HK Weekly Recap & Analysis April 3rd, 2023

THE WEEK AHEAD (APRIL 3RD – APRIL 7TH)

KEY ECONOMIC DATA RELEASES TO WATCH

MARKET RECAP FROM THE PREVIOUS WEEK

March 27, 2023

First Citizens BancShares is buying out Silicon Valley Bank

The FDIC said First Citizen's purchase of about $72 billion of SVB's assets came at a discount of $16.5 billion

Elon Musk has offered new equity grants to Twitter employees valued at $20 Billion

Musks see a "clear, but difficult, path to a $250 Billion valuation."

The CFTC is suing Binance and their CEO, CZ, over regulatory violations.

The CFTC is seeking permanent trading and registration bans

Disney begins the first round of 7,000 expected job cuts

Intraday Change for Indices:

S&P 500 +0.19%

Dow Jones +0.62%

Nasdaq -0.69%

March 28, 2023

US Wholesale Inventories MoM Adv. Actual 0.2% (Forecast -0.1%, Previous -0.4%)

US Retail Inventories Ex-Auto Adv. Actual 0.4% (Forecast -, Previous 0.1%)

US Advance Goods Trade Balance Actual -91.6B (Forecast -90B, Previous -91.09B)

Bank of America clients funneled the most significant sum of money into US equities last week since October, with investor preference for individual stocks over exchange-traded funds reaching a record level.

Alibaba shares popped 9% on news that it will split the company into six units, each with the ability to raise outside funding and go public.

US House Price Index YoY Actual 5.3% (Forecast -, Previous 6.6%)

US House Price Index MoM Actual 0.2% (Forecast -0.3%, Previous -0.1%)

Silicon Valley Bank shares were officially delisted and now trading in OTC markets

US Conference Board: US 1-Yr consumer inflation rate expectations 6.3% in March vs. February revised 6.2% (previous 6.3%)

NY Fed Housing Survey:

Short-term home price expectations drop sharply. Rental price growth expectations remain elevated

Anticipated rent price rise for next year at 8.2% vs. 11.5% last year.

The expected home price increase stands at the lowest in survey history.

Apple introduces Apple Pay Later to allow consumers to pay for purchases over time

Lucid announces it will lay off 18% of its workforce

Intraday Change for Indices:

S&P 500 -0.22%

Dow Jones -0.15%

Nasdaq -0.53%

March 29, 2023

US Pending Homes Index Actual 83.2 (Forecast -, Previous 82.5)

US Pending Home Sales Change MoM Actual 0.8% (Forecast -3%, Previous 8.1%)

Republican US Representative Hern:

Fed's Powell, in a meeting, indicated one more interest rate increases this year.

Fed's Powell said FDIC insurance limits would be an excellent topic for Congress.

Powell informs House Republicans that supply chain inflation has been significantly reduced.

Ratings Agency Moody's on the US:

Our baseline shows that the US banking sector strains to have indirect fiscal costs through weaker growth. However, we see weakness to be moderate.

Our baseline expectation remains that the 2023 recession will be mild. Bank credit remains tight and will tighten further, causing economic growth to slow.

Intraday Change for Indices:

S&P 500 +1.45%

Dow Jones +1.01%

Nasdaq +1.82%

March 30, 2023

US Initial Jobless Claims Actual 198k (Forecast 196k, Previous 191k)

US Continued Jobless Claims Actual 1.689M (Forecast 1.7M, Previous 1.694M)

US GDP QoQ Final Actual 2.6% (Forecast 2.7%, Previous 2.7%)

US PCE Prices Final Actual 3.7% (Forecast -, Previous 3.7%)

US Core PCE Prices Final Actual 4.4% (Forecast 4.3%, Previous 4.3%)

The Fed is forecasting at least one more rate hike in 2023, and there likely won’t be rate cuts

Intraday Change for Indices:

S&P 500 +0.59%

Dow Jones +0.43%

Nasdaq +0.95%

March 31, 2023

US Core PCE Price Index YoY Actual 4.6% (Forecast 4.7%, Previous 4.7%)

US Core PCE Price Index MoM Actual 0.3% (Forecast 0.4%, Previous 0.6%)

US Consumer Spending MoM Actual 0.2% (Forecast 0.3%, Previous 1.8%)

US Real Personal Consumption MoM Actual -0.1% (Forecast -0.1%, Previous 1.1%)

US Personal Income MoM Actual 0.3% (Forecast 0.2%, Previous 0.6%

US PCE Price Index MoM Actual 0.3% (Forecast 0.3%, Previous 0.6%)

US PCE Price Index YoY Actual 5.0% (Forecast 5.1%, Previous 5.4% )

Fed’s Collins says the reading on PCE inflation is about what was expected, and the data was good news

US Chicago PMI Actual 43.8 (Forecast 43, Previous 43.6)

University Michigan Sentiment Final Actual 62 (Forecast 63.3, Previous 63.4)

UMich Conditions Final Actual 66.3 (Forecast 66.4, Previous 66.4)

UMich Expectations Final Actual 59.2 (Forecast 61.4, Previous 61.5)

UMich 1 Yr Inflation Final Actual 3.6% (Forecast 3.8%, Previous 3.8%)

Tesla recalls 35 semi-trucks for brake issues

Intraday Change for Indices:

