Highlighted Trades - 03/12/2024

We made 57 trades today - a bit more than average - 32 long and 25 short positions.

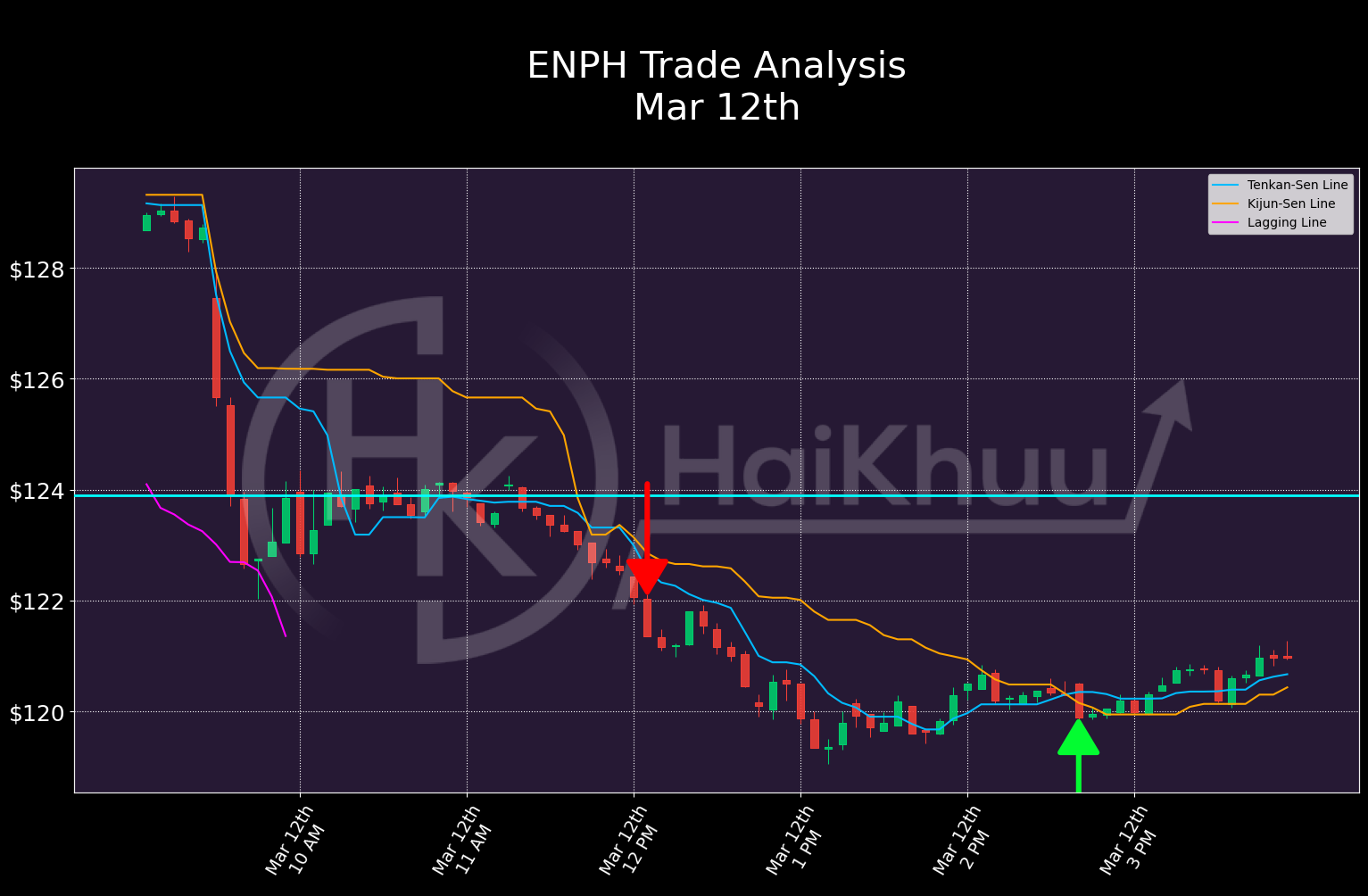

Of these, our biggest winner was a short on ENPH, returning 1.16%. The entry here is decent, but the cross is pretty flawed. It’s not a TK-crossunder, more a brief TK-crossover, followed by a reversion. Both TK lines are sloped down pretty hard, which does help to make this more appealing, but overall, I don’t think I would have taken this one - at very least, I would have under-allocated it.

