HaiKhuu Daily Report 04/02/2024

Good morning, and happy Tuesday! Markets are relatively neutral during the pre-market session, meaning a lot can happen today. I hope you are excited for today, and I hope that market conditions are more favorable than yesterday. Go into today with relatively lower expectations of market momentum, but just know that realistically, as bad as this sounds. The markets either meet our expectations, or we are able to see some momentum in the markets and be relatively surprised. There still is a chance that we will make an all-time high today, as we are less than 1% away from making an all-time high, but it just seems relatively unrealistic to expect a large market movement without a catalyst, momentum, or reasoning for it to happen. Tread lightly in these market conditions, don’t force any allocations you are not comfortable or confident in, and prepare accordingly for whatever the markets end up doing.

Hopefully, we see a lot more momentum in the markets.

Good luck trading, and let’s see where the markets take us today!

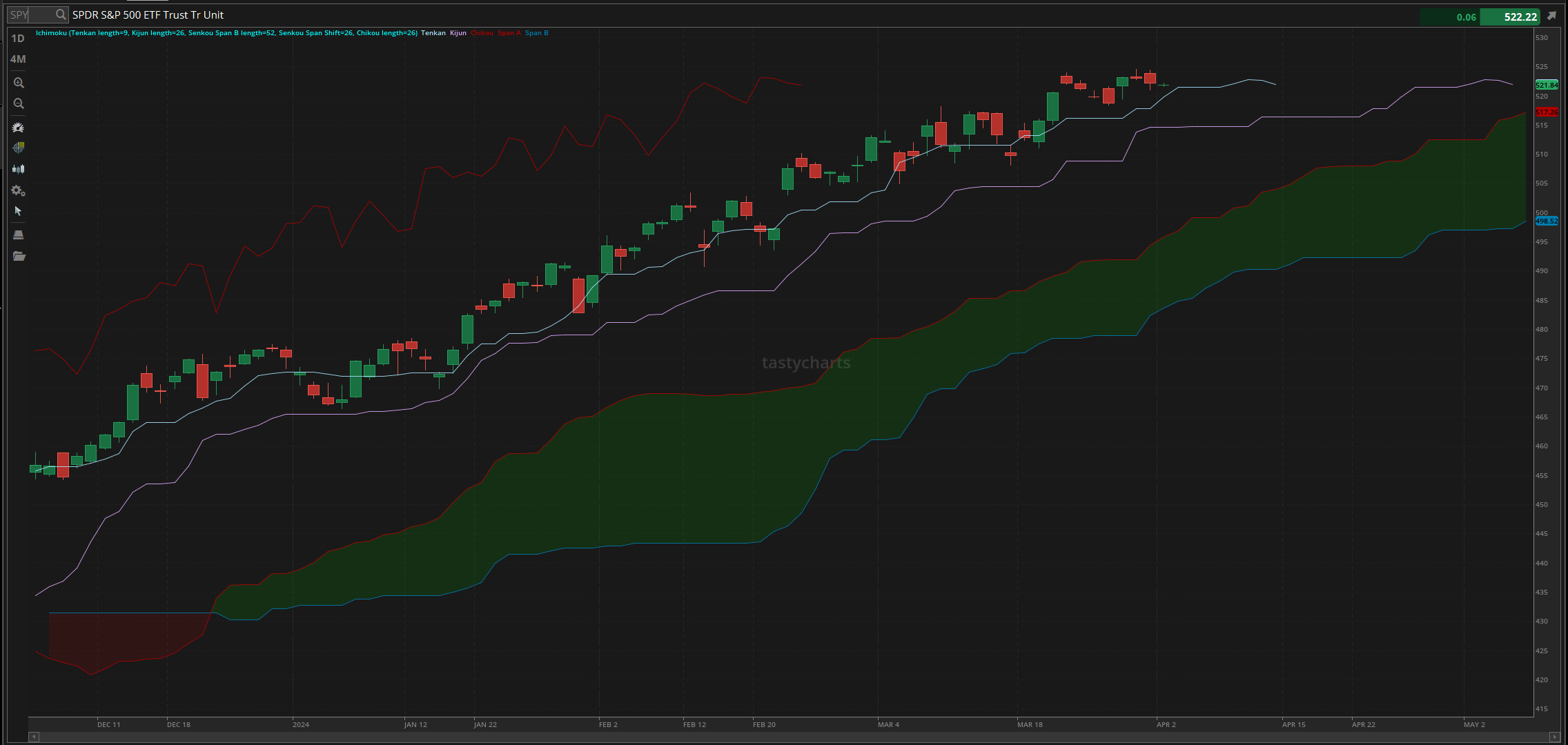

The updated $SPY daily levels are as follows:

Conversion Line Support: $519.85

Baseline Support: $514.68

Psychological Support: $500

Daily Cloud Support: $495.85

$SPY Daily Candles - [04/01/2024]

Thoughts & Comments from Yesterday, 04/01/2024

Yesterday was an extremely slow day for the markets. We saw some general bearish momentum early in the morning, which was followed up by absolutely no momentum or direction in the markets. It was a slow and genuinely gross day with little to no opportunity at all. It was unfortunate that this happened as $SPY did make a new all-time high during the pre-market session, which caused some excitement. However, conditions were tough and relatively unbearable. If you were able to remain sane yesterday and realize some gains, congratulations, as many individuals were not able to do either yesterday.

