HaiKhuu Daily Report 5/10/2022

Good morning and happy Tuesday everyone! Hope you are all ready for today after the devastation of yesterday.

Thoughts & Comments from 5/09/2022

Yesterday was an intense day for the markets. $SPY broke below major support at $400 and closed the day down 3.2%. $SPY closed at $398.17.

Markets have fortunately come up a couple of points from reaching a new low into the night session (PWWR $401.91).

Things definitely did not look good while we took the slow grind and tumble down to, and below the $400 support level on $SPY, but there is not much that we could have honestly done in the meantime.

I sold some highly OTM spreads on $SPY on the pilot yesterday to capitalize on the high volatility, and anticipate continuing to do so until volatility comes down in the markets.

$SPY 5/09/2022 ONE MINUTE INTRADAY CHART

Thoughts & Comments for Today 5/10/2022

Cash is king in these market conditions, literally because of days unfortunately like yesterday. Cash will not actively lose you any money, but you will miss out on opportunities to purchase equities for cheap.

In the short term, equities are a tough hold as the markets are coming down, but if you are looking to start entering into any new positions in the markets, now is a great time to do so. Buy into the fear. Buy the cheap underpriced equities that people are selling at a loss due to panic and commotion in the markets. Don’t go heavy but start to allocate in organizations that you personally have conviction in at a price you are comfortable and confident in allocating to. Practice safe risk management and don’t do anything dumb.

Look for solid tech organizations that have been hit the hardest that you personally have confidence in and start allocating capital. Only get a starter position and have room to average down accordingly assuming the markets decide to drop another 5-10%. (Realistically don’t think we will see that hard of a drop, but always just prepare for the worst)

Organizations I am looking to get safe allocations in are:

$MSFT , $AAPL , $SPY , & $BA

$MSFT / $AAPL - 2 of the largest tech organizations

$SPY - Major tech indices

$BA - Major airline producer, heavily hit. Buy and hold for 1-3-5 years

I am looking to average down on $GOOGL and $PYPL long holdings & am looking to reallocate into $TSLA soon as I sold right after the announcement that Elon is purchasing $TWTR.

Lots of plays I’ll be watching and making today. If you want to follow any of them, please make sure you are in the HaiKhuu Discord because I’ll be posting these in real time!

HaiKhuu Proprietary Algorithm Report:

The algorithm, fortunately, beat the market yesterday but unfortunately was not profitable. Utilizing a full allocation BAOSAC, you would have generated a net loss of 0.7%, beating out /NQ and /ES by a landslide. Managing the portfolio actively I was able to minimize the losses to approximately 0.1% for our intraday allocations. Great way to dodge a day like yesterday.

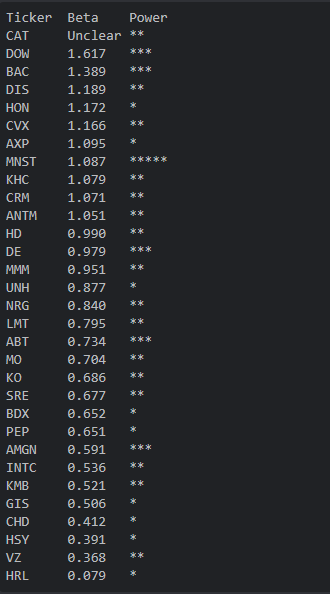

Today, we will be allocating most of our capital into the markets due to an increased amount of confidence the algorithm has in the market. This obviously does not take into account the risk of external news impacting the market, so we will be actively treading lightly. But I will be allocating roughly 96% of all of our capital directly at open into 31 different allocations. All allocations will be made directly with a linear scaled entry in accordance with our power confidence model.

All positions will be created prior to the market opening.

DISCLAIMER - Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. We cannot guarantee success. Take these at your own risk.

Generated entries for 5/10/2022

My Personal Watchlist :

Note, just because something is on my watchlist, does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $GOOGL , $BABA , $AAPL , $MSFT , $TSLA, $SOFI*

Free Equity List:

Safe - $SPY

Risky- $AAPL , $BABA , $AMD , $MSFT , $NVDA , $SOFI

Swing Opportunities:

Cash is king right now, but start to get starter positions on smart equities and sell cash secured puts while volatility is high on $SPY, $AAPL , $MSFT , $BABA and $AMD for some great premium.

LONG OPPORTUNITIES:

(Note, these are risky long speculative purchases but have a lot of upside potential)

$BABA & $PYPL - Both are heavily hit organizations that are severely undervalued.

$AMZN , $GOOG/L , $TSLA - Three stocks that in the near future will have a stock split

Economic News for 5/10/2022

NFIB small-business index - 6 AM ET

Real household debt (SAAR) - 11 AM ET

Notable Earnings for 5/10/2022

Pre-Market Earnings:

Sony Group (SONY)

Sysco Corp (SYY)

Fox Corp (FOX)

Li Auto (LI)

Hyatt Hotels (H)

Aramark (ARMK)

Norwegian Cruise (NCLH)

Planet Fitness (PLNT)

Peloton (PTON)

Workhorse Group (WKHS)

After-Market Earnings:

Occidental Petroleum (OXY)

Electronic Arts (EA)

Coinbase (COIN)

Roblox (RBLX)

SOFI (SOFI)

Wynn Resorts (WYNN)

Darling Ingredients (DAR)

TradeDesk (TTD)

Welltower (WELL)

Wrap up

Good luck trading today everyone, we will need it. Let’s see some beautiful green movement in the markets today.

Play aggressively, start to allocate in positions for a long-term investment, and manage your downside risk.

Stay hydrated, and let’s make some BANK today.

If you are not a part of our free Discord , click HERE to join