Algorithm Performance: 10/12/2022

Performance Rankings

Sector Neutral: +0.17%

Experimental Market Neutral: +0.02%

Experimental Sector Neutral: -0.01%

Market Neutral: -0.26%

Base Algorithm: -0.33%

The Market: -0.45%

Long Term Portfolio: -0.61%

What Happened And Why?

Only our sector hedgers fell short of their baseline today, giving us a a win rate of 3 out of 5. Good, but not great. This is easier for me to stomach since no matter what you chose, you would have beat the market and our long term portfolio, and had you chosen any hedger (with the slight exception of Market Neutral), you would have won by a large margin.

I did some looking into which signals our sector neutral systems lost on. As usual, I can’t list all of them here. But I can say they didn’t have a lot of bad signals in common. Their biggest common losers were HOLX and MNST. There were also a couple of bigger winners that they missed out on (JPM and C both outperformed financials big time following yesterday’s loss, but neither sector neutral system allocated into either). Their modeling systems are fairly different, but it’s interesting that our only losers today were the ones using sector-based hedging. This tells me that after yesterday’s light shake-up, a lot of technical indicators didn’t yield well in the sector space. The Kaufman Adaptive Moving Average for instance betrayed us pretty consistently today.

All in all, a good day for us. But I think we could have done better.

Tomorrow’s Outlook

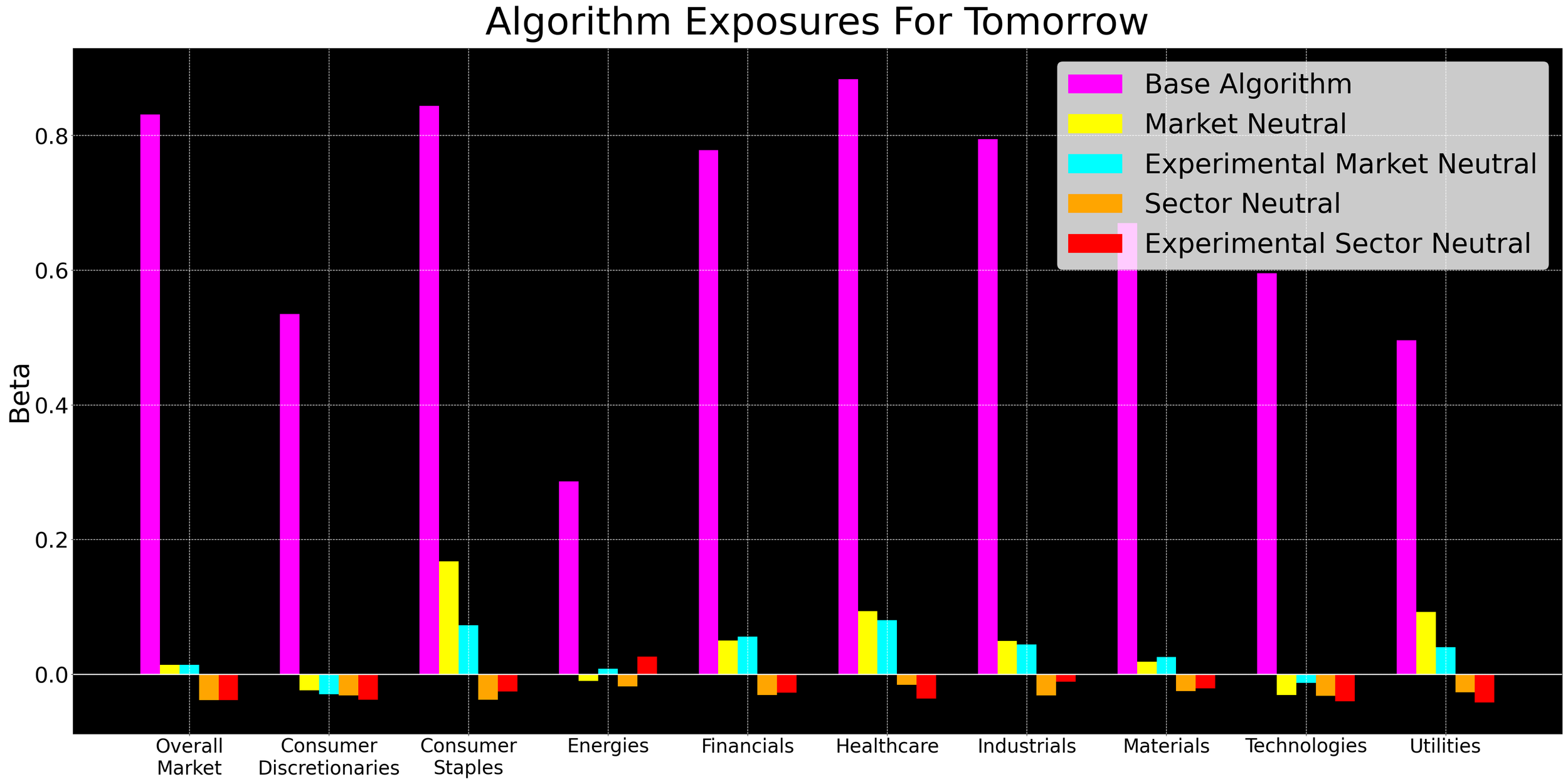

The full algorithm reports will be published tomorrow morning, once Allen has had a chance to vet its recommendations. In the meantime, here are our tentative exposures for the trading day tomorrow:

That’s all for tonight. Thanks for reading and good luck tomorrow.

-Asher