We started the day with $SPY opening at $523.81, the highest opening on record, and watched as conditions looked relatively favorable. $SPY was looking strong at open as we pushed up slightly to break $524, but that was quickly met with some bearish momentum after making the official high of the day, trading at $524.38. Markets started to come down instantly, and we were met with bearish momentum until Noon EST, where $SPY went on to make the official low of the day, trading at $520.98. Conditions were great if you were bearish and shorted at the top but were relatively rough for everyone else.

After making the official low of the day, we did quickly bounce back up to test $522, and remained within that range for the rest of the day. There was no momentum in the markets, and everything was relatively slow. This is obviously not ideal for any trader as anyone who wants to allocate cannot, anyone in a position is watching time tick by slowly, and anyone with an option contract just watched theta slowly burn. It was a difficult day to watch, but that is just part of watching the markets. Some days are extremely exciting, while others are relatively uneventful. IE, yesterday.

We ended the day with the markets moving up slightly, with $SPY closing at $522.16, down $0.91 for the day, or down 0.17%, with an intraday bearish movement of $1.65. It was a tough day for the markets, with initial bearish momentum and no momentum at all to end the day. Hopefully, you all were able to realize gains in the process, but I know that the unfortunate reality is the majority of people most likely generated unrealized or realized losses yesterday.

Heatmap - $SPY 04/01/2024

Thoughts & Comments for Today, 04/02/2024

Today, hopefully, should be a better day for the general markets. We are neutral at the time of writing this report, and it genuinely would not surprise me to see another neutral day for the overall markets. With this said, we do have to remain optimistic about these market conditions and look for the opportunities that are available. This is going to be one of those days that I do not advise the majority of people to attempt to trade unless market conditions get better. And if you are itching to trade, at least find an organization that is trending. Look for the organizations that have momentum and potential, and capitalize on that potential. Don’t try to catch a bottom on an organization that is not trending, and look to be safe in the process.

The biggest thing to watch out for today is not being over-allocated or over-trade. If market conditions remain neutral, I am expecting to see an extremely tight range, and people who will have relatively tight stop losses will get chopped out. If you get emotional while attempting to trade, it is going to be extremely difficult to make the losses back, making trading more difficult to do consistently, and making traders be irrational.

If you are over-trading today and starting to become emotional with your allocations, look to take a step back and prepare your allocations accordingly. There is no reason that anyone should willingly force themselves to allocate in market conditions that are not optimal, and it is worse if an individual is continually taking losses as a result of an emotional over reaction. Be smart and safe in these market conditions, and remain level-headed. Do not get emotional, do not get greedy, and practice safe risk management.

For my allocations today, I plan on making today a lighter day. With market conditions not being favorable over the previous couple of days, I am not overly ambitious about wanting to force any allocations. I will look for opportunities to scalp intraday, as there will be opportunities that are presented to us, but realistically, I am going into today with the anticipation of not trading. If market conditions change or become favorable, I will look to allocate when I have the confidence to do so, but I am not looking to be allocated in either a day trade or a scalp if conditions remain less than optimal. If I see any opportunities, or if I decide to get into any other plays and see opportunities, I’ll announce what I see in the HaiKhuu Discord.

HaiKhuu Proprietary Algorithm Report:

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY, $LULU, $RIVN, $BABA, $NVDA, $GRYP, $AMD, $TSLA

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $BA

Confirmed Re-entry - $RIVN

Economic News for 04/02/2024

JOLTS Job Openings - 10:00 AM

Factory Orders - 10:00 AM

Durables Excluding Defense - 10:00 AM

Durables Excluding Transport - 10:00 AM

Fed's Bowman Speaks - 10:10 AM

Fed's Williams Speaks - 12:00 PM

Fed's Mester Speaks - 12:05 PM

Fed's Daly Speaks - 1:30 PM

Notable Earnings for 04/02/2024

Pre-Market Earnings:

Paychex (PAYX)

After-Market Earnings:

Dave & Buster's Entertainment (PLAY)

Cal-Maine Foods (CALM)

Wrap up

Hopefully, today is filled with more opportunities. I am excited to see what happens in the markets today, but I am not overly ambitious about these conditions. If markets remain neutral, that will be an unfortunate time, but I am excited to see what could possibly happen in the markets in case we see any type of movement in either direction that we can capitalize on. Tread lightly on these market conditions and make sure to practice safe risk management in the process.

Good luck trading, and let’s see what the markets do today!