HaiKhuu Daily Report 5/12/2022

Good morning and happy Thursday! What an intense day for the markets yesterday. I just want to give you all props for being here, actively trading and capitalizing on the opportunities that present themselves in the markets.

Market conditions are currently tough, but that does not mean we cannot seize the opportunity.

Trading is not as easy as it was in the second half of 2020. The markets are down roughly 20% from the highs earlier this year.

If you are down money this year, you are not alone. The majority of retail traders have been hit this year.

The fear and pain in the market is transitory. No one learns how to efficiently navigate the markets in a hyper bullish market. Lots of lessons will be learned quickly in market conditions like these. Limit your risk and downside potential, and learn from your mistakes quickly.

If you are here and you are reading this, but have any doubts about yourself as a trader, don’t doubt yourself now. You’ve been able to sustain yourself in the markets longer than 95% of retail traders at this point.

Most people who have started during the COVID pump have quit the market, and the select few that are still here are either lucky, recently joined the market, or are in the process of becoming seasoned investors in the market.

This downturn in the market sucks, but there are a lot of opportunities to actively trade intraday with the volatility and momentum that we have, as well as this is giving us great prices to start purchasing and investing in stocks again.

People see this as a time of fear and panic, we should see look at it from a positive perspective and think about it as giving us an opportunity to purchase equities cheap and with confidence.

Tread lightly in these market conditions. Cash is king but start deploying capital in equities you have confidence in. Average down accordingly and start to look into more long-term passive plays. I personally invested in and am looking more into is $GAIN.

I just started a position in my Robinhood to purchase $GAIN every day for the rest of my life and I have DRIP turned on so I’ll be acquiring more shares absolutely free. .

It’s not enough to acquire many shares, but it is a great time to start a DCA position and let this ride for the next 50 years of my life.

The way I recommended my father to play $GAIN;

Download Robinhood

Deposit some money and purchase equity in $GAIN (Multiples of 200 shares)

Turn on a reoccurring investment to purchase $GAIN

Delete the app

???

Come back to the app multiple years after forgetting about the allocation and be surprised with the number of shares you have.

Thoughts & Comments from 5/11/2022

Yesterday was an absolutely terrible day for the markets, things were looking good prior to the CPI report coming out at 8:30 am EST. The report was not terrible, but the result of the report was. We dropped down to continue to make new lows.

An extremely difficult day for the markets, not many opportunities to trade. It was nice being able to capitalize on volatility by selling 0DTE SPX contracts.

Days like yesterday are the reason why I actively recommend practicing risk management.

$SPY 5/11/2022 ONE MINUTE INTRADAY CHART

Thoughts & Comments for Today 5/12/2022

I am optimistic about what we have in store for today. Markets at the time of writing this report are down from close. We reached a low on $SPY at $388.81. Things are at least showing signs of hope as the markets are moving up from the lows.

Tread lightly in these current market conditions. There is no current sign of a bottom and we will not know when the bottom happens until after it happens. Please practice safe risk management.

$AAPL broke $150 support, $MSFT is coming down to $250 support, $AMZN is coming down to $2,000 support and $TSLA is coming down to $700 support. In the worst-case scenario, if things go poorly very poorly, we can soon possibly see a chain reaction of these support levels being tested as things are breaking down.

I hope that this does not happen. This would be what would be a worst-case scenario. Markets would drop another 5-8% and we can see $SPY test $350.

Ideally, we come back above this $400 resistance line, hold and continue to move up, but as the markets are making some absolutely crazy moves, there is not much we can do but speculate on the sidelines and pray for the best.

We need some good news to come out and come out relatively quickly to save us from the worst-case scenario happening.

I am looking for different long-term equities that I want to purchase but I will be waiting with cash in hand ready to purchase as things are coming down and averaging into allocations I already have to get the best price possible.

My trades have been doing great recently but my long-term holds have been hurting. I hope you all are doing alright in this process. There’s at least light at the end of this tunnel, we just have to find the end first.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

HaiKhuu Proprietary Algorithm Report:

Yesterday fortunately was a success on the Pilot account. We were able to close out the account +0.54% up. I did not purchase any positions for the BAOSAC due to a lack of confidence in the market. Instead, I sold 0DTE $SPX contracts to capitalize on the volatility. Our BAOSAC unfortunately, lost money. The result of utilizing that system was -0.7566%. Thankfully I was able to actively manage the pilot account yesterday to be able to beat the system by roughly 1.3%.

