Highlighted Trades - 06/05/2024

We saw 49 trades today (36 long and 13 short) across 41 unique tickers. Let’s check them out.

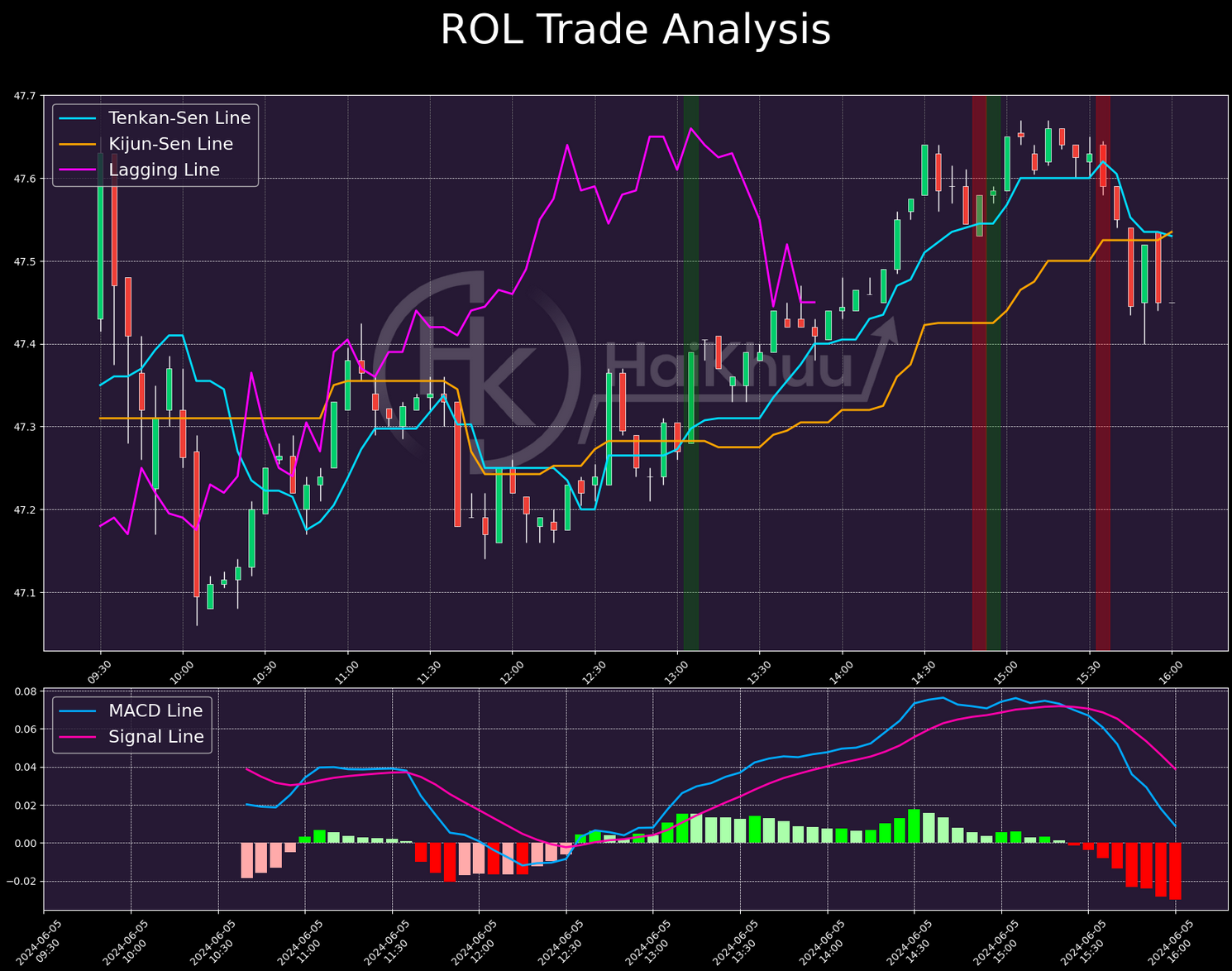

Our big winner today is ROL - we made 0.35% here between 2 positions. I like our initial entry, but I wouldn’t say I love it. We enter on a pretty big green candle, meaning we need the stock to keep climbing even higher for this to work out (though granted, ROL did exactly that). The momentum is just okay, not that consistent, and MACD is similar. The second bit I think is questionable here is our first stop-out. It breaks through the Tenkan-Sen line, but just barely. If you saw this and kept holding, I wouldn’t disagree with that move. This goes double since we lose money by taking that first stop; if you had held through it, you could have increased your return to 0.44%. Still, this was a strong trade, albeit a flawed one.

Next, I’d like to discuss this long on NEM, where we made 0.23% between 2 entries. While I think our initial entry is fairly strong, I’m not sure I would have taken the re-entry. The system re-entered on a relatively flat candle, after riding the Tenkan-Sen line for a while. There was clearly a danger of being stopped out here. Additionally, the momentum and MACD were both much weaker here, with MACD on a steady downtrend prior to our re-entry. These red flags are all obvious to a human trader, so I feel reasonably confident saying most of our traders would not have taken the re-entry here. If you only took the first position, you could have increased your return here to 0.27% - not a big increase, but all positive returns are great to see. It’s always worth doing your own due diligence here.

Our biggest loser of the day was DLTR, where we lost 0.55% from one trade, with no re-entries. Overall, I like the entry conditions here. Momentum is very strong, MACD is ideal, both TK-lines slope down, and the cross is a strong one. The only major red flag on this trade is that, at the time of entry, the price action is a good deal below the Tenkan-Sen line, making this a relatively high risk play, but given all of the other factors, it’s perfectly understandable if you considered this red flag to have been mitigated. Unfortunately, it doesn’t look like this trade was avoidable; this one just didn’t work out.

That’s all I have for you tonight - thank you for reading, and happy trading!