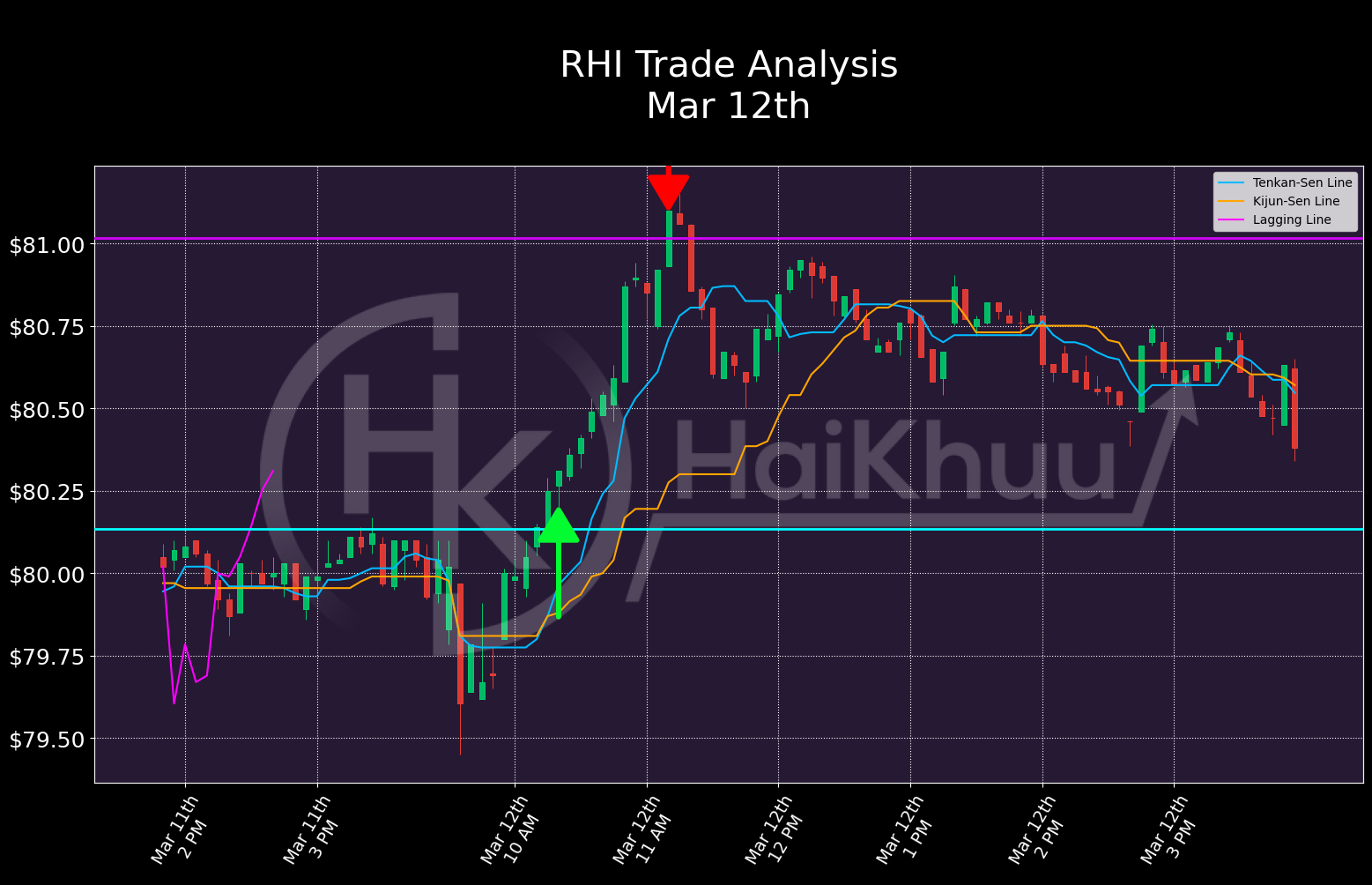

Our best long of the day, even if less profitable, had a much stronger entry setup in my opinion. In fact, all of our green flags are present here. There’s very solid momentum going into this, the cross is solid, TK-lines sloped upwards, lagging line above price action, candles above Tenkan-Sen line, stop loss is reasonable - this is really the gold standard of what we’re looking for here. Even our exit went nearly perfectly, with the stock price peaking just above our target exit.

