HaiKhuu Daily Report 5/03/2022

Good morning and Happy Tuesday!

Things are looking exciting heading into open today. Hope you are all ready and optimistic for the day, let’s make some bank!

A quick recap of 5/03/2022

Yesterday was an insane day for the markets. We rallied an hour into the trading day reaching a high on $SPY at $416. $SPY rejected $416 and came down to make a low of $405.02 right before power hour. Right after making that low, $SPY rallied through power hour to close at $414.48.

If you look at it purely from a day-to-day standpoint, $SPY didn’t move that much, it was only up 0.6% yesterday. But if you look at $SPY intraday, you will see a whole bunch of movement and volatility. $SPY rallied 0.74% from open, dropped -2.5%~ to the bottom, and rallied back up 2.5%~.

Overall insane day for the market, I’m sure there were a lot of emotions felt throughout the day. As long as you capitalized on the volatility or the bullish momentum and made some money, I am sure you had a great time. Yesterday presented lots of opportunities to trade and have a realize some gains.

$SPY 5/02/2022 ONE MINUTE INTRADAY CHART

Thoughts & Comments for Today 5/03/2022

Today should be another volatile and crazy day for the markets. There will be lots of opportunities to trade the Indices. Hopefully, we see some beautiful bullish momentum and watch things run throughout the day. In the case that the markets do decide to come down, make sure to practice safe risk management and protect your downside risk.

$AMD has earnings after hours, it will be exciting to watch and play.

Personally, I might grab a little bit of equity just in speculation of positive earnings.

Watch out for free equity opportunities to grab some $BA while equity is cheap. There should be some good momentum you can capitalize on in this perfect case scenario. Great organization, equity cheap, strong momentum. The mix of the three will result in a perfect free equity trade.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

HaiKhuu Proprietary Algorithm Report:

Yesterday our algorithm was not able to beat the market. With a rally into close, we were not able to capitalize on the final run for the day leading us to have a net return on the pilot of roughly 0.6% yesterday. Prior to the rally when the markets were down 1.5% this was a great move cutting allocations early, but with the heavy move into close, C’est la vie.

We are working on a new system that will be acting like our previous system where we would pick out certain plays with different price targets for entries, exits, and stop losses. This system was requested by members of the community. I’ll update you guys on the progress of this system over the next week or so.

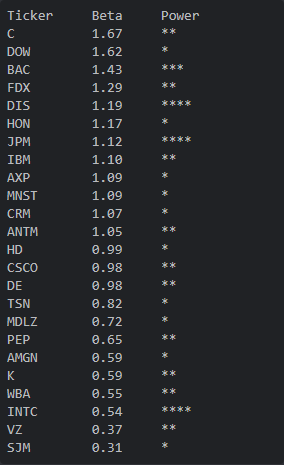

All positions will be entered as normal today with linear scaled entries in accordance to our power confidence model and presented prior to markets opening in the HaiKhuu Discord.

DISCLAIMER - Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. We cannot guarantee success. Take these at your own risk.

Generated entries for 5/03/2022

My Personal Watchlist :

Note, just because something is on my watchlist, does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY, $GOOGL, $BABA , $TSLA , $AMD , $TWTR , $MSFT , $AAPL

Free Equity List:

Safe - $SPY

Risky- $AAPL , $BABA , $AMD , $MSFT , $NVDA , $SOFI

Swing Opportunities:

Continue to have cash on standby to actively deploy in strong equities you have confidence in. The best way to start this process is by selling CSPs on positions you want to allocate into. You will either get equity at a price you are comfortable and confident purchasing at, or collect premium in the process.

High Risk - $BABA , $PYPL

Medium Risk - $BA , $AMD , $NVDA

Low Risk - $SPY , $AAPL , $MSFT

LONG OPPORTUNITIES:

(Note, these are risky long speculative purchases but have a lot of upside potential)

$BABA & $PYPL - Both are heavily hit organizations that are severely undervalued.

$AMZN , $GOOG/L , $TSLA - Three stocks that in the near future will have a stock split

Economic News for 5/03/2022

Job openings & Quits - 10 AM ET

Factory orders - 10 AM ET

Core capital goods orders (revision) - 10 AM ET

Motor vehicle sales (SAAR) - Varies

Notable Earnings for 5/03/2022

Pre-Market Earnings:

Pfizer Inc (PFE)

Estee Lauder (EL)

S&P Global Inc (SPGI)

BP plc (BP)

Illinois Tool Works (ITW)

Fidelity National Information (FIS)

Eaton Corp (ETN)

Thomson Reuters Corp (TRI)

Hilton Worldwide Holdings (HLT)

Biogen Inc (BIIB)

After-Hours Earnings:

Advanced Micro Devices (AMD)

Airbnb (ABNB)

Starbucks (SBUX)

Public Storage (PSA)

American International Group (AIG)

Prudential Financial (PRU)

Waste Connections (WCN)

Verisk Analytics (VRSK)

ONEOK, Inc (OKE)

Skyworks Solutions (SWKS)

Wrap up

Good luck trading everyone! Practice safe risk management and realize some gains!

Have a great time trading. Today should be an exciting day!

If you are not a part of our free Discord , click HERE to join