HaiKhuu Daily Report - 02/04/2026

Good morning and happy Wednesday!

Wow, what a volatile week this has become, as traders are both confused and starting to become fearful at this level. Markets are up slightly at the time of writing this report, but general market volatility and confusion do not appear to be easing anytime soon.

We are seeing a continuation of general market weakness, and traders are genuinely struggling right now. PLEASE go into today anticipating more irrational volatility in the markets, and please do everything in your power to realize significant gains in a short period of time.

Traders will have some fun while attempting to trade, so make the most out of this volatility, as this is going to be one of the best times to attempt to trade in the markets, but please make sure you are protecting yourself, as this is the time that the most losses can be generated.

Please make sure to check out the full report and prepare for another confusing day in the markets!

Good luck today - Y’all are going to need it!

The updated $SPY daily levels are as follows:

(Daily Supports are still impacted)

Conversion Line Support: $383.42

Baseline Support: $383.42

Psychological Support: $680

Daily Cloud Support: $675.93

Thoughts & Comments from Yesterday - 02/03/2026

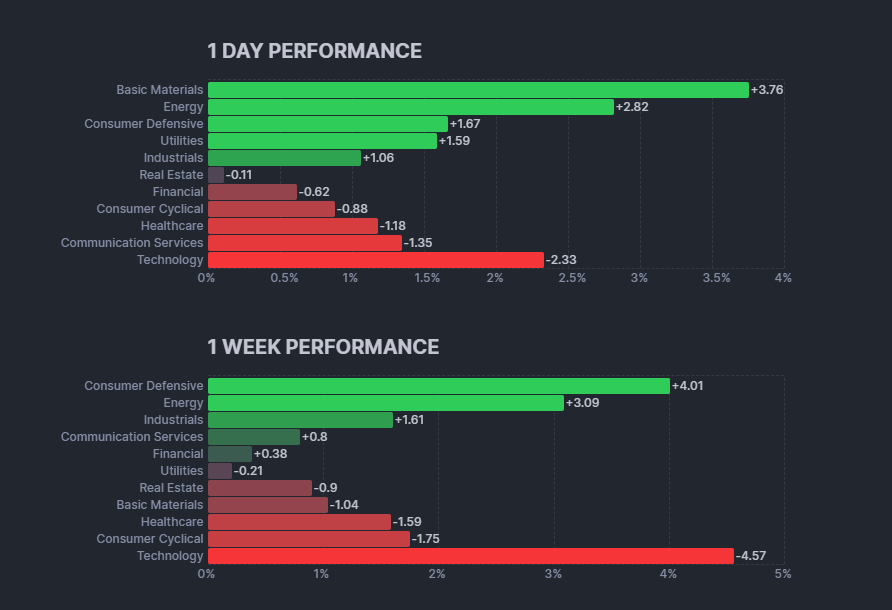

Yesterday was an absolutely disgusting day for many, as we watched a massive sector rotation out of tech into more consumer defensive. Tech organizations got absolutely slaughtered while everywhere in the market was up nicely. This seems to be a rotation back into safety, and it will be an interesting time seeing what happens here in the short term, but man, anyone who attempted to force any position in tech yesterday had a tough time.

We started the day with $SPY honestly not looking great, opening the day at $696.27. Conditions were disgusting as we quickly went on to make the official high of the day at $696.96, and then watched as the markets absolutely fell through the ground, going on to sell off throughout the rest of the morning, through the entire lunchtime lull, through the early afternoon, and only found a bottom towards the back half of the afternoon.

Conditions were gross despite the news that the “partial” government shutdown has ended, and watched as $SPY bounced from the bottom. $SPY went on and made the official low of the day trading at $684.04. Things at the bottom were absolutely disgusting as $SPY dropped almost $13 in the process, but thankfully in the back half of the afternoon, the markets recovered slightly, where we went on and officially ended the day with $SPY trading at $689.53, down about $6 for the day, or down 0.85%.

I would say that overall, that was a terrible day for the markets filled with selling and fear, but depending on what assets you purchased and where you attempted to allocate, there was opportunities available left and right. Traders were able to scalp on an intraday basis, and anyone who was able to simply follow the momentum had an absolutely amazing time, but hey, we warned about bearish momentum yesterday in the live call, so hopefully you all heard the warnings and didn’t tumble and fall the same way the markets did yesterday. But hey, we see where these volatile times take us, and prepare accordingly for some more confusion today!

