Highlighted Trades - 04/17/2024

We saw 7 trades today (1 long, 6 short) across 4 unique tickers. Today was unique in an unfortunate way - our first day since rolling out the new system with zero profitable positions - only losers. This obviously isn’t desired, but given the relatively small number of positions this system takes on, it was inevitable eventually.

I do want to say that results are still good from this system. We’re net positive overall, and even net positive just this week. The name of the game with this model is “lose small, win big”. Today we lost small, but we’re winning enough to out-do our losers.

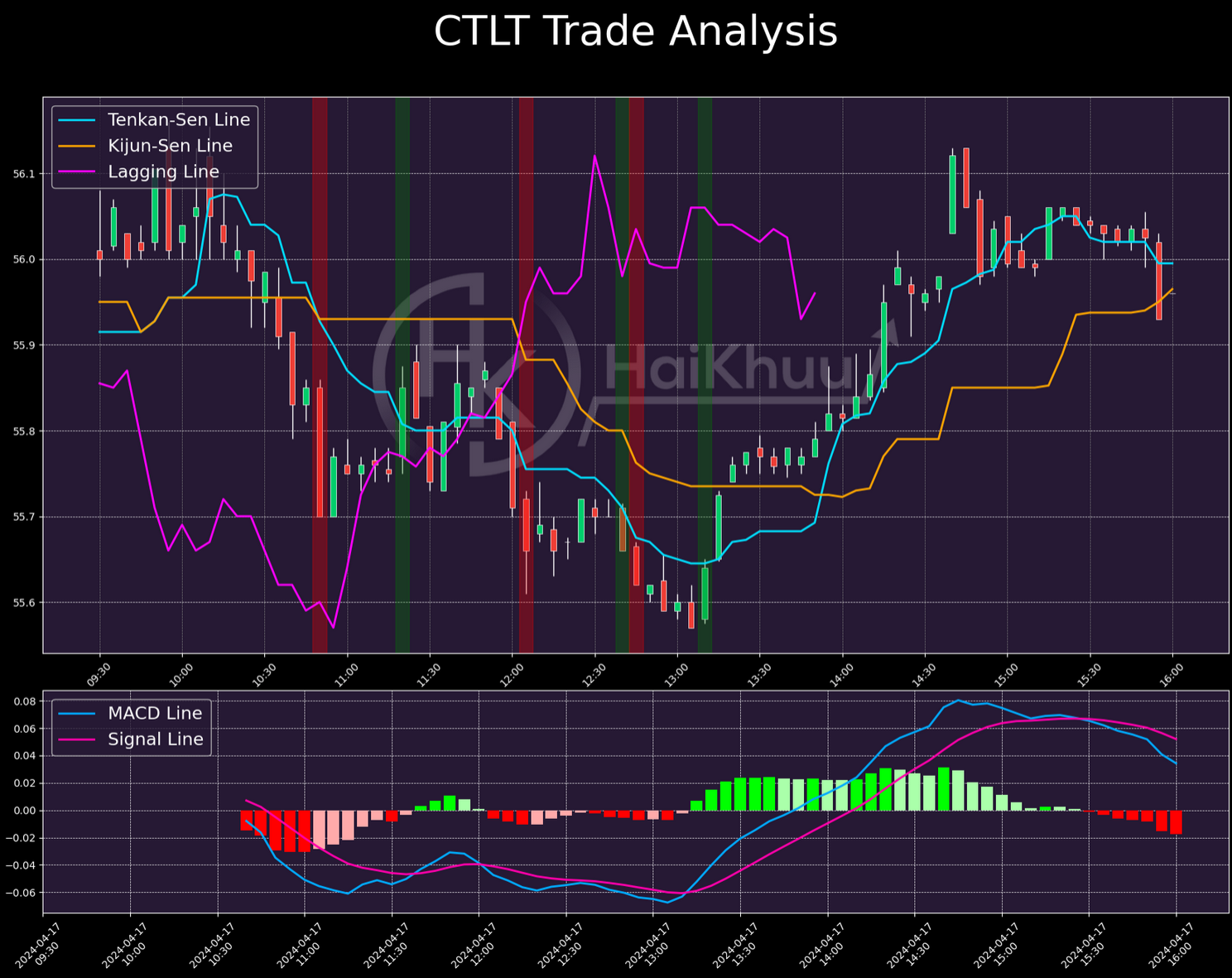

Our biggest loser of the day was CTLT. We took on 1 main entry, and 2 re-entries, losing a total of 0.40% here. While I don’t mind our initial entry, I think both re-entries were pretty avoidable here. During our initial entry, the MACD is strong. It’s solidly negative, and consistently decreasing at the time. Between our first entry and our re-entries, MACD mostly goes flat, even becoming positive briefly. The weaker MACD is the biggest red flag here, suggesting that even if there’s some bearish momentum, it’s significantly weaker than it was when we first entered. Even though the first entry is solid enough, I don’t think I would have taken either re-entry position.

Our most minor loser of the day is depicted here - a long position where we lost 0.07%, ending up relatively in the black. Overall, I would have taken this trade. There’s great momentum going in, the MACD is strong, and the TK-cross is well-pronounced with both lines trending upwards. It looks like we just got unlucky here.

The next trade I want to examine is BIIB. We lost 0.13% here across 2 entries. Visually, the initial entry isn’t great MACD is almost completely flat. It’s difficult to evaluate that algorithmically, but visually, it’s pretty clear at a glance. This is a problem that’s exacerbated even further during our re-entry. Flat MACD is a red flag that’s difficult to evaluate algorithmically, but usually obvious to a human trader. Even if I had taken the initial entry, I almost certainly would have refused that re-entry.

Our last trade today was this short on NSC. We lost 0.27% here and, unfortunately, I don’t think this trade was easily avoidable. The only red flag in our entry is the Kijun-Sen line being relatively flat, but given the strong bearish momentum during our entry, I wouldn’t blame you if you disregarded that. The only reason I can see to have been concerned here is that the price is approaching a support level it tested, and bounced back from earlier that afternoon. In that sense, if you took this position, you were betting a breakout here, and probably exited as soon as it became clear the price was turning around. Even if this was a tough trade to miss entirely, it was a relatively easy one to reduce losses on.

That’s all I have for you tonight. Thank you for reading - and happy trading!