HaiKhuu Daily Report - 02/19/2026

Good morning and happy Thursday! I hope you all have been absolutely killing it in these market conditions, as $SPY has been extremely volatile recently, but has provided us with some absolutely insane opportunities to realize some gains and have some fun!

Markets are down slightly at the time of writing this report, but we are not down anything of any major significance that should cause fear in any way. The mild bearish momentum we are seeing right now is unfortunate, but it is not something to be overly concerned about. Just tread lightly and practice safe risk management today.

We are coming up and testing many of the resistance levels on the daily chart, so watch out for resistance levels here in the short term, before we get a larger directional move in the markets. It would obviously be better if we broke out and continued to show strength, but just remember that, as bad as this sounds, bearish plays are still valid, as we can easily reject and sell off. Tread lightly, practice risk management, and limit your exposure.

I do believethis will be a fun day full of opportunities to scalp and trade, so please do what you can to make the most of these current market conditions. These conditions are made for traders who thrive on volatility and risk, so utilize the momentum that is being presented to us, and have an amazing time.

This will be a lot of fun today, so make sure to check out the full analysis below!

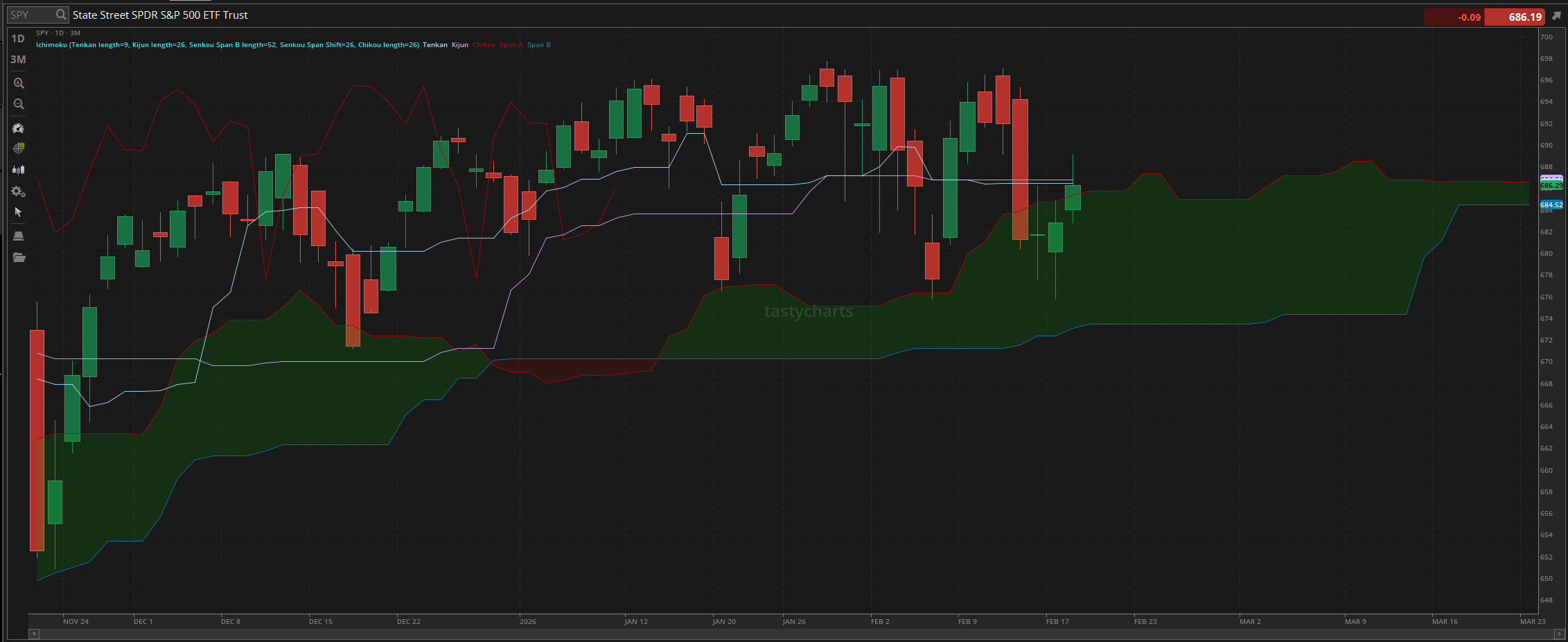

The updated $SPY daily levels are as follows:

Conversion Line Resistance: $686.46

Baseline Resistance: $686.81

Psychological Support: $680

Daily Cloud Resistance: $685.41

Thoughts & Comments from Yesterday 02/18/2026

Yesterday was an absolutely wild and volatile time for the markets. Traders could have easily printed playing either direction, and it all just came down to when and where you attempted to allocate in the markets. Many did unfortunately get caught in the momentum, but hopefully you all heard our warnings on the general sentiment and were able to capitalize and print in the process!

