HaiKhuu Daily Report - 01/15/2026

Good morning, and happy Thursday! Wow, this has been an absolutely INSANE week for the markets, and traders are experiencing volatility like no other at the moment. Market conditions are looking strong, yet are becoming more and more sketchy as time goes on. We’ve only continued to slowly drop from the top, so the question is now, where do we head from here?

Markets are up slightly at the time of writing this report, so leading into today, I am not overly bullish or bearish. I am optimistic and hope that the markets go up, but we are in some conditions where realistically, we could go either direction with relative ease. We could magnet back to $SPY $680, or we can watch as $SPY breaks out and goes on and makes a new all-time high.

Both scenarios are extremely possible at this point, so I am going to warn you that anything can genuinely happen while trading today. Please, as always, make sure that you are practicing both basic risk management and following the momentum.

If the markets are selling off, it will be clear that we are bearish. Do not attempt to catch a falling knife and just wait for the reversal. The same goes if we are looking bullish.

Just tread lightly today, and make sure that you can survive. This will be a hectic time, so let’s have some fun and realize some gains!

Good luck trading today, and let’s kill it!

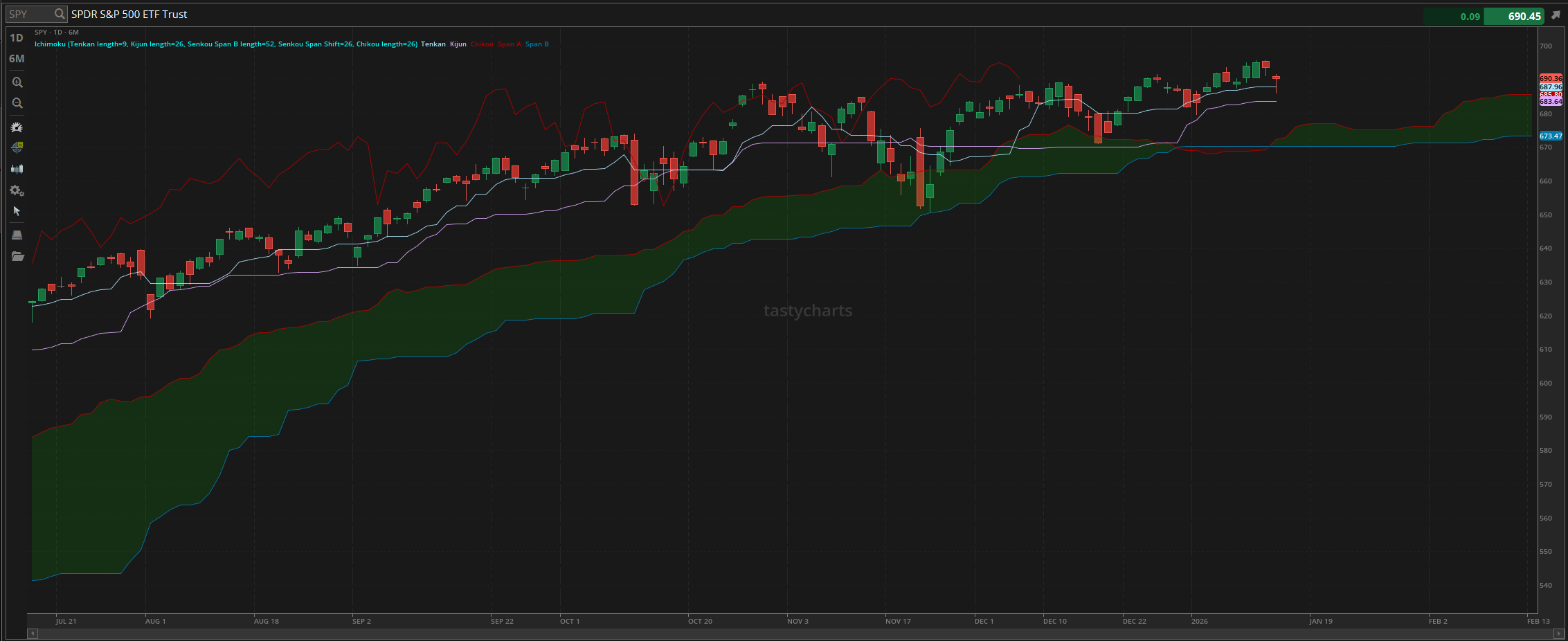

The updated $SPY daily levels are as follows:

Conversion Line Support: $687.96

Baseline Support: $683.64

Psychological Support: $680

Daily Cloud Support: $670.16

Thoughts & Comments from Yesterday - 01/14/2026

Yesterday was a tough day for the overall markets. Conditions were not overly bearish, but there were no insane opportunities to capitalize on the general indices, and $SPY had some tough overall momentum. There were definitely opportunities to actively trade, and I love seeing people optimistic and excited about these conditions!