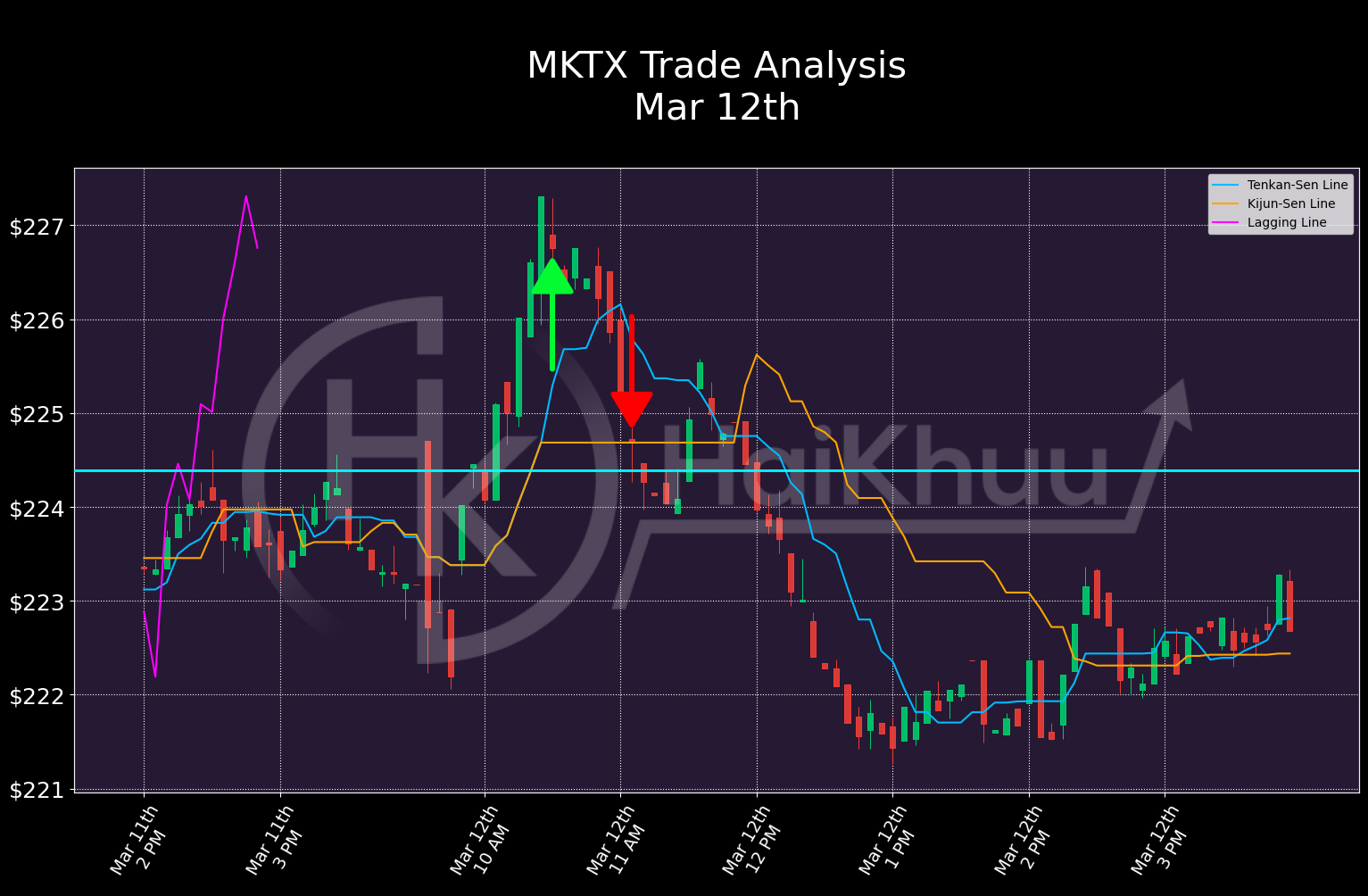

Our biggest loser of the day was on MKTX, and cost us 1.16%. The only real red flag with this trade is that the TK lines spend a long time stuck together before the cross. This red flag would be relatively easy to ignore if the TK-lines both sloped upwards after the cross, but they don’t; the Kijun-Sen line remains completely flat. Additionally, using the “Tenkan-Sen as a stop loss” strategy, you could have cut losses pretty substantially here. This trade is somewhat ironic, as the TK-crossunder that came shortly after its close was a very strong winner.