Our alert system net a return of 0.5% with 11 buy alerts, 9 of them resulting in green. It was a beautiful day watching those alerts get hit and exited intraday as there were a lot of great opportunities to buy and sell.

With the way the markets are looking prior to open, I do not have confidence in allocating any money with the BAOSAC system today and will be holding all cash. The algo itself does not have confidence in the markets and only recommends a 60% allocation today. If I do decide to take a play by open, it will be a general $SPY allocation in the market that is relatively light.

We will wait for the opportunity to present itself prior to us allocating any capital for the day.

All alerts are still valid, but I would urge you to stay away from any plays you do not have any personal confidence in due to the market conditions.

DISCLAIMER - Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. We cannot guarantee success. Take these at your own risk.

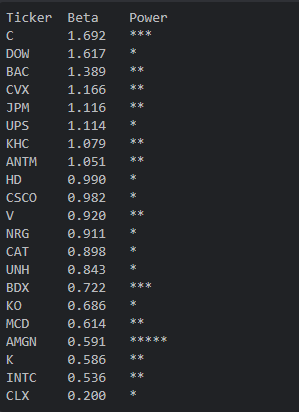

Generated entries for 5/12/2022

My Personal Watchlist :

Note, just because something is on my watchlist, does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $GOOGL , $AAPL , $MSFT , $BABA , $TSLA , $AMD , $NVDA, $GAIN

Free Equity List:

Safe - $SPY

Risky- $BA , $AAPL , $BABA , $AMD , $MSFT , $NVDA , $SOFI

Speculative Crypto Plays

Apecoin (I bought light)

ETH (Looking to buy soon, Ideally enter 1700~)

Swing Opportunities:

Start to purchase equities that you are willing to hold long at these relative good prices, but if the markets do decide to go down, have some room to be able to average down if necessary.

Watch major tech, I think there is still room to come down, but at these relative bottoms, it will be a great time to buy.

LONG OPPORTUNITIES:

$GAIN - Long term dividend play

$QS - NOT YET, wait until $TSLA breaks down and EV hype crashes, once this happens purchase $QS for pennies on the dollar and forget that you have the organization. Come back in 10-20 years and vibe

$COIN - NOT YET, wait until crypto tanks and the majority of retail sells their holdings. Buy $COIN and forget about it until the next wave of cryptocurrency hype. It might take 2 years, it might take 5 years, and it might take 20 years. But when USDT or some other major coin tanks, things will be disgusting. Be the person who goes up and is able to buy into the bloodshed, then hold out until people are hyped about cryptocurrency again.

Economic News for 5/12/2022

Initial jobless claims – 8:30 AM ET

Continuing jobless claims – 8:30 AM ET

Producer price index (final demand) - 8:30 AM ET

Notable Earnings for 5/12/2022

Pre-Market Earnings:

Brookfield Asset (BAM)

NICE Ltd (NICE)

Tapestry (TPR)

Endava (DAVA)

CyberArk (CYBR)

WeWork (WE)

Blackstone Secure (BXSL)

Crescent Point Energy (CPG)

IronSource (IS)

Six Flags (SIX)

After-Market Earnings:

Motorola Solutions (MSI)

Toast Inc (TOST)

Affirm Holdings (AFRM)

Houlihan Lokey (HLI)

Endeavor Group (EDR)

Mister Car Wash (MCW)

Ryan Speciality Group (RYAN)

Joby Aviation (JOBY)

Compass (COMP)

VIZIO Holding (VZIO)

Wrap Up

Overall, I am excited to see what will happen in the markets today. I am preparing for the worst but hoping for the best.

Hopefully that we are able to hold some major support levels and are optimistic that we can do so.

In the case the markets come down, make sure to practice safe risk management and limit your downside risk.

Hope you all have an amazing day and make sure to stay hydrated!

If you are not a part of our free Discord , click HERE to join