We started the day yesterday with $SPY trading at $684.09. Market conditions were alright as we dropped slightly at open to make the official low of the day, trading at $682.83, before watching as the markets rip, rally, and recover beautifully, rallying all the way to the $688 resistance level, and retaining that level throughout the majority of the morning, through the lunchtime lull, and into the early afternoon.

Conditions at the top were nice, and we watched as $SPY went on to make the official high of the day trading at $689.13, which honestly was amazing at the time, and then watched as $SPY reversed in the back half of the afternoon, providing bears with a beautiful short opportunity as $SPY sold back off to hit $684, before bouncing once again into close where we officially ended the day with $SPY trading at $686.29, up $3.50 for the day, or up roughly 0.5%.

So I won’t say that yesterday was a perfect day for the markets, but anyone and everyone should have been able to generate either realized or unrealized gains yesterday. Those who simply held their equities should be up, while those who attempted to scalp & trade long early in the day printed, and those who were bearish had a beautiful opportunity to short in the afternoon. So hopefully the markets continue to provide us with confidence in these conditions, and that we do everything in our power to make the most out of today!

S&P 500 Heat Map - 02/18/2026

Thoughts & Comments for Today - 02/19/2026

Today will be an interesting time for the markets, with the markets trending the way that they do. We are seeing strength and confidence in the markets, yet are experiencing elevated volatility, inconcisientencies and opportunities to trade. Hopefully, you all are ready for another battle going into today and are prepared to make the most out of the opportunities available.

Market conditions are still strong despite showing minor weakness at the time of writing this report, and we are looking bullish from a technical analysis standpoint. The markets have sold off heavily over the previous couple of days, and are now starting to experience some bullish momentum during this recovery. We are actively testing the daily cloud resistance and many different support levels. With the way that $SPY is moving at this point, it would not surprise me if we saw a directional move.

Either the markets are about to break out of the resistance levels it is testing today, or expect to see a rejection and sell off.

It would be unfortunate if today were a day full of neutrality, but I don’t think that is realistically going to be the case. My prediction is less than a 10% chance that we experience neutrality throughout the day.

But I genuinely do believe that there are going to be opportunities to actively scalp today. The biggest thing will be following the general market momentum and trend, but as long as you are allocating properly, I don’t see any reason why we cannot consistently realize gains today.

Just remember, as much as I hate saying this, bearish plays are on the table.

Tread lightly, practice risk management, and look to press your luck when you are confident.

Many traders are going to lack the confidence necessary to allocate heavily when they should, and press their comfort zone when things start to go against their strategy, which ultimately is going to be the failure for many. So watch out for a trending directional move in the markets, and just allocate accordingly. I do not see a reason why we cannot continue to capitalize on the short-term market momentum, especially during this volatile time.

If anything, continue to look to scalp and trade higher beta organizations when given the confidence to do so. Obviously, you should make sure to practice safe risk management as everyone in these conditions should be doing, but at the same time, look to elevate your risk when given an opportunity. I am not saying that you should press your luck and go all in on 0-DTE contracts, but if a higher beta organization you love is down and is showing signs of a reversal or breakout, look to play those positions accordingly and capitalize on that short-term weakness.

This is one of the best times to be trading in the markets, so please continue to do everything in your power to make the most of these conditions and realize as many gains as humanly possible!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $INTC, $RIVN , $ORCL, $NVDA, $TSLA, $AMD, $PLTR

Speculative: $PTLO, $RIVN, $CVX, $UNH, $AIFF

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: $MSTR, SOL, BTC

Economic News for 02/19/2026 (ET):

Initial Jobless Claims - 8:30 AM

Trade Deficit - 8:30 AM

Philadelphia Fed Manufacturing Survey - 8:30 AM

Minneapolis Fed President Neel Kashkari speaks - 9:00 AM

Pending Home Sales - 10:00 AM

Notable Earnings for 02/19/2026:

Pre-Market Earnings:

Walmart (WMT)

First Majestic Silver (AG)

Quanta Services (PWR)

Klarna (KLAR)

Wayfair (WAY)

Evergy (EVRG)

Esty (ETSY)

Aegon N.V. (AEG)

After Market Earnings:

Newmonth Mining (NEM)

Transocean (RIG)

Texas Roadhouse (TXRH)

Sprouts Farmers Market (SFM)

Floor & Decor Holdings (FND)

Alliant Energy (LNT)

Wrap up

This will be an interesting time for the markets. Please, continue to tread lightly, practice safe risk management, but make sure you do everything in your power to capitalize on the strength and opportunity, while at the same time, maximizing your potential for return. Just remember, both bull side and bear side are a very real possibility, so tread lightly, protect your bottom line, and realize some gains. As long as you follow the market momentum and practice risk management, you’re going to be set for the day.

Good luck trading, and let’s see what $SPY serves us today!