S&P 500 +1.41%

Dow Jones +1.26%

Nasdaq +1.66%

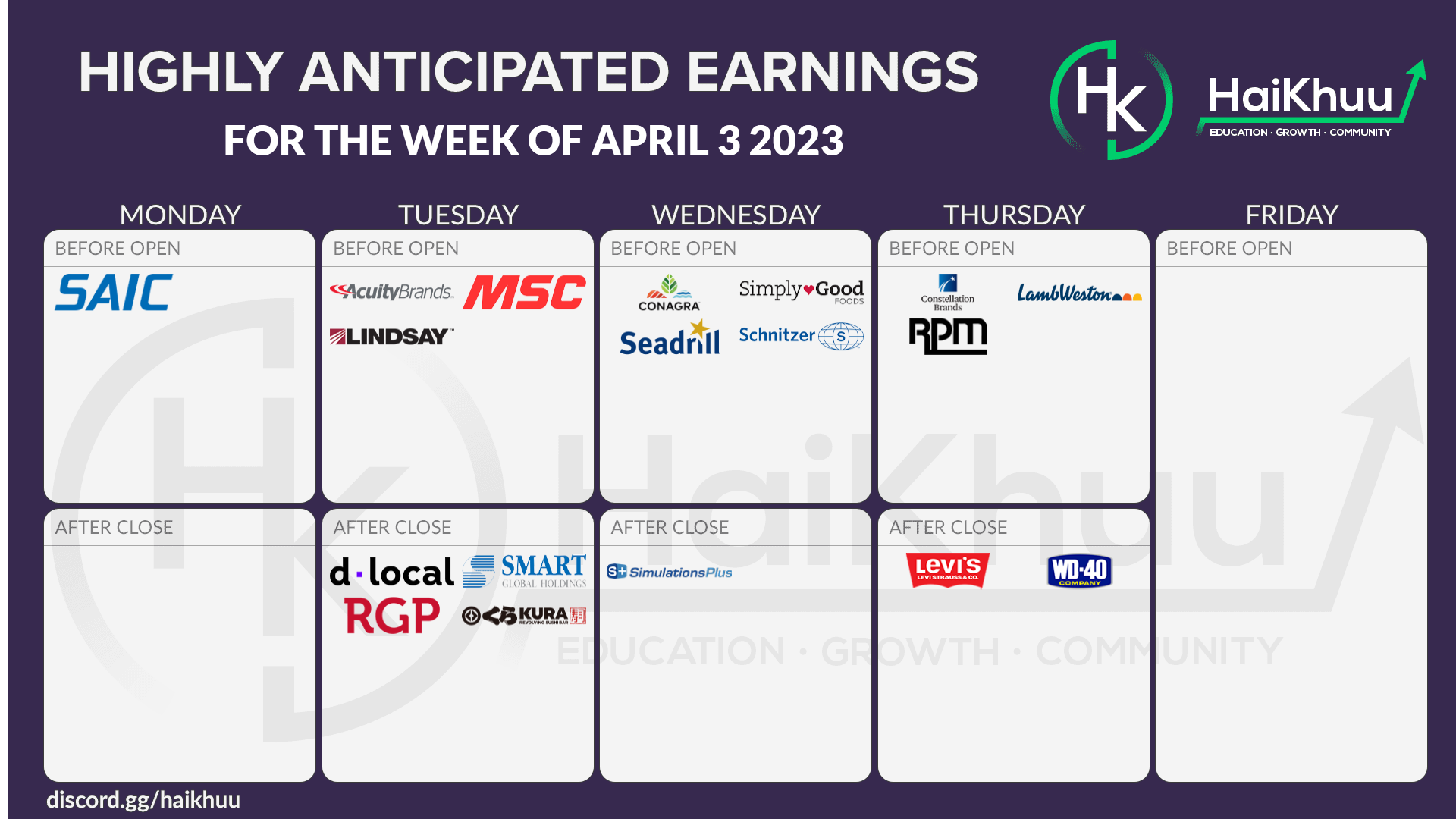

THE WEEK AHEAD & EARNINGS

Monday – 04/03/2023

St. Louis Fed President Bullard speaks - 8:30 AM ET

S&P final U.S. manufacturing PMI - 9:45 AM ET

ISM manufacturing - 10 AM ET

Construction spending - 10 AM ET

Fed Gov. Cook speaks - 4:15 PM ET

AM Earnings: Science Applications International Corp (SAIC)

PM Earnings: None scheduled

Tuesday – 04/04/2023

Factory orders - 10 AM ET

Job openings.- 10 AM ET

Cleveland Fed President Mester speaks - 6 PM ET

AM Earnings: Acuity Brands (AYI), MSC Industrial Direct Co (MSM), Lindsay Corp (LNN)

PM Earnings: DLocal Limited (DLO), SMART Global Holdings (SGH), Resources Connection (RGP), Kura Sushi (KRUS)

Wednesday – 04/05/2023

ADP employment - 8:15 AM ET

U.S. trade balance - 8:30 AM ET

S&P final U.S. services PMI - 9:45 AM ET

ISM services - 10 AM ET

AM Earnings: ConAgra Brands (CAG), The Simply Good Foods Company (SMPL), Seadrill Limited (SDRL), Schnitzer Steel Industries (SCHN)

PM Earnings: Simulations Plus (SLP)

Thursday – 04/06/2023

Initial jobless claims - 8:30 AM ET

Continuing jobless claims - 8:30 AM ET

St. Louis Fed President Bullard speaks - 10 AM ET

AM Earnings: Constellation Brands (STZ), Lamb Weston Holdings (LW), RPM International (RPM)

PM Earnings: Levi Strauss (LEVI), WD-40 Company (WDFC)

Friday – 04/07/2023

U.S. employment report - 8:30 AM ET

U.S. unemployment rate - 8:30 AM ET

Average hourly wages - 8:30 AM ET

Average hourly wages (year over year) - 8:30 AM ET

Consumer credit - 3 PM ET

AM Earnings: None scheduled