HaiKhuu Daily Report - 02/09/2026

Good morning and HAPPY Monday!

Congrats to ALL of the Seahawks Fans! Markets are up beautifully, Seattle is still in shambles, and this is going to be a beautiful day for the markets. I hope you all are excited and prepared for continued volatility and strong market conditions.

The previous couple of weeks have been volatile and inconsistent, but beautiful opportunities have continued to present themselves.

Markets are down slightly at the time of writing this report, but we are not down anything of any major significance at the moment. We are seeing headlines about how the US dollar is slightly weakening, some weakness in the cryptocurrency markets, and some strength in precious metals.

Make sure to tread lightly and practice safe risk management at this time. Traders are feeling more confident going into today, but given these market conditions, we will see irrational volatility. Many people will realize significant gains, while others will have an unfortunate time. So make the most out of today, and let’s start this week strong!

I’ll talk more about my general market sentiment later in the report, so make sure to check it out. Also, check out the WEEKLY PREVIEW to see all the earnings this week! :)

Good luck trading this week, and let’s make the most of it!

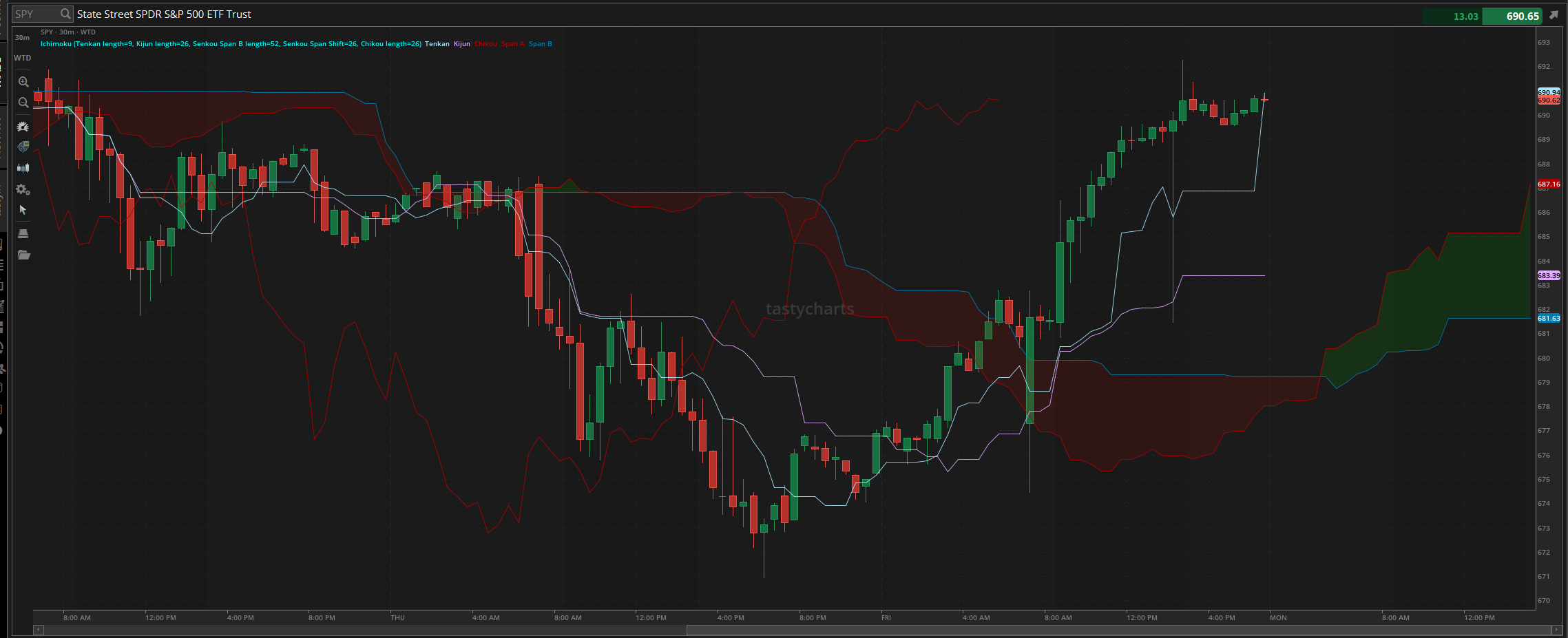

The updated $SPY daily levels are as follows:

Previous All-Time High: $697.84

Psychological Support: $680

Daily Cloud Support: $676.16

Thoughts & Comments from Last Week

Last week was either one of the best trading weeks you’ve had in your career, or one of the worst. It all came down to which organizations you attempted to allocate into and where you attempted to trade. Both bulls and bears were given some insane opportunities, and many people printed. I hope you all had a lot of fun trading last week and made the most of it!

We started last week with $SPY starting the week trading at $689.61. Market conditions were strong as $SPY quickly moved up and made an all-time high, trading at $697.84. Conditions were looking beautiful until things started to tumble.

Conditions were great on Monday, and the markets tumbled through Tuesday, all the way until Thursday. We watched as cryptocurrencies dropped heavily, watched as general tech organizations got slammed, and precious metals saw volatility.