S&P 500 Heat Map - 02/03/2026

Thoughts & Comments for Today - 02/04/2026

Let's talk about the fears, concerns, and opportunities that should fill the markets today. Before I get started talking about anything in the markets, I just want to warn and remind everyone that we are back in fear on the fear and greed index, we are within the $680 magnet zone, and things can continue to get sketchy in a short period of time. We are seeing the beginning signs of a general market rotation, and many traders do not know how to handle it, allocate accordingly, or prepare accordingly for this time.

I just want to remind everyone that many of these organizations that you are seeing at these all-time highs are heavily overvalued, and you need to zoom out on your charts to see the bigger picture. Yes, many of these massive organizations are down from the top, but at the same time, we are in a place where realistically, if something is extremely overpriced, but comes down 10-20% from the top, but is still 50% above MSRP, you would not think that it is a deal, so just something to consider about equities and attempting to allocate into some equities at this level.

People do not understand the volatility of these market conditions and understand how much the markets can move in a short period of time before becoming overly concerning. A “small” movement from the top is honestly insignificant, despite the fact that we are in a place where the markets have become less than ideal. At the time of writing this report, $SPY is about 1% away from the previous all-time high, yet people are starting to panic and worry that the markets are going to crash heavily and that traders are about to lose everything they’ve worked their lives for.

Obviously, in the case the markets sell off heavily, and we are in a place of genuine panic, conditions are going to be different, but as $SPY continues to move up and becomes larger, the dollar movements will also become larger, while the % movement, which is what we should concern ourselves with, remains neutral. Think about it this way: $SPY moved down less than 1% yesterday, which does not sound like anything of any major concern. We did drop approximately $12 during that time, but to put this in perspective, that was also 20% of the entire 2008 market correction (points-wise) that occurred in the first half of yesterday's trading day. Kind of crazy to put it that way. Obviously, the % movement of yesterday and 2008 are extremely different, as $SPY moved down approximately 2% yesterday from open to the low, compared to 2008 when everything crashed roughly 50%.

So just consider how volatile these market conditions are, and recognize why I am constantly warning everyone about them. There are going to be times in our lives when you will see me overly bullish, there are times when you will see me become overly bearish, and there are times when I am just genuinely concerned about the liquidity and solvency of people. This is one of those times.

Losses, when generated, will come quicker and be significantly larger, but at the same time, the same effect can happen for gains, but oftentimes gains are cut short, while losses are extended and added to in hopes of a reversal.

Just make sure to protect your bottom line and follow the market momentum at times like this. These conditions are not easy to navigate, and I am not attempting to push that narrative at all. These conditions are tough, and honestly is exactly what I am expecting during this time, while we are trending and trading towards new highs in the markets.

But, in other news, this is also just a reminder that despite the fact that the markets are weak and that traders are going to have a generally difficult time, just remember that in the case the markets break out and display more confidence, that we are going to see extremely quick bullish movement up that is unexpected, and provide us with the confidence nessary to continue to move up. All we need is a single news headline that positively impacts the tech sector for a recovery. The issue is, what is that news line going to be, when are we getting it, and how long will we have to wait before the markets provide solvency?

As long as you are practicing risk management, though, and following the momentum today, you are going to be completely fine attempting to scalp and trade, but just be careful and cautious if you are attempting to allocate long in these market conditions right now.

Let’s see where the markets take us today and have some fun. If I see any opportunities, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $INTC, $RIVN , $ORCL, $NVDA, $TSLA, $AMD, $PLTR

Speculative: $PTLO, $RIVN, $CVX, $UNH, $SLV

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: $MSTR, SOL, BTC

Economic News for 02/04/2026 (ET):

ADP Employment - 8:15 AM

Notable Earnings for 02/04/2026:

Pre-Market Earnings:

Uber Technologies (UBER)

Eli Lilly & Co (LLY)

Novo Nordisk (NVO)

Johnson Controls (JCI)

AbbVie (ABBV)

GE Healthcare (GEHC)

Bio-Techne (TECH)

After Market Earnings:

Arm Holdings (ARM)

Google (GOOG)

Qualcomm Incorporated (QCOM)

O'Reilly Automotive (ORLY)

Coherent (COHR)

Snap (SNAP)

e.l.f. Beauty (ELF)

Allegiant Travel (ALGT)

Metlife (MET)

Wrap up

These market conditions are going to be extremely interesting and, honestly, provide us with some great opportunities to trade and realize some gains. Please make sure to tread lightly and practice safe risk management at this time, because traders genuinely are going to have both a confusing and difficult time navigating these markets, mostly if you are blindly throwing some darts and simply praying. Make the most out of these conditions and have a fun time!

Good luck trading, and let’s see where $SPY takes us!!!