We started the day with $SPY looking gross, markets were down slightly at the time of open, and watched as $SPY opened the daya t $691.04. Conditions at open were alright as we quickly went on and made the official high of the day trading at $691.72, before watching as the rest of the morning was filled with weak bearish momentum, and watched as $SPY went on and continued to make new lows throughout the entire morning, going on to make the official low of the day trading at $686.13.

Market conditions at the bottom really were gross and slow leading into the lunchtime lull, and honestly as much as I hate saying this, really were uneventful mostly if you were attempting to trade, but thankfully, after the slow choppy momentum we saw during the lull, markets were able to break out again in the afternoon to recover the majority of the losses generated.

$SPY started to recover in the final two hours of the trading day, snapping back up quickly to end the day at $690.36, meaning $SPY rallied approximately $4 from the bottom, and provided us with an alright close.

We officially ended the day with $SPY down approximately $3.50, or roughly 0.5%. On an overall basis, it was kind of a tough day for the markets, but for those who simply held, there was a 0.1% drop on $SPY on an intraday basis, as well as opportunities to trade both directions by simply following the general market momentum. I hope that you all were able to make the most out of the conditions presented to us yesterday, and are excited about where the markets are going to take us today! So let’s see where the markets take us and have a great time!,

S&P 500 Heat Map - 01/14/2026

Thoughts & Comments for Today - 01/15/2026

Today is gearing up to be at least more fun than yesterday. Markets are up slightly, yet general fears and uncertainty have remained unchanged. We have seen a drop in VIX, which is a great sign leading into the day, but I am warning you all now that with the way the markets are trending, many individuals are going to print a significant amount of cash in a short period of time, while others are going to unfortunately and inevitably end up losing money today.

Everything will come down to what organizations you are allocated into long-term, what risks you are attempting to take here in the short term, and what you are attempting to achieve.

If your goal is to simply sit back, relax, and watch as your strong equities continue to print you money, that is not a bad goal, nor is it something that traders can scoff at. It is still, in my opinion, the easiest way to capitalize on these conditions, and the next is simply watch these conditions and maximize your potential here in the short term.

Quick scalps in these market conditions will not net you with an irrational amount of unrealized gains, but at the same time, allow you an opportunity to get some short-term exposure in the markets, especially if you are watching the markets rally, with relatively little to no downside risk. Just set tight stops under major support levels, and simply follow the trend.

Assuming we are going to be able to continue to follow the general market momentum, it will be almost impossible to lose money. The only people who will incur losses at this time are those who get chopped/stopped out of their positions, as well as those who are overallocating or entering into option contracts incorrectly. It may sound bad to say this, but that is just the reality of the markets and these current conditions.

But, assuming this all becomes one insane buy-the-dip opportunity, I genuinely believe many traders will have absolutely no problem realizing significant gains, especially if the markets continue to move up. We are less than $5 away from making a new official all-time high on $SPY, so all we have to do now is follow the general market momentum, not attempt to fight any trends, and hope that we see a breakout.

I do not know what catalysts would be necessary for the markets to reach a new all-time high from here, but at the same time, reason is not necessary during times of irrationality.

Just continue to retain your strong exposure, watch for opportunities to buy the dip, and enjoy actively scalping and day trading higher beta stocks that provide the volatility necessary for a beautiful trade. Make sure to practice safe risk management, and I don’t see any reason why traders won’t be able to simply realize a significant amount of gains today.

Make the most out of the opportunities available to us, and let’s have a great time!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $PLTR, $ORCL, $NVDA, $TSLA, $AMD, $INTC

Speculative: $PTLO, $RIVN

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: $MSTR, SOL

Economic News for 01/15/2026 (ET):

Initial Jobless Claims - 8:30 AM

Import Price Index - 8:30 AM

Philadelphia Fed’s Manufacturing Survey - 8:30 AM

Richmond Fed President Tom Barkin speaks - 12:40 PM

Notable Earnings for 01/15/2026:

Pre-Market Earnings:

Taiwan Semiconductor (TSM)

Morgan Stanley (MS)

Goldman Sachs Group (GS)

BlackRock (BLK)

First Horizon National (FHN)

Insteel Industries (IIIN)

After Market Earnings:

J.B. Hunt Transport (JBHT)

Wrap up

This should be a beautiful day for the markets, full of opportunity and hopefully insane bullish momentum. Let’s hope that these conditions continue to provide us with some beautiful opportunities , and do everything in our power to realize a significant amount of gains today. Just make sure to practice risk management and never fight any trends!

Good luck trading, and let’s see where $SPY takes us today!