HaiKhuu Daily Report 05/03/2024

Good morning, and happy Friday! This has been a wild week for the markets due to earnings, economic news, and consistent volatility. Apple had earnings yesterday where they beat both estimates on revenue and EPS, and are up 6% at the time of writing this report. Apple also announced that they are doing a $110 Billion dollar stock buyback, which is phenomenal for these market conditions. It’s hard not to fight against Apple, mostly during strong market conditions, so let’s see what happens today. Markets are up during the pre-market session as a result of Apple earnings, and this is going to be a great way to end the week, so let’s end this week strong, and realize some gains!

Good luck trading, and let’s see where the markets take us!

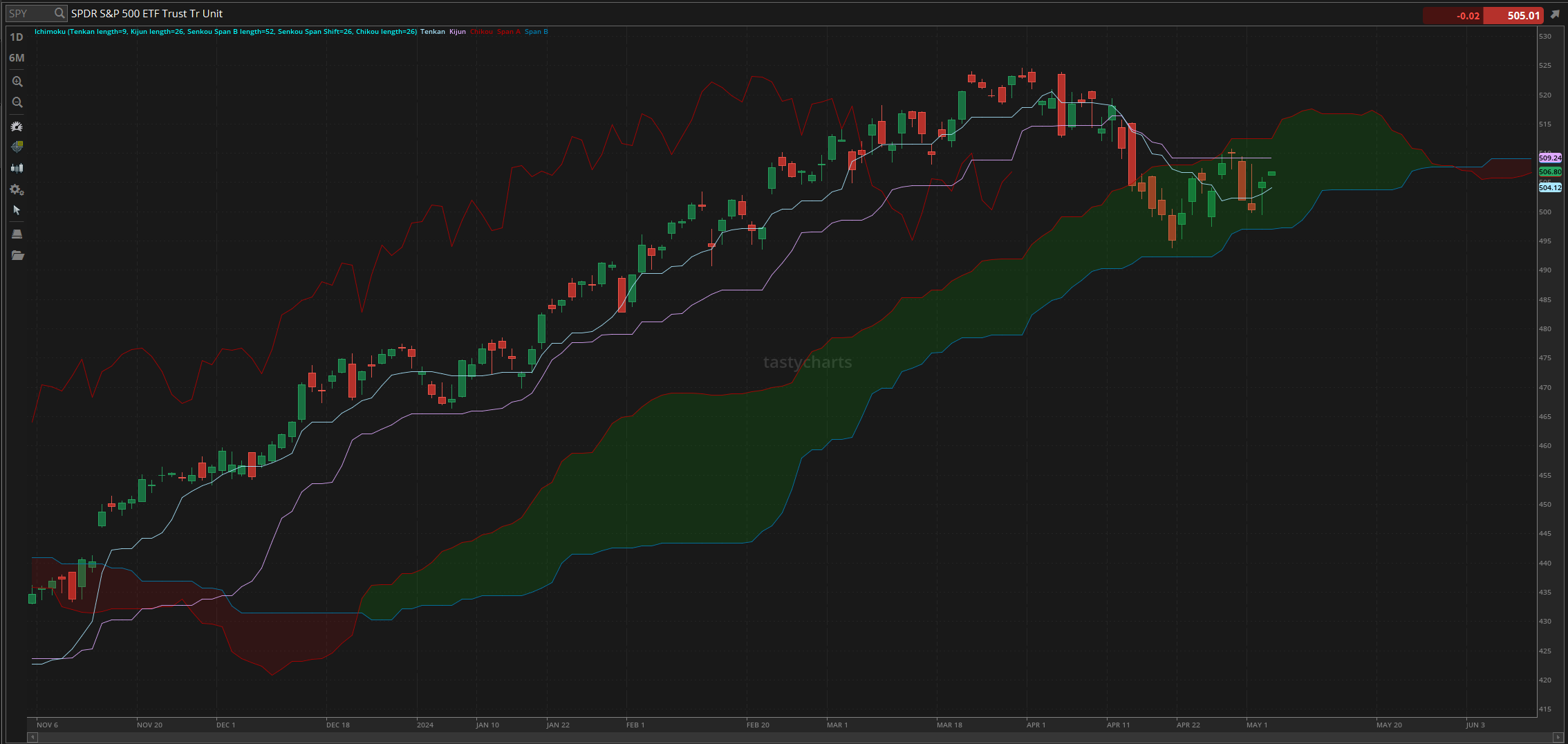

The updated $SPY daily levels are as follows:

Conversion Line Support/Resistance: $504.12

Baseline Resistance: $509.24

Psychological Support: $500

Daily Cloud Resistance: $512.48

$SPY Daily Candles - [05/02/2024]

Thoughts & Comments from Yesterday, 05/02/2024

Yesterday was a beautiful recovery in the overall markets, despite conditions remaining relatively neutral for the large majority of the day. I’m sure that many traders felt relieved watching the markets move up, but was that a choppy time for the overall markets. Hopefully, you all were able to capitalize on the opportunities presented to us, and realized gains in the process.

