HaiKhuu Weekly Recap & Analysis

April 1 - April 5, 2024

MAJOR EVENTS OF LAST WEEK

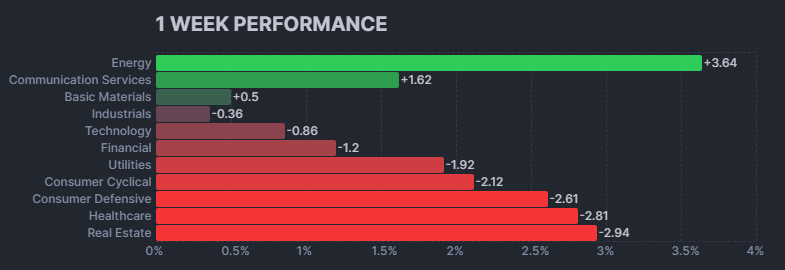

Major Indices’ Weekly Movement:

S&P 500: -1.91%

Nasdaq: -1.95%

Dow Jones: -2.95%

Highlights:

Fed's Powell said most FOMC participants see it as likely appropriate to begin cutting policy rate at some point this year

Tesla stock dropped 7% following the release of its delivery numbers

Apple is exploring home robots as the next big thing after their car failed

DAILY EVENT BREAKDOWN

Monday, April 1

Stock Related News:

Microsoft will sell its video app Teams separately from its Office product globally

United Parcel Service will become the United States Postal Service's (USPS) primary air cargo provider as rival FedEx walked away

OpenAI plans to open its first office in Asia in April with a location in Tokyo

United Airlines is asking pilots to take unpaid time off next month, citing late-arriving aircraft from Boeing

Economic News:

S&P Manufacturing PMI Final 51.9 (Forecast 52.5, Previous 52.5)

ISM Manufacturing PMI 50.3 (Forecast 48.3, Previous 47.8)

Employment Index 47.4 (Previous 45.9)

Prices Paid Actual 55.8 (Forecast 52.9, Previous 52.5)

New Orders Index 51.4 (Forecast 49.8, Previous 49.2)

Construction Spending MoM Actual -0.3% (Forecast 0.7%, Previous -0.2%)

Major Indices:

S&P 500: -0.17%

Nasdaq: +0.21%

Dow Jones: -0.61%

Tuesday, April 2

Stock Related News:

Tesla stock dropped 7% following the release of its delivery numbers:

Produced 433K, delivered 387K, the delivery estimate was 449K

Amazon to discontinue Just-Walk-Out checkout tech and to revamp majority of its fresh locations

Toyota Motor's unit in North America on reported Q1 sales of 565,098 vehicles in the US, an increase of over 20% on a volume basis

Intel disclosed a $7 Billion operating loss on its chip-making unit

A wallet tagged as belonging to the U.S. government containing 30.1K ($2.1B) confiscated from the Silk Road was moved to a Coinbase wallet

Silver Lake has agreed to take Endeavor private at $27.50/share

Economic News:

JOLTS Job Openings 8.756M (Forecast 8.73M, Previous 8.863M)

Durable Goods Revised 1.3% (Forecast 1.4%, Previous 1.4%)

Core Revised 0.3% (Previous 0.5%)

Factory Orders MoM 1.4% (Forecast 1%, Previous -3.6%)

Fed’s Mester: I still expect Fed can cut rates later this year

Does not expect a smooth path back to 2%

Major Indices:

S&P 500: -0.64%

Nasdaq: -0.86%

Dow Jones: -0.94%

Wednesday, April 3

Stock Related News:

Disney’s CEO Bob Iger won the proxy vote over Peltz with board’s election

Apple is exploring home robots as the next big thing after their car failed

Google hit an all-time high of $159.62 iin after-hours trading

Paramount and Skydance entered exclusive talks to merge

Amazon Web Services is laying off hundreds of physical store’s tech and sales staff

Boeing 737 Max production has fallen sharply to low single digits per month as FAA steps of factory audits

OpenAI just announced you can now edit DALL·E photos in ChatGPT

Economic News:

Fed's Powell: Most FOMC participants see it as likely appropriate to begin cutting policy rate at some point this year

Recent readings on job gains and inflation higher than expected, but do not materially change overall picture.

The economy still one of solid growth, strong but rebalancing labor market, inflation moving down to 2% on a sometimes bumpy path

ADP Employment Change Actual 184k (Forecast 150k, Previous 140k)

S&P Services PMI Final 51.7 (Forecast 51.7, Previous 51.7)

S&P Composite PMI Final 52.1 (Previous 52.2)

ISM Services PMI 51.4 (Forecast 52.8, Previous 52.6)

Prices Paid 53.4 (Forecast 58.4, Previous 58.6)

New Orders 54.4 (Forecast 55.5, Previous 56.1)

Employment 48.5 (Forecast 49, Previous 48.0)

Fed's Bostic still forecasts one rate cut this year and thinks we won't be back to 2% inflation target until 2026

Major Indices:

S&P 500: +0.11%

Nasdaq: +0.22%

Dow Jones: -0.09%

Thursday, April 4

Stock Related News:

Fed's Kashkari caused the markets to fall after stating, "It's possible Fed won't cut this year if inflation stalls"

Ford to delay all-electric SUV to focus on offering hybrid vehicles across its lineup by 2030

Palantir and Oracle announced a partnership for secure cloud and AI solutions

Hubspot was halted on volatility after news that Alphabet is in talks for a potential offer

Tesla has begun producing right-hand drive cars in Germany for export to India later this year

Economic News:

Jobless Claims:

Initial 221k (Forecast 214k, Previous 210k)

Continued 1.791M (Forecast 1.811M, Previous 1.819M)

US Trade Balance -68.9B (Forecast -67.6B, Previous -67.4B)

Fed's Goolsbee: In March I jotted down two rate cuts this year, but if inflation continues to move sideways, makes me wonder if we should cut rates at all this year

Housing inflation has to come down; I still think it will

If it doesn't, that is a threat to our 2% target

Major Indices:

S&P 500: -1.22%

Nasdaq: -1.53%

Dow Jones: -1.34%

Friday, April 5

Stock Related News:

Reuters claims that Tesla has canceled plans for a low-cost car plans to focus on developing self-driving robotaxis on the same small vehicle platform

In response to the report Elon Musk tweeted, “Reuters is lying (again)”

Meta hit an all-time high of $530.70

Johnson & Johnson agreed to acquire Shockwave Medical for $335.00 per share in cash, corresponding to an enterprise value of approximately $13.1 billion

Meta will begin labeling a wider range of video, audio and image content as "Made with AI" starting in May

Jersey Mike’s Subs is considering a sale that could value the popular sandwich chain at $8 Billion

Economic News:

Unemployment Rate 3.8% (Forecast 3.8%, Previous 3.9%)

Labor Force Participation 62.7% (Forecast 62.6%, Previous 62.5%)

Manufacturing Payrolls Actual 0k (Forecast 3k, Previous -4k)

Average Workweek Hrs 34.4 (Forecast 34.3, Previous 34.3)

Average Earnings MoM Actual 0.3% (Forecast 0.3%, Previous 0.1%)

Average Earnings YoY 4.1% (Forecast 4.1%, Previous 4.3%)

Fed's Logan: There is no urgency right now for Fed to cut, we have time

We can't wait until inflation reaches 2% to cut rates

The risk of cutting rates too soon is higher than being late

Major Indices:

S&P 500: +1.55%

Nasdaq: +1.33%

Dow Jones: +0.93%