Highlighted Trades - 03/05/2024

Currently, our best trade of the day is still open. So far, it’s not only our best trade of the day, but the best we’ve ever seen on this system. It’s a short on ALB, and so far it’s up 6.21%. We alerted this at $116.64, and so far the stock is down to $109.40. Overall, I’d say our entry conditions look nice - though I probably would have entered a few candles after we alerted. The cross is decent at the time of our alert, but does get stronger later. Additionally, the lagging line was only barely below price action when we altered, but a few candles later it would have been more noticeably below. There’s also some solid bearish momentum going into the trade. The stop loss is a bit generous for my liking, but if you take the trade, you can always choose to place it closer.

The one thing that makes me question whether I would have taken this is ALB’s recent volatility. The price went down nearly 9% overnight. Even though the price mostly held steady throughout the day (until the last 90 minutes of the day), that would give me some pause on taking trades on the ticker. Not necessarily a hard no, but definitely a reason to think twice.

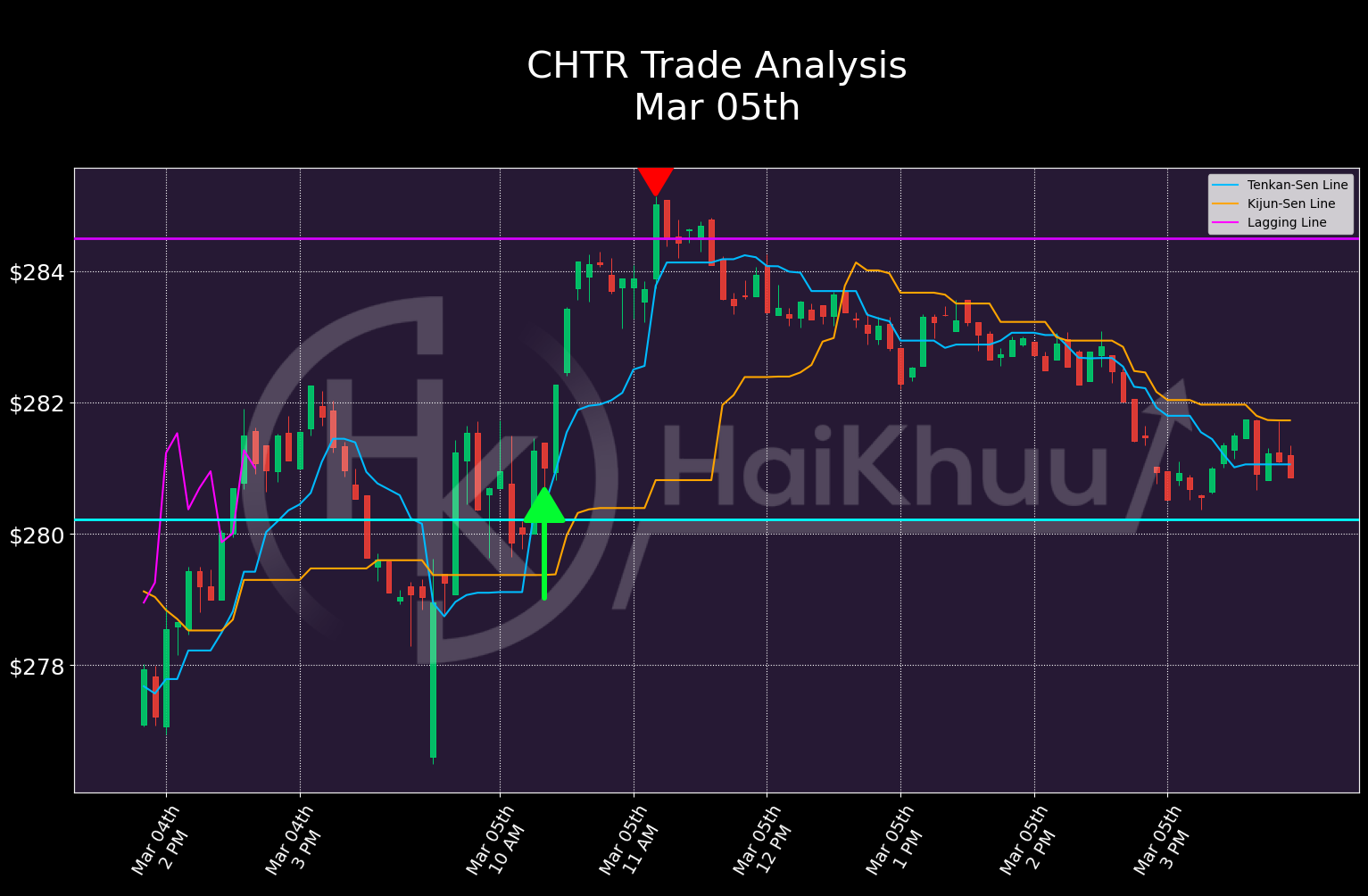

Our best long of the day was on CHTR, where we made a return of 1.22%. The cross here is fairly solid, but with the lagging line below previous price action, I don’t think I would have taken this trade. The conclusion is unfortunate, but we want to be as picky as we can here. Theoretically, this system can monitor an unlimited number of stocks 24/7, so there isn’t much incentive for us to take sub-optimal trades.

Our worst trade of the day is . . . interesting. We went long on PFE at $26.24, and on the chart, it looks like we picked a profitable point to exit. In practice, PFE had one candle with a range of more than 2% (the average is 0.3%, so this was nearly a 10x increase in volatility for that one candle), which was enough to hit our stop loss. The entry for this trade is questionable for a few reasons, but not that bad. Lagging line is above price action, there’s good momentum, and even though the cross is weak, both TK-lines are slanted upwards, which is a good sign. If you’d taken this trade and used the Tenkan-Sen line as your stop loss, you would have taken a much smaller loss here. If you’d held until the TK-cross reversed, you would have roughly broken even. It seems like we just got really unlucky with our stop loss here. But we always like to practice risk management, and we accept that sometimes our risk management techniques will end up reducing the profitability of a trade. It looks like this time, we just got unlucky with price action.

Overall, we entered 45 positions today - 14 long and 31 short. That’s all I have for you tonight - thank you for reading, and happy trading!