Highlighted Trades: 02/22/2024

Our best trade of the day is this short on ENPH. Despite being up more than 1%, it leaves a good deal to be desired. We came fairly close to hitting our target exit, but just missed it, and consequently it looks like we’ll be missing out on some profit. The stock hit a low of $122.73, while our target exit was $122.48 - just $0.25 off! If I were trading live, I can pretty safely say I would have just closed this one out at EOD, but as it stands we’re up 1.14% and holding overnight. Technicals don’t show much sign of turning, but given how volatile market open can be, there’s a good chance we won’t be holding this one long into tomorrow.

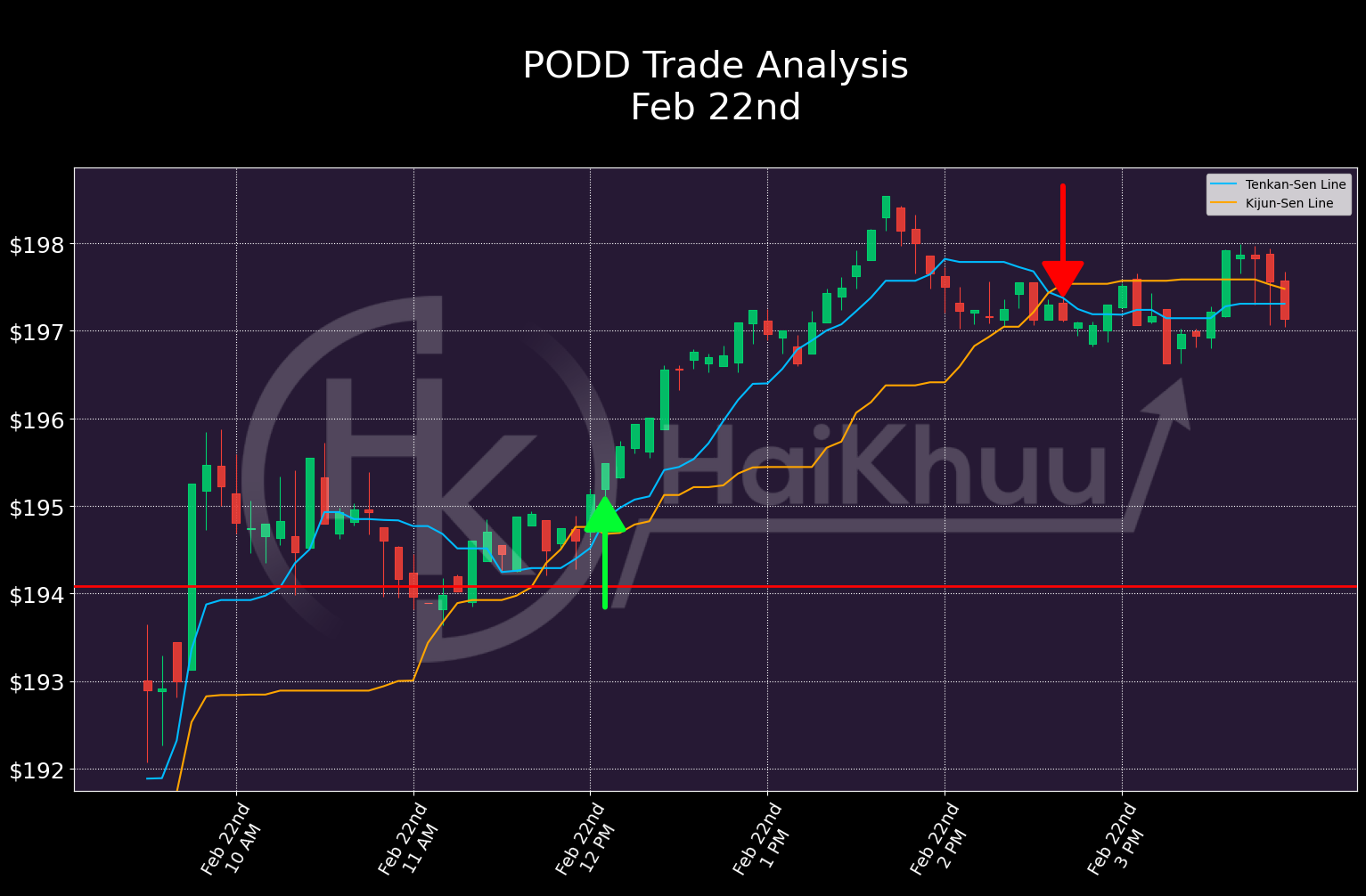

Our best long of the day was on PODD, and was closed out for a profit of 0.94%. We got out of this one when technicals went sour. This wasn’t necessarily a bad move - the stock price mostly leveled out from there until close - we did miss out on some additional profit by not leaving earlier. Still, a win is a win, but it’s hard not to nitpick these things. Overall, I do like this trade. Levels placed reasonably, no clear red flags at time of entry - this one’s fairly clean, even if it wasn’t perfect.

To no one’s surprise, our worst trade of the day was the product of an overly volatile open. But this is a bit deceptive, as this open passes both of our experimental checks. The total price range of the opening 30 minutes is 1.68% - a far cry from the 4% threshold we’re experimenting with. Additionally, the biggest candle has a range of 0.954%, just barely passing our experimental requirement that the biggest recent candle have a range of 1% or less.

No matter what we come up with for weeding out fake-out signals, it’s never going to be perfect. Even with our new system in place, this is a trade that would have made it to users, but even if it’s not clear to a computer, from a human perspective this one has a lot of red flags. Even if you didn’t avoid this trade entirely, there’s a good chance an end user would have at least under-allocated. I don’t like having to rely on the end user to avoid trades like these, as it would be highly preferable to have caught this before it went out.

Overall, we made 50 trades today - exactly our target! These consisted of 29 longs and 21 shorts. That’s all I have for you tonight. Thanks for reading, and happy trading!