HaiKhuu Daily Report 4/26/2022

Good morning and happy Tuesday, everyone! I hope you all are having a great morning! Today will be an insane day, and I hope you all are excited for what’s to come!

Thoughts & Comments from 4/25/2022

Yesterday, markets were quite insane. We broke significant support when $SPY broke the $420 support levels and reached a low of the day at $418.84. Markets were down over 1% across the board.

After hitting a bottom, the markets rallied into the end of the day. It was incredible to watch markets recover beautifully from the low of the day. $SPY closed yesterday at $428.51.

There was a significant amount of opportunity to trade and make money, both on the up and the downside. Shorts won in the morning, Options sellers had a great opportunity to sell CSPs at the bottom, and scalpers/day traders had a beautiful ride on the way up.

Twitter announced that they are accepting Elon Musk’s bid to purchase the organization at the price of $54.20/share. This is a great play for anyone who has been holding their Twitter equity long and it is a guaranteed arbitration opportunity, assuming that this deal holds up, I’ll go into this opportunity later in the report.

$SPY 4/25/2022 ONE MINUTE INTRADAY CHART

Thoughts & Comments for Today 4/26/2022

Markets are looking more optimistic than yesterday, but they are coming down premarket when writing this report. Because we are not actively testing the $420 level on the markets anymore, we can be a little more confident in allocating in the market. Still, I would advocate for you to actively ensure that you practice safe risk management and tread lightly in these current market conditions.

When you see opportunities to create an allocation, please don’t be too aggressive from open and have room to average down if necessary. Rather win small and have little on the table than lose big and have no room to average down on an allocation.

CSPs are not as optimal as yesterday at the market’s lows. However, the opportunity is still available for you to actively sell some Cash Secured Puts on organizations you have confidence in at a price you are comfortable purchasing.

After hours today, we have $GOOG/L and $MSFT earnings. This will be exciting for people who have allocations in Google and Microsoft while hopeful for everyone else in the market. I hope that both numbers exceed expectations and cause a continued bullish momentum in the stock market to take us back to the $440 resistance level on $SPY and have $AAPL and $AMZN to take us through $440.

If you want to follow any of my allocations, nothing is financial advice nor a signal to buy or sell any positions, but I will be posting them live in the HaiKhuu Discord.

HaiKhuu Proprietary Algorithm Report:

Yesterday with the markets being sketchy into open, we decided not to have any BAOSAC allocations. This was the correct move for the first three hours as markets came down heavily. The move would have been to purchase shares on that dip to ride the markets on the way up. I called this out to the team that we have reached a potential bottom but we did not get any allocations for safety’s sake.

Utilizing a linear scaled entry model with a BAOSAC system, we would have generated a net return yesterday of 0.47%.

We also concluded the most recent test and retraining to utilize a new validation data set yesterday.

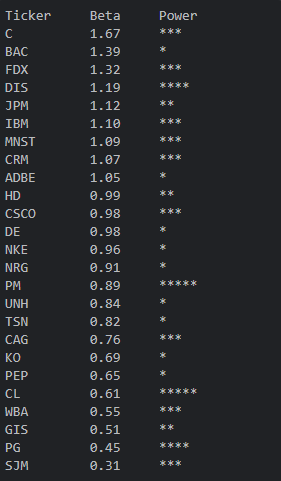

With positive test results, we will be using more signals to alert us on different allocations. Please note that we can confidently find more reasons why we are bullish on an organization with us utilizing new alpha signals. But due to this, there are more entries in our power model system. We will still be using a linear scaling model for these allocations, but we want to make sure you all emphasize that organizations with a lot of power confidence will go up. More Stars = Higher Confidence.

All entries made in the HaiKhuu Pilot trading account will be announced before market open in the HaiKhuu Discord.

DISCLAIMER - Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without considering market conditions, news, or any external biases. We cannot guarantee success. Take these at your own risk.

Generated entries for 4/26/2022

My Personal Watchlist :

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities.

Watchlist:

$SPY , $GOOGL*, $TWTR* , $TSLA , $AAPL* , $MSFT* , /CL , $SOFI , $BABA , $FB* , $DWAC

Free Equity List:

Safe - $TWTR , $MSFT , $SPY , $AAPL*

Risky- $QS , $BABA , $AMD , $SOFI , $NVDA , $TSLA

Swing Opportunities:

$TWTR - Arbitrage Opportunity

Selling Cash secured puts on organizations you have confidence in; $AAPL* , $MSFT , $BABA , $PYPL* , $AMD

LONG OPPORTUNITIES:

(Note, these are risky long speculative purchases but have a lot of upside potential)

$BABA & $PYPL* - Both are heavily hit organizations that are severely undervalued.

$AMZN*, $GOOG/L*, $TSLA - Three stocks that soon will have a stock split

*=Earnings Soon

Economic News for 4/26/2022

Durable goods orders – 8:30 AM ET

Core capital equipment orders – 8:30 AM ET

S&P Case-Shiller US Home price index (year-over-year) - 9 AM ET

FHFA US home price index (year-over-year) - 9 AM ET

Consumer confidence index - 10 AM ET

New home sales (SAAR) - 10 AM ET

Notable Earnings for 4/26/2022

Pre-Market Earnings:

3M Company (MMM)

United Parcel Service (UPS)

Raytheon (RTX), PepsiCo (PEP)

DR Horton (DHI), Ecolab (ECL)

Waste Management (WM)

General Electric (GE)

JetBlue Airways (JBLU)

Novartis International (NVS)

After-Hours Earnings:

Microsoft (MSFT)

Alphabet (GOOG)

Visa (V)

Canadian National Railway (CNI)

Texas Instruments Incorp (TXN)

Enphase Energy (ENPH)

Mondelez International (MDLZ)

General Motors (GM)

Capital One (COF)

Chipotle (CMG)

Wrap up

Be smart making allocations in the markets today. Practice safe risk management and navigate the markets actively. Capitalize on confidence and short fear. Good luck trading today everyone. Hope you have an amazing day and make sure to stay hydrated!

If you are not a part of our free Discord, click HERE to join!

HaiKhuu Rap - 2020