$SPY made the official low of the week, trading under $673, and traders were spooked.

We had an amazing buy-the-dip opportunity presented to us. BTC hit $60k, Solana dropped to $68, and silver hit $67. Anyone who attempted to buy the dip on Thursday and held until Friday absolutely killed it.

Friday was absolutely beautiful and everything we expected coming from the markets. We got the bullish volatility we were hoping for, and there was strong buying momentum throughout the day, showing confidence in these market conditions.

$SPY gapped up slightly to start the day on Friday, opening the day at $681.46, up about $4 from the previous close. We watched as $SPY continued to trend up through the morning, and slowly continued a bullish trend throughout the entire day. We alerted an entry on $MSTR before markets opened, and watched as some of our option contracts ran 500%+ in just a few hours.

Conditions were beautiful, continuing to rally until the end of the day, where $SPY finally broke above the $690 resistance level, and made the official high of the day at $692.31, before coming back down leading into close, where Friday by itself, was up $13, or up roughly 2%, just on its own.

The markets ended the week up $1, or 0.15% overall, where those who simply held, should have remained neutral, where if you were on the wrong side of tech, you had a terrible time last week, but if you allocated properly, you could have and should have printed. So, let’s just see what this week has in store for us and go from there!

S&P 500 Heat Map - 02/06/2026

Thoughts & Comments for Today - 02/09/2026

Today is going to be a spicy time for the overall markets. There is mass confusion and indecisiveness going into open. This is not necessarily a bad thing, but it just means the markets will act irrationally and be more difficult to be confident as a trader. Again, irrationality in the markets is not bad; it means that there will be opportunities to trade, allocate, and take advantage of the general market momentum. There will be some organizations that trend beautifully, while there are other organizations that ultimately will sell off. Hopefully, none of the organizations you are in experience this elevated volatility, but I can tell you right now that statistically, some of you will have a difficult time, while others are able to realize a significant amount of gains.

Just go into today with two fists up, ready to fight, and know that genuinely, opportunities are going to be amongst us to allocate long into the markets, as well as provide us with chances to realize some gains actively scalping.

The biggest warning for everyone going into today is to make sure that you are simply not fighting the market momentum. Many traders are going to watch as the markets are trending with neutrality, or watch as the markets show weak momentum. If you are trading during this time, you are most likely not going to generate anything of significance and most likely get stopped out of your position for a loss.

The easiest way to realize gains is as simple as this sounds. Is allocating with the market momentum and simply following the trend. This can mean either bull side or bear side trend, but trend nonetheless. Follow the market momentum, and prepare accordingly to allocate when you have both the comfort and the confidence to do so.

This is the time that you should be looking to take on some short-term risk, and the volatility in the markets is perfect for those who are attempting to scalp. If you are scalping, again, just make sure that you follow the trend, and if you are day trading, look for that confirmation of a reversal. As long as you catch the trend and the organization you decided to allocate towards is strong, you should have a great time.

So just make sure to tread lightly, practice safe risk management, and realize some gains today!

Now let’s talk markets and opportunity. I genuinely believe that many organizations and allocations have the potential to break out today. Am I guaranteeing anything happens at all? No. I don’t have a magic crystal ball that can tell you exactly where the markets are headed, but at the same time, these are the conditions that will provide us with the most potential. Look for an opportunity to buy the dip in the markets in a higher beta organization, when you personally have the comfort and confidence to do so.

I genuinely do believe that if you are attempting to trade and are able to catch a long allocation that you believe is volatile in your favor, and within your risk parameters, please be smart and take advantage of it, as many will recognize it and simply not trade it, or worse, never spot the reversal unfolding in front of their eyes. So keep your eyes peeled for the opportunities that will be presented to us today!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $AMZN, $INTC, $RIVN , $ORCL, $NVDA, $TSLA, $AMD, $PLTR

Speculative: $PTLO, $RIVN, $CVX, $UNH, $SLV

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: $MSTR, SOL, BTC

Economic News for 02/09/2026 (ET):

Atlanta Fed President Raphael Bostic speaks - 10:50 AM

Notable Earnings for 02/09/2026:

Pre-Market Earnings:

Cleveland-Cliffs (CLF)

Apollo Global Management (APO)

CNA Financial (CNA)

Kyndryl Holdings (KD)

Pagaya Technologies (PGY)

Powerfleet (AIOT)

Becton, Dickinson & Co. (BDX)

Sally Beauty Holdings (SBH)

After Market Earnings:

onsemi (ON)

Arch Capital Group (ACGL)

Amkor Technology (AMKR)

AECOM (ACGL)

Cincinnati Financial (CINF)

Corebridge Financial (CRBG)

Principal Financial Group (PFG)

Wrap up

This is going to be a hectic week for everyone involved. Please prepare for some irrationality in the markets, but just know that opportunities genuinely will be amongst us to realize some gains. Protect your bottom line, practice safe risk management, and seize the opportunities presented to us. This is going to be an amazing time to trade, so let’s make the most out of this week and have a great time!

Good luck trading, and let’s see where $SPY takes us!