We started the day with $SPY opening at $504.10, up significantly from the previous close of $500.35, and displaying relative strength at open. Despite displaying a lot of strength, right at open we were met with some bearish momentum as we continued to drop continuously for the first half hour of the day as $SPY went on to make the official low of the day, trading at $499.55. Conditions were not great in any way, shape, or form, but remained relatively stable as we did bounce nicely off of the $SPY $500 support. We were only below $500 for a brief moment to stop traders out, and we continually pushed up afterward as a result.

After making a quick reversal, $SPY moved back up and remained relatively neutral around $502 for the majority of the lunchtime lull. There was tight choppiness, but nothing that would cause any serious concern. After the lunchtime lull, thankfully we did see continued bullish momentum in the back half of the afternoon, as $SPY continually pushed, and conditions were looking great. $SPY made the high of the day leading into powerhour, trading at $505.88, before coming down slightly into close.

The markets ended the day up nicely from the previous close, and provided traders with confidence to realize gains with both comfort and confidence. We ended the day with $SPY trading at $505.03, up $4.68, or up 0.95%, with an intraday bullish movement of roughly $1. The overall movement from open was not that significant, but we did have some amazing opportunities to realize a significant amount of gains in the process, playing either direction. I hope that again, you were able to realize a significant amount of gains while trading yesterday, and are extremely excited for market conditions today!

Heatmap - $SPY 05/02/2024

Thoughts & Comments for Today, 05/03/2024

Today should be an exciting day for the general markets. With Apple moving up on earnings, that is the final major organization that would heavily impact the markets in the case that it came down, and as a result of that, we are in for what should hopefully be a smooth sailing day for the markets. I am expecting to see less volatility and confusion in the markets, and hopefully, we will be able to see a beautiful momentum-based bullish movement. Consistency would be key, and it would be great to see this all in real-time. As I have said before, we are not out of the woods just yet, but this is a reminder that market conditions are still extremely strong, and there is NO reason at all to be overly bearish at this time. Continue to ride the market momentum and capitalize on these conditions while you can, as markets won’t always display this strength, despite us having this continued strength for multiple months on end.

I will take a little bit more time to elaborate on these market conditions right now because I’ve seen multiple traders be extremely confused about these conditions. I did talk about them a little bit before, but I will go more in depth with it now. With the markets in the place that they are, many traders are conflicted about the sentiment that they should have in the markets, some traders are overly bullish, while other traders are overly bearish. I think that this is a terrible way to navigate these conditions because the markets are extremely volatile at the moment. You should remain fluid with your positions, and follow the market momentum. We can very easily break out from here, and we can very easily sell off; the only thing that is hard is predicting which direction the market is going to go with confidence. Ideally, the markets only continue to move up with confidence, but at the same time, that is not how the markets move. I will say that these market conditions are extremely strong and that you should look to take advantage of this strength, but remember that cracks are starting to form in the foundation of the markets as we have a bearish TK cross and are trading within the daily cloud. This is not a time to be overly ambitious, as we can get to a point of free fall, but at the same time, conditions can strengthen with ease. This is not the time to wonder what if, but more so a time to seize an opportunity and realize some gains.

This is a trader's paradise. There is almost no reason why you should not consistently realize gains in these market conditions. So continue to tread lightly on these market conditions, but genuinely be excited to have some fun in the process. Opportunities will consistently provide themselves to you, so do not FOMO into a play that you missed; find the next one and move on.

For my allocations today, my sentiment does remain relatively the same. As a result of the losses that were incurred on Tuesday, I am forcing myself not to make any positions today. This is unfortunate but it is a punishment to myself for breaking my own personal rules while trading. Thank you all for understanding, and I will be back and actively trading starting next week, I just needed a breather for a couple of days to remain level-headed and mentally reset. I still will be calling out all of the opportunities and plays that I see, and if I see anything that is notable, I’ll announce it in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY, $AAPL, $NVDA, $TSLA, $MSFT, $BA, $RIVN, $ULTA, $LULU

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $BA

Confirmed Re-entry - $RIVN, $ULTA, $LULU

Economic News for 05/03/2024

Unemployment Rate - 7:30 AM

Nonfarm Payrolls - 7:30 AM

Notable Earnings for 05/03/2024

Pre-Market Earnings:

Cheniere Energy (LNG)

Hershey Company (HSY)

XPO Logistics (XPO)

fuboTV (FUBO)

Fluor Corp (FLR)

Plains All Amerian Pipeline (PAA)

Magna International (MGA)

Plains GP Holdings (PAGP)

Wrap up

This is going to be a fun way to end the week, so let’s do what we can to maximize the opportunities that are presented to us, and watch a break out in the general markets. I am excited to see where the markets go today, so take advantage of these conditions, practice safe risk management, and have an amazing time in the process!

Good luck trading, and let’s end this week strong!