HaiKhuu Daily Report - 02/02/2026

Good morning and welcome to February!

Wow, the weekend has flown by, and we are all back here, waiting for the markets to open and ready to have an amazing time! Markets are looking extremely bloody at the time of writing this report. The markets have dove heavily, and I hope you all are ready for what is going to be an interesting day.

I want to state right away that I am not overly concerned about these market conditions. Things are obviously less than ideal, but you have to remember the overall strength of these conditions. These market conditions are strong, but the uncertainty and fear that is in the markets is driving this selling.

The only thing I am concerned about is if this becomes a major market rotation. Obviously, I am still going to be as optimistic as possible, but I will warn you all to tread lightly on these conditions, practice safe risk management, and hope for the best.

I’ll talk more about my general sentiment later on in the report, so please just make sure to check out the WEEKLY PREVIEW to see the earnings and economic news coming up this week!

For now, go into the week preparing for a fight, because this is going to be an irrational and difficult week for the markets!

Let’s prepare accordingly and make the most out of these conditions!

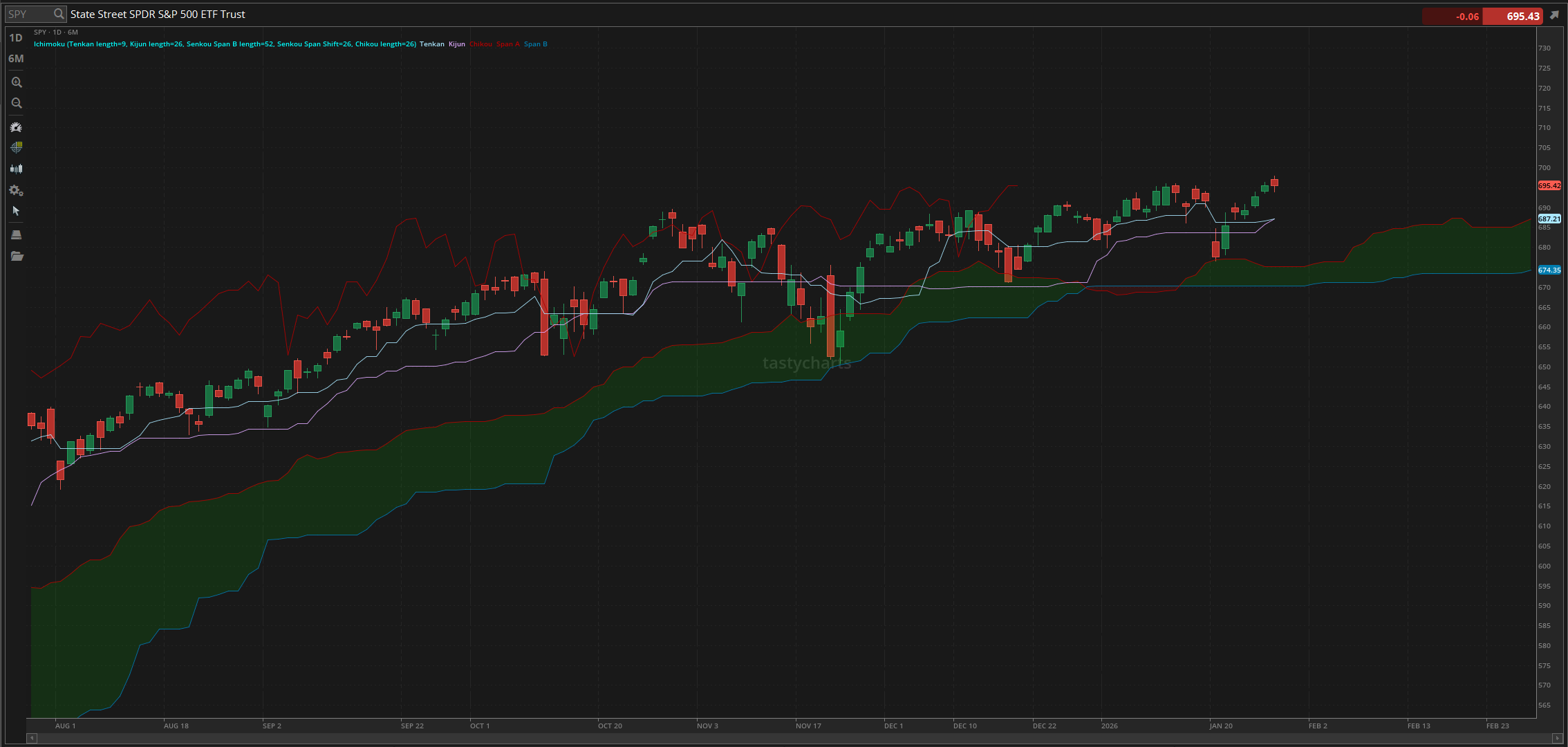

The updated $SPY daily levels are as follows:

Conversion Line Support: $687.21

Baseline Support: $687.21

Psychological Support: $680

Daily Cloud Support: $675.14

Thoughts & Comments from Last Week

Last week was an insane week for the markets. We watched as $SPY and everything hit new all-time highs, we watched as silver and precious metals hit a new irrational high, and we watched as almost everything came crashing back down, all within an extremely short period of time. Traders had opportunities to absolutely print last week, and some traders got absolutely slaughtered. That is simply just life and these market conditions. I hope you all practiced safe risk management and made the most out of the times because man, that was a tough week to navigate.

