HaiKhuu Daily Report 04/23/2024

Good morning, and happy Tuesday! $SPY is back above $500, and I hope you all are excited about these conditions. Markets are in a state of confusion, but this is extremely optimistic if markets remain extremely volatile. The selling has stopped (for now), and the markets are starting to recover. It’s a beautiful time, and I hope you are excited to see what is about to happen. We have many major earnings coming up, with the biggest ones today being $GM, $RTX, $TSLA, and $V, so prepare accordingly. The only earnings that will really impact the performance of the markets are after-hours today, so there is not too much to worry about, but tread lightly. It will be extremely interesting to see where $TSLA goes. It’s hard to fight against Elon, but numbers don’t lie, and $TSLA is down over 40% year to date. Tread lightly if you are watching Tesla, and good luck if you are playing it. We are due for a bounce on $TSLA, the question is when does it happen.

This is going to be a fun day for the markets, so good luck trading, and let’s see what $SPY does here at $500!

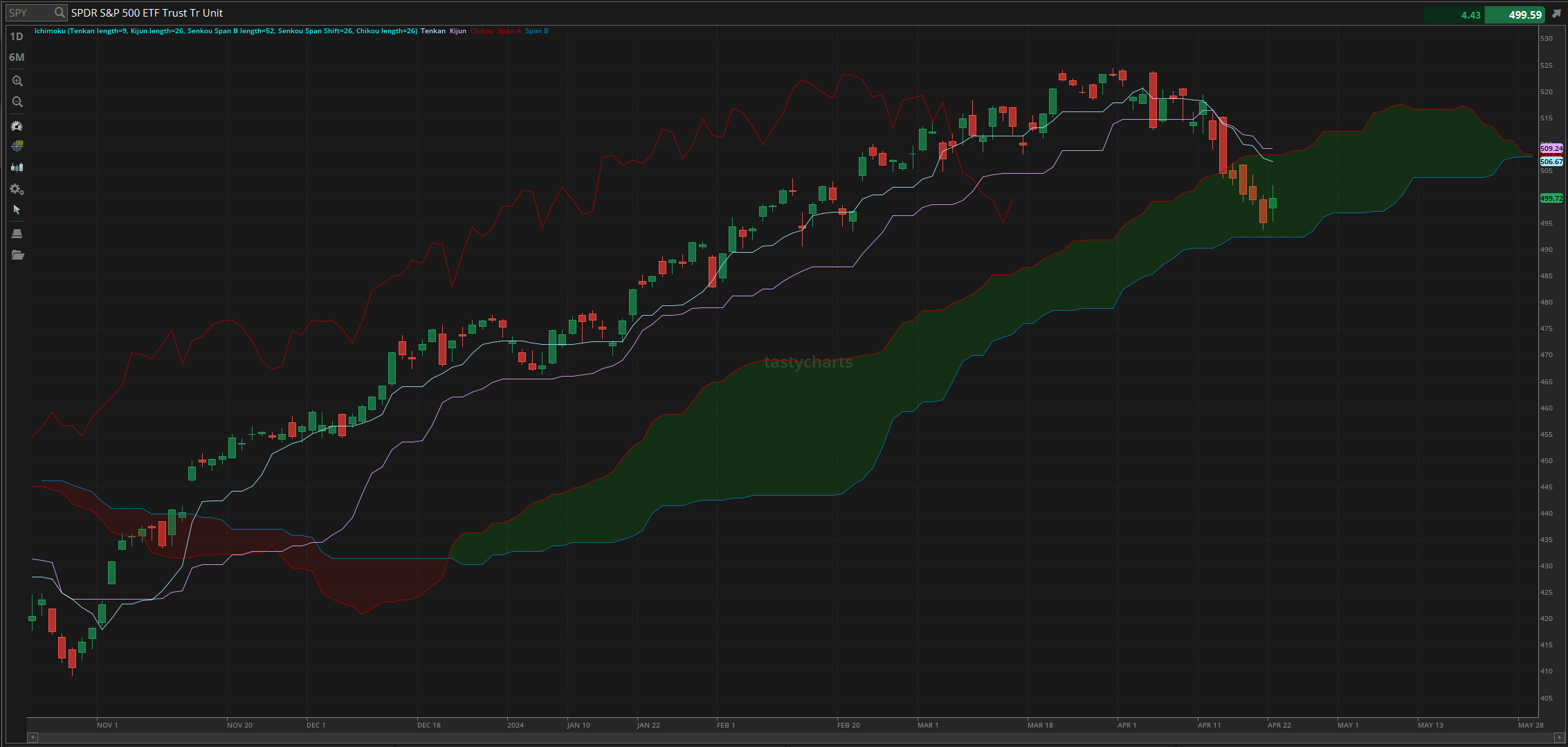

The updated $SPY daily levels are as follows:

Conversion Line Resistance: $506.67

Baseline Resistance: $509.24

Psychological Support/Resistance: $500

Daily Cloud Resistance: $508.02

$SPY Daily Candles - [04/22/2024]

Thoughts & Comments from Yesterday, 04/22/2024

Yesterday was the perfect day for the markets, and then there was $TSLA. In honor of Earth Day, the markets went BEAUTIFULLY green, and opportunities were presented to us. It was almost impossible to lose money attempting to trade yesterday, and many traders did absolutely phenomenally in the process. The bounce in the general markets was nice and provided traders with a level of confidence that was not previously in the markets.

We started the day with $SPY trading at $497.88. In the morning, market conditions seemed a little sketchier as we watched as $SPY dropped for the first couple of hours during the day, going on to make the official low of the day, trading at $495.44, still green for the day from the previous close, but down a little over $2 from open, but during the lunchtime lull, we saw a confirmation of a reversal towards the upside on an intraday basis, and that is where the breakout started to happen.