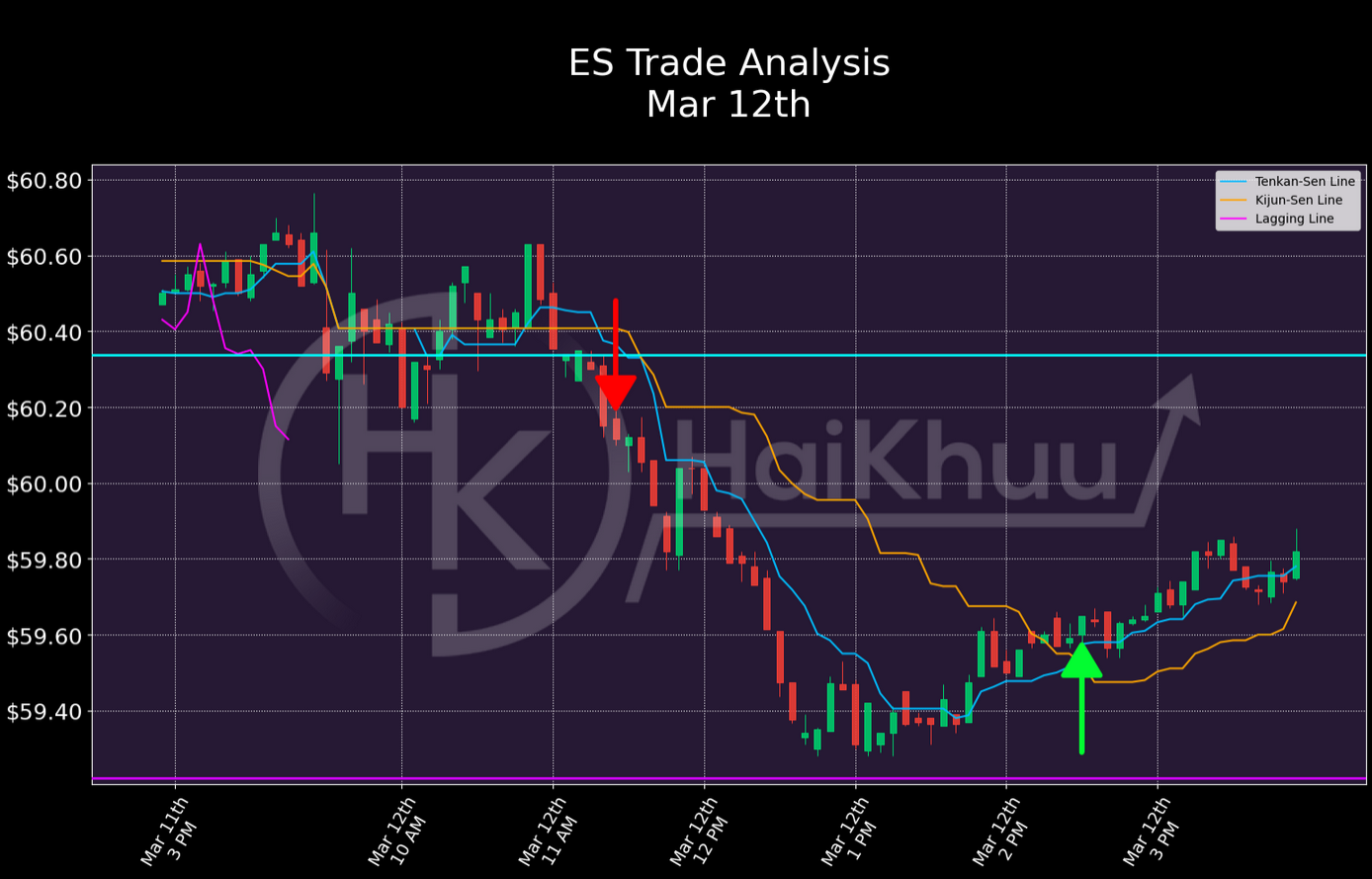

The last trade I want to highlight today is this short on ES. This was both a successful trade, and a fairly strong setup, hitting most of our targets. The only flaw to this one was an overly-optimistic exit price, but the Tenkan-Sen stop loss would have mitigated that, capturing a larger portion of potential profit. Overall, we had some big winners today, with lots of opportunities to bring in profit.

That’s all I have for you today - thank you for reading, and happy trading!