HaiKhuu Daily Report 05/13/2024

Good morning, and happy Monday! I hope