn’t add anything new.

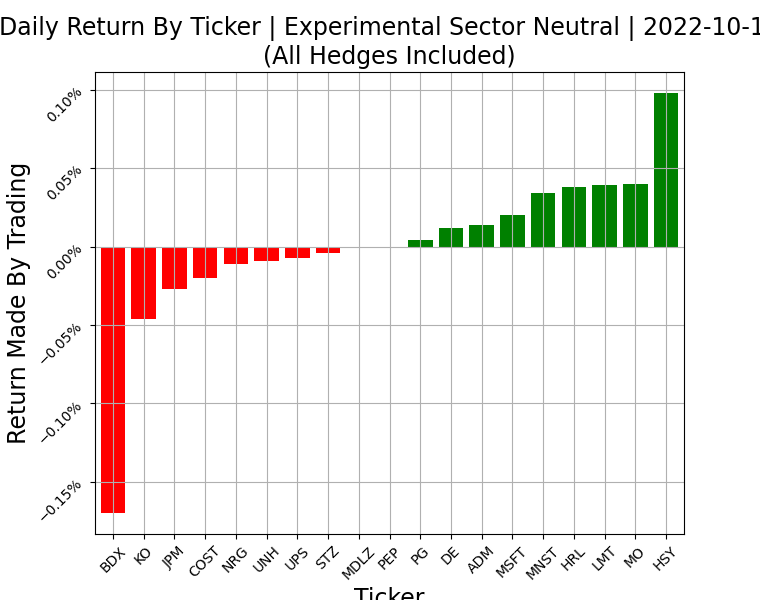

ESN however does have one outlier: BDX. This was its second most allocated ticker today (at 11.76% of its portfolio), and also one of our worst performers. We can also see it missed the top 5 performers with sector hedging - not allocating into any of them.

3 of our 5 algorithms winning is a solid day for us, especially when we win by these margins. While they hedge the same way, SN and ESN use totally different modeling. This leads me to believe that there isn’t a major outlier affecting them both - just a bad toss of the dice today. I’m going to add some functionality to our system tonight - showing which tickers we didn’t buy and why each day.

This will take too long to implement in the current report, but I’d like to see why we miss some of the top performing tickers when we underperform. It could be a good cue on how we can improve things.

All in all - great day! I’m fairly happy with performance today. Even if you’d chosen one of our underperformers, there weren’t a lot of opportunities to lose money today.

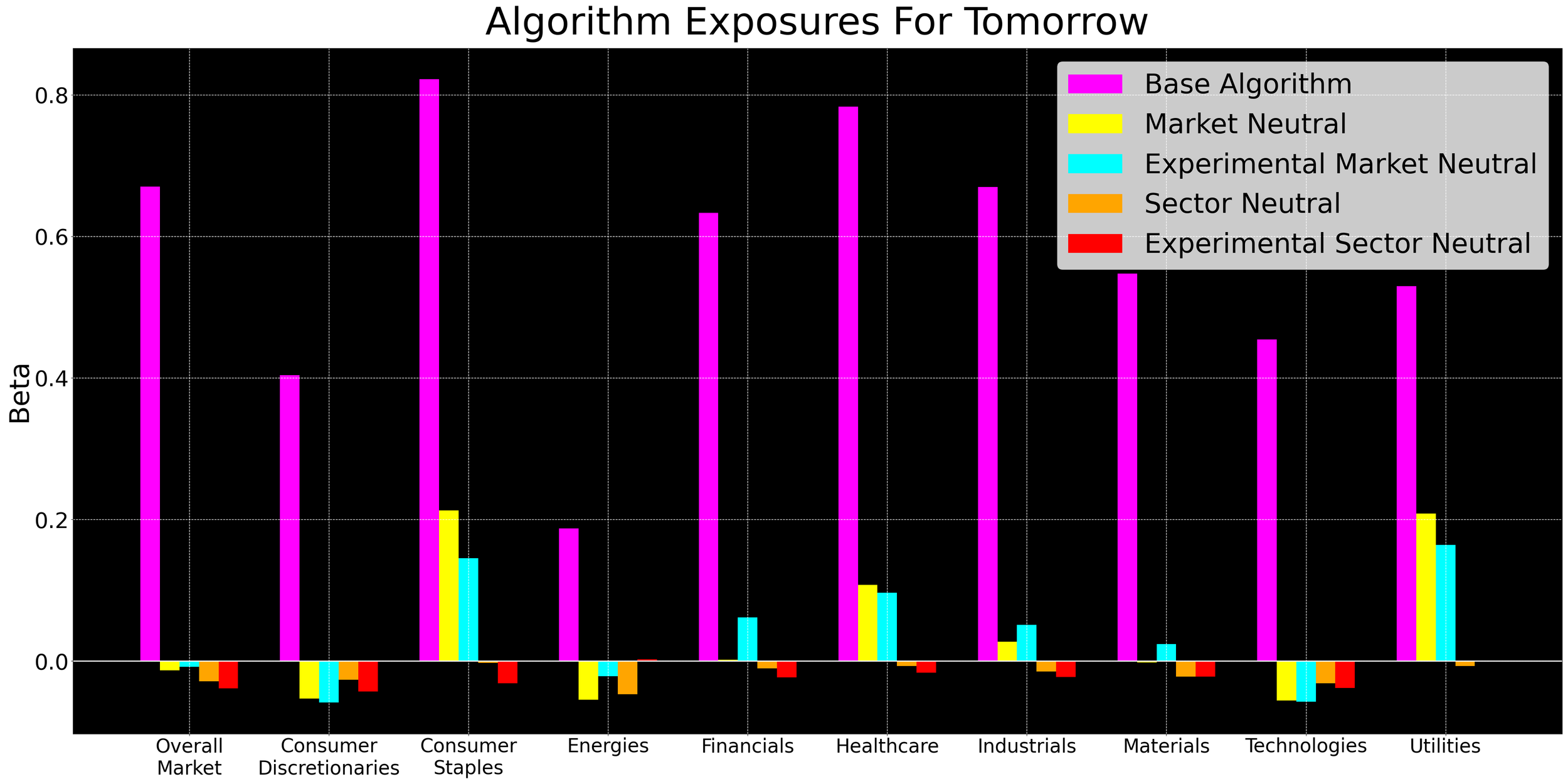

Tomorrow’s Outlook

The full algorithm reports will be published tomorrow morning, once Allen has had a chance to vet its recommendations. In the meantime, here are our tentative exposures for the trading day tomorrow:

That’s all for tonight. Thanks for reading and congrats to everyone who made money today!

-Asher