We started the week with $SPY trading at $690.57. Conditions were alright leading into the week as there was mild bullish momentum throughout Monday, displaying general strength to start out the week, and watched as $SPY continued to rally through Tuesday.

Market conditions at the top on Tuesday were great, and things only continued to heat up into Wednesday.

On Wednesday, $SPY went on and made the official high of the week, and the official all-time high, trading at $697.84. I was extremely proud to have alerted a silver short at almost the perfect top, and watched as throughout the rest of the week, the markets came down, and watched as precious metals absolutely fell through the ground.

We watched as silver prices dropped heavily from the top, dropping $30 per oz on Friday. The volatility that we experienced on Silver last week was absolutely insane and, honestly, unheard of, and thankfully, we watched as the markets absolutely printed for anyone who was bearish on Silver, or simply followed a couple of our plays. But we watched as the markets continued to have a great time despite coming down slightly from the top, where we went on to officially end the week trading at $691.97, up $1.40 for the week, but down roughly $6 from the previous all-time high.

Hopefully, you all were able to realize a significant amount of gains last week and made the most out of the volatile times. Again, there were so many insane opportunities presented to us, so hopefully you were able to catch at least some and had a great time. But hey, regardless of what happened last week, let’s just prepare accordingly for today, as every day is a new day.

S&P 500 Heat Map - 01/30/2026

Thoughts & Comments for Today - 02/02/2026

Now, let’s talk about today and the fearful conditions the markets are providing us right now. The markets have dropped heavily over the weekend, meaning that we are about to start this week out with fear, confusion, and unrealized losses. If you were bearish over the weekend, congrats. This is either going to be the beginning of the end, or a beautiful buy-the-dip opportunity. I am honestly confused as a result of these conditions, but I am attempting to make the most out of it. With the way that everything is trending right now, traders are feeling conflicting sentiment, but that is honestly fine as the markets are bloody leading into today.

I am personally starting to allocate into Solana on this dip (light entry), and am looking to see where the markets ultimately take us from here.

There is so much uncertainty in the air right now that many traders are going to have an extremely difficult time remaining both solvent and confident at this time, resulting in a possible continuation of a sell-off, despite us being literally dollars away from a new all-time high. This is the uncertainty and irrationality that I’ve been talking about for the previous couple of weeks.

The short-term confusion is going to possibly lead to the markets becoming oversold, providing us with opportunities to trade, buy the dip, and get some strong allocations before confidence comes back into the markets, and we watch as new all-time highs continue to happen after dropping the weakest traders.

Everything comes down to these market conditions. Traders can easily capitalize on these market conditions, and I genuinely do believe that as a result of this, we are going to see great opportunities to trade. It all will come down to how you perform under pressure and if there is anything that you can do in the short term to capitalize on this weakness.

I will warn you all again that there is a possibility that this is the market rotation we’ve been watching and waiting for, happening in real time. In the case that this is where we start to sell off, I am going to be overly concerned and am curious to see where the markets ultimately take us. In the case that we sell off heavily from here as a result of everything going on, my price target will be approximately $100 down on $SPY, meaning we would trade in the high $500’s range, let’s say $560-580.

Again, that is my tinfoil hat thesis, under the assumption that we get major selling, weakness, fear, and irrationality. I still do believe that one of the sudden strikes that will heavily impact us in the future is going to be OpenAI not meeting their order requirements, but until that point, we will be in a state of irrational and illogical bliss.

Do everything in your power to make the most out of these conditions. $SPY is only down about half a percent right now, which is obviously not ideal, but at the same time, provides us with everything necessary to capitalize on the markets in the short term.

Look for opportunities to buy the dip, look for opportunities to actively scalp and day trade, and look for opportunities to realize gains.

If I am just being honest with all of you, these market conditions are either about to become even easier for some or exponentially harder for others. Tread lightly with everything going on, have some fun, and realize some gains!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $INTC, $RIVN , $ORCL, $NVDA, $TSLA, $AMD, $PLTR

Speculative: $PTLO, $RIVN, $CVX

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: $MSTR, SOL, BTC

Economic News for 02/02/2026 (ET):

ISM Manufacturing - 10:00 AM

Notable Earnings for 02/02/2026:

Pre-Market Earnings:

Walt Disney (DIS)

Aptiv PLC (APTV)

IDEXX Laboratories (IDXX)

Alliance Resources (ARLP)

Tyson Foods (TSN)

Hess Midstream (HESM)

After Market Earnings:

Palantir Technologies (PLTR)

Teradyne (TER)

Fabrinet (FA)

DaVita (DVA)

NXP Semiconductors (NXPI)

Ashland (ASH)

Capital Southwest (CSQC)

Simon Property (SPG)

Wrap up

This is going to be an interesting and confusing time for the markets. Please continue to tread lightly and practice risk management as a result of the confusion and irrationality that we are seeing. It will be hard not to make the most out of these conditions, so take advantage of the weakness and fear we are seeing across the board. Just protect your bottom line, and have an absolutely amazing time in the process!

Good luck trading, and let’s kill it this week!