Algorithm Performance: 10/11/2022

Performance Rankings

Market Neutral: +0.68%

Long Term Portfolio: +0.53%

Base Algorithm: +0.31%

Experimental Market Neutral: +0.18%

Sector Neutral: +0.03%

Experimental Sector Neutral: +0.02%

The Market: -0.14%

What Happened And Why?

I have mixed feelings about today. On one hand, everything we published beat the market. Not just that, but the market was red and everything we have went green.

Even better - the market went down 0.14% intraday, but only a couple times did any of our algorithms get close to that. You would have really had to try to underperform the market today and I love to see that.

That said, our modeling failed today. The technical signals we use didn’t work to our benefit. Only base market neutral beat its baseline, all of the others fell short. The reason for this is illustrated most clearly in the base algorithm’s ticker breakdown.

BAC and JPM were our only real losers, and also some of our most heavily allocated (combined, they occupied nearly 24% of our portfolio). If we look at the unhedged performance of our portfolio as a whole, we can see that today was a rough day to be in financials - and especially to be long banks.

This is also the reason our sector hedgers underperformed today. The banking stocks did poorly, but banks underperformed the financials sector as a whole - none of our hedging could have saved us today. Theoretically, we could have offset this had we hedged using a banking ETF instead of a financials sector ETF - and this is something we could look into in the future. Can we improve our results by using more specific hedges? I’ll add this to the back log, as I think it has some potential. At absolute least, it could have saved us today.

So in summary, our modeling failed today because:

Technical analysis led us to over-allocate into banking stocks

Banking stocks underperformed their sector and the market as a whole today

I want to give a major shoutout to our long term analyst Vlad - his portfolio absolutely carried us today. We would not have beaten the market without him.

Tomorrow’s Outlook

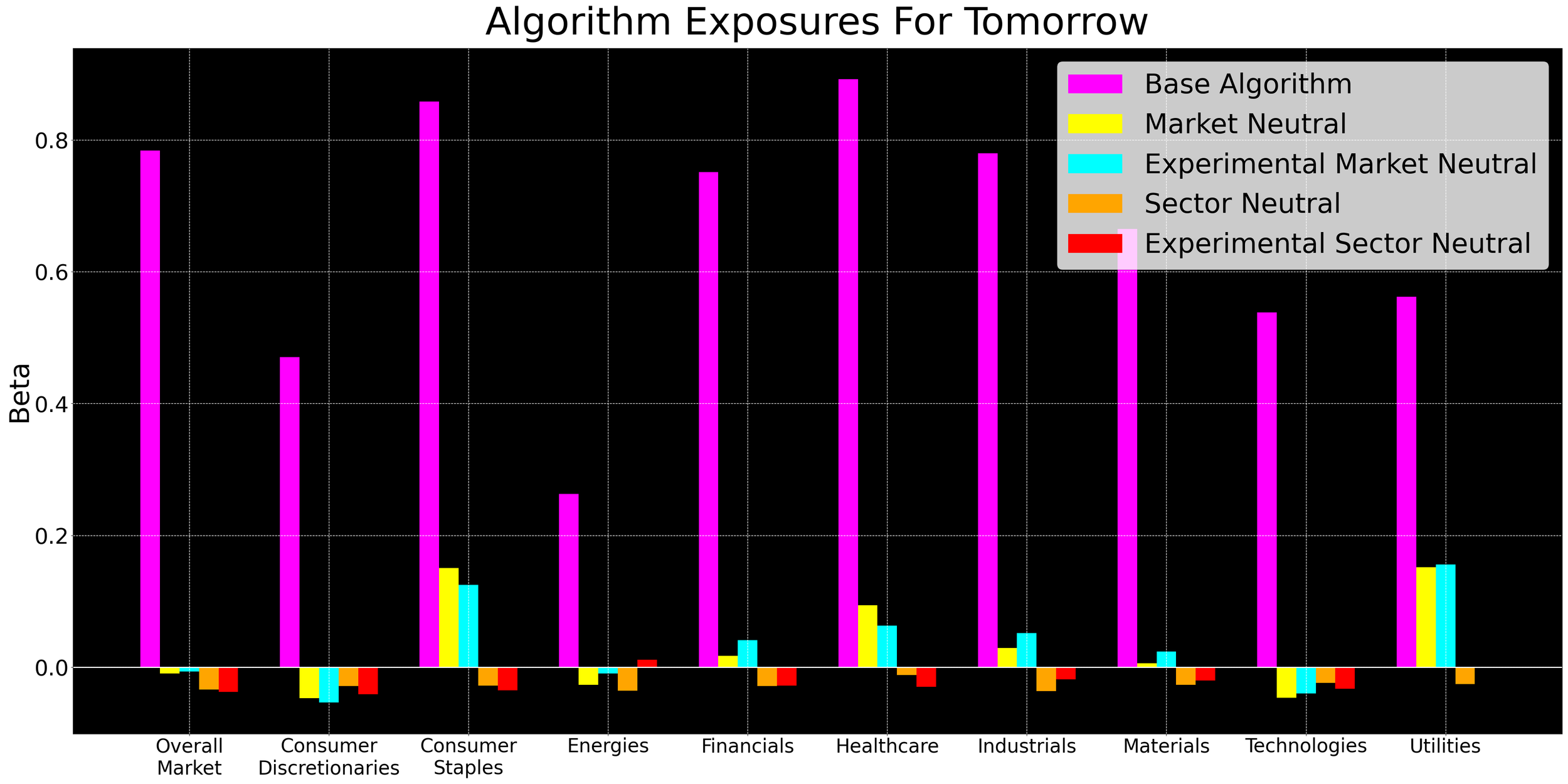

The full algorithm reports will be published tomorrow morning, once Allen has had a chance to vet its recommendations. In the meantime, here are our tentative exposures for the trading day tomorrow:

That’s all for tonight. Thanks for reading and congrats to everyone who made money today. Let’s see if the market turns around tomorrow.

-Asher