As the lunchtime lull came to an end, we watched as $SPY continued to rally throughout the early afternoon, and all of the volume coming back in the market was buying like a frenzy. $SPY went on to rally from $498 to breaking out and pushing to make the official high of the day, trading at $502.38. Conditions were perfect at the top, and we genuinely had an amazing time in the process. The markets did slow down in the back half of the afternoon, whereas during power hour, $SPY did break back down below $500, and momentum slowed down heavily.

$SPY ended the day trading at $499.72, up $4.56 for the day, or up 0.92%, with an intraday bullish movement of around $2. Overall, for the day, I would consider yesterday a win despite the markets not being able to sustain the upside potential, but all that matters is the markets have bounced from the bottom, and we are looking at significantly more confident as $SPY is back and actively testing $500 again. This is not a sign to let your guard down, but it does provide us with some short-term confidence during a state of confusion. Let’s see where the markets go today and make the most of it.

Heatmap - $SPY 04/22/2024

Thoughts & Comments for Today, 04/23/2024

Today should be a significantly more exciting day for the markets. With the way that everything is standing right now and with $SPY trading above $500 at the time of writing this report, I am extremely excited to see where the markets are headed, and I hope you are excited too. Obviously, as I just said, it is too soon to put your guard down, but traders are significantly more optimistic about these current conditions. Look to take advantage of that optimism, but just remain level-headed and diligent in the process. Many traders are going to make a significant amount of realized gains while trading today, while others are going to have an unfortunately rough time. So remain level-headed and smart during this time, and you’ll be well taken care of. Continue to practice safe risk management and do what you can to maximize your profit potential.

I want to talk a little bit about $TSLA right now, leading into their earnings, and give you all a little bit of my thoughts on the organization. I would advise everyone to be extremely cautious of $TSLA right now, and I would be cautious attempting to allocate into the organization for earnings. With the way that they stand in comparison to the rest of the markets, it is clear that they are an obvious outlier. They are down 43% YTD, while the only other red MAG 7 stock is $AAPL being down 14%. We see organizations like $NVDA being up 60%, while $META is up 36% during the same time. All of this sounds terrible when comparing $TSLA to these organizations that are outperforming, but I believe that this is 100% justified. $TSLA has been overpriced over the previous year since the rally after the Twitter acquisition, and EV demand has slumped heavily. I will say that in the short term, I am indecisive on $TSLA, but I will say that depending on the timeframe of your allocation and how long you are willing to hold $TSLA, I still believe it is an amazing organization. With the American Charging Standard, Full self-driving, and being the largest US car manufacturer by market cap, I believe that $TSLA has a lot of potential in the future with their ability to scale their business outside of just delivering vehicles but providing a licensing fee to other car manufacturers for both the charging network as well as their self-driving technology. There is no one out there processing as much road data as $TSLA, and at this point, I believe that, honestly, they are too big to fail. Yes, failure is a relative term because dropping 43% in five months does sound like a failure, but at the same time, I do not believe that there will ever be a point when $TSLA goes bankrupt. There is a lot of future potential with this organization, but that does not remove the fact of the short term volatility and selling. Be careful if you are allocating into $TSLA now, but just know that after earnings, assuming there is another sell-off, I will look for opportunities to slowly purchase $TSLA shares with the anticipation of holding them.

Practicing risk management when allocating into $TSLA is obviously going to be the key to your success in these market conditions, but just remember that here, while market conditions are rather risky and extremely volatile, this is the time to take advantage of the opportunity while protecting your bottom line. Many traders are going to have a difficult time conceptualizing this right now as they have been in general market conditions that have remained extremely strong and resilient, but now that we’ve hit a couple of speed bumps and potholes, it feels like a lot of traders do not know how to navigate these conditions. Protecting your bottom line is going to be the fundamental key to the longevity of your portfolio.

For my allocations today, I will say that I am excited to actively trade, but I am hesitant as a result of the current market condition. I will be watching $TSLA as a main position today, attempting to scalp and trade it wherever possible as a result of the increased volatility leading into its earnings. I do not anticipate holding $TSLA for earnings specifically, and I do not advise anyone to gamble with $TSLA for earnings, but I do believe that this is going to be an organization that scalpers will have a lot of potential with by actively trading, and this is something that I do anticipate actively scalping throughout the day, so be on the watch out for my positions. I am more than happy to play either side of the position, and it is just a matter of the active momentum and timing of the position!

If I see any opportunities, or if I decide to get into any other plays and see opportunities, I’ll announce what I see in the HaiKhuu Discord.

HaiKhuu Proprietary Algorithm Report:

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY, $TSLA, $MSFT, $AAPL, $ULTA, $LULU

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $BA

Confirmed Re-entry - $RIVN, $ULTA, $LULU

Economic News for 04/23/2024

Building Permits - 8:00 AM

Redbook - 8:55 AM

S&P Global US Manufacturing PMI - 9:45 AM

S&P Global Composite PMI - 9:45 AM

S&P Global Services PMI - 9:45 AM

New Home Sales - 10:00 AM

2-Year Note Auction - 1:00 PM

Notable Earnings for 04/23/2024

Pre-Market Earnings:

General Motors (GM)

United Parcel Service (UPS)

General Electric (GE)

Lockheed Martin (LMT)

PepsiCo (PEP)

Polaris Industries (PII)

RTX Corporation (RTX)

Spotify (SPOT)

JetBlue Airways Corporation (JBLU)

Sherwin-Williams Co (SHW)

After-Market Earnings:

Tesla (TSLA)

Visa (V)

Texas Instruments (TXN)

Steel Dynamics (STLD)

Chubb Corporation (CB)

Baker Hughes (BKR)

Seagate Technology plc (STX)

Canadian National Railway (CNI)

AVANGRID (AGR)

Veralto Corp (VLTO)

Wrap up

This is going to be a beautiful day for the markets, with consistent opportunities being presented to us. Remain calm in these conditions, but maximize the opportunities that are available to you. Take advantage of the confidence in the markets and realize gains as a result. Just make sure to practice safe risk management and have a great time in the process.

Good luck trading, and let’s see where $TSLA goes today!