HaiKhuu Weekly Recap & Analysis

December 18 - December 22, 2023

MAJOR EVENTS OF LAST WEEK

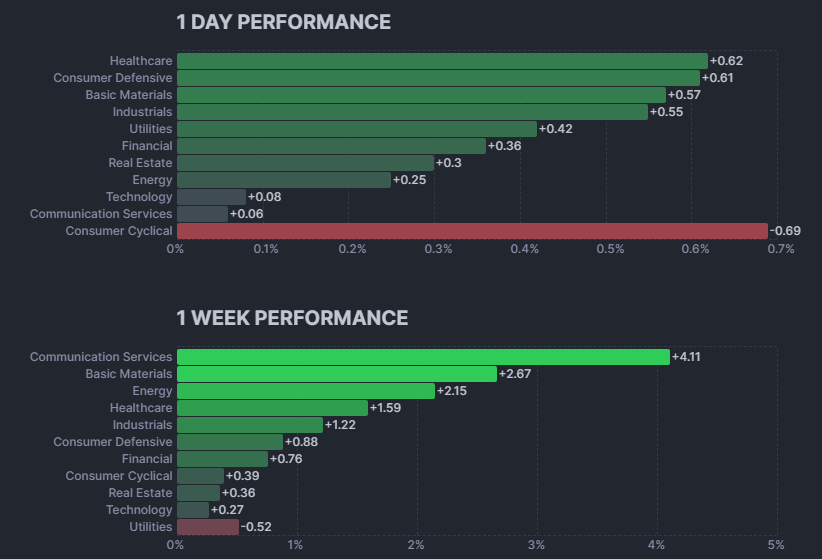

Major Indices’ Weekly Movement:

S&P 500: +0.57%

Nasdaq: +0.85%

Dow Jones: +0.14%

Highlights:

Apple is halting sales of Apple Watch models in the US due to a long-running patent dispute between the medical technology company Masimo

Nippon Steel Corp. will buy US Steel Corp. for $14.1 billion to create the world’s second-largest steel company

Affirm surged 16% on news that it will offer Buy-Now Pay-Later at Walmart's self-checkout kiosks

PCE Price Index:

YoY 2.6% (Forecast 2.8%, Previous 3.0%)

MoM -0.1% (Forecast 0%, Previous 0.0%)

DAILY EVENT BREAKDOWN

Monday, December 18

Stock Related News:

Apple is halting sales of Apple watch models in the US due to a long-running patent dispute between the medical technology company Masimo

Nippon Steel Corp. will buy US Steel Corp. for $14.1 billion to create the world’s second-largest steel company

The SEC delayed the Grayscale futures Ethereum ETF

Nikola founder Trevor Milton was sentenced to 4 years in prison for defrauding investors

Amazon is in talks to invest in the biggest regional sports programmer Diamond Sports Group

Economic News:

NAHB Housing Market Index Actual 37 (Forecast 37, Previous 34)

Fed’s Daly says 3 rate cuts could be needed in 2024 to avoid over-tightening

Major Indices:

S&P 500: +0.56%

Nasdaq: +0.43%

Dow Jones: +0.09%

Tuesday, December 19

Stock Related News:

Affirm (Buy-Now Pay-Later) surged 16% on news that it will offer BNPL at Walmart's self-checkout kiosks

Google is forced to pay $700m to US consumers in Play Store settlement

BlackRock updated its spot Bitcoin ETF proposal to allow cash redemptions, in a move that could help it secure approval from the SEC

A US court approved order for Binance to pay $2.7 bln to CFTC

CZ will pay $150 million and Binance will pay $2.7 billion to the CFTC as a result, the agency said in a statement

Volkswagon announced it has signed an agreement with Tesla to adopt its North American Charging Standard (NACS) starting in 2025

Economic News:

Housing Starts Number 1.56M (Forecast 1.36M, Previous 1.372M)

Change MoM 14.8% (Forecast -0.9%, Previous 1.9%)

Building Permits Number 1.46M (Forecast 1.465M, Previous 1.498M)

Change MoM -2.5% (Forecast -2.2%, Previous 1.8%)

US Redbook YoY Actual 3.6%, Previous 3.4%

Fed's Bostic projects 2 rate cuts next year in the second half of 2024.

Major Indices:

S&P 500: +0.61%

Nasdaq: +0.51%

Dow Jones: +0.68%

Wednesday, December 20

Stock Related News:

Electric Scooter Company Bird has filed for bankruptcy

Apple is ramping up its Vision Pro VR headset production and is aiming for a February Launch

Warner Bros Discovery held talks with Paramount about a possible merger

Microsoft announced that Activision Blizzard CEO Bobby Kotick will be stepping down on December 29

Economic News:

US Current Account Actual -200.3B (Forecast -196B, Previous -212.1B)

Consumer Confidence 110.7 (Forecast 104.5, Previous 102.0)

The Present Situation Index rose to 148.5, indicating positive assessments of current business and labor market conditions

Expectations for income, business, and labor market conditions leapt to 85.6, reaching levels of optimism last seen in July

Major Indices:

S&P 500: -1.39%

Nasdaq: -1.49%

Dow Jones: -1.25%

Thursday, December 21

Stock Related News:

Apple Watch Series 9 and Ultra 2 are officially unavailable to purchase on their Website

The US Department of Commerce is launching a survey on the semiconductor supply chains amid security concerns about Chinese-sourced chips

The CBOE will be adding Tuesday and Thursday expiries to the Russell 2000 options

Apple increased the APY on its high-yield savings account to 4.25% from 4.15%

United Launch Alliance received buyout bids from multiple companies including Jeff Bezos-owned Blue Origin

Honda’s US unit is recalling 2.5 million vehicles over fuel pump issues

Economic News:

GDP Data:

GDP QoQ Final 4.9% (Forecast 5.2%, Previous 5.2%)

GDP Price Index 3.6% (Forecast 3.6%, Previous 3.6%)

GDP Deflator SA Final 3.3% (Previous 3.5%)

PCE Prices:

PCE Prices 2.6% (Previous 2.8%)

Core PCE Prices 2.3% (Forecast 2.3%, Previous 2.3%)

Jobless Claims:

Initial Claims 205k (Forecast 215k, Previous 202k)

Continued Claims 1.865M (Forecast 1.88M, Previous 1.876M)

Leading Index Change MoM -0.5% (Forecast -0.5%, Previous -0.8%)

Major Indices:

S&P 500: +0.95%

Nasdaq: +1.16%

Dow Jones: +0.83%

Friday, December 22

Stock Related News:

Lionsgate has agreed to separate its studio business which owns franchises like John Wick and The Hunger Games

Lionsgate will merge the studio business with a SPAC (SCRM) and go public as a standalone pure-play content company valued at $4.6B

Bristol Myers to buy schizophrenia drugmaker Karuna Therapeutics for $14 billion

Cathie Wood of Ark believes deflation is likely in the coming year & expects aggressive interest rate cuts by the Fed

Economic News:

PCE Price Index:

YoY 2.6% (Forecast 2.8%, Previous 3.0%)

MoM -0.1% (Forecast 0%, Previous 0.0%)

Core PCE YoY 3.2% (Forecast 3.3%, Previous 3.5%)

Core PCE MoM 0.1% (Forecast 0.2%, Previous 0.2%)

UMich Inflation Expectations and Sentiment:

Sentiment 69.7 (Forecast 69.4, Previous 69.4)

1-Yr Inflation 3.1% (Forecast 3.1%, Previous 3.1%)

5-Yr Inflation 2.9% (Forecast 2.8%, Previous 2.8%)

Expectations 67.4 (Forecast 67.5, Previous 66.4)

Conditions 73.3 (Forecast 74.6, Previous 74.0)

New Home Sales

Units 0.59M (Forecast 0.69M, Previous 0.679M)

Change MoM -12.2% (Forecast 1.6%, Previous -5.6%)

Durable Goods 5.4% (Forecast 2.3%, Previous -5.4%)

Core Durable Goods 0.5% (Forecast 0.1%, Previous 0.0%)

Consumer Spending MoM 0.2% (Forecast 0.3%, Previous 0.2%)

Personal Income MoM 0.4% (Forecast 0.4%, Previous 0.2%)

Real Personal Consumption MoM 0.3% (Forecast 0.3%, Previous 0.2%)

Major Indices:

S&P 500: +0.20%

Nasdaq: +0.15%

Dow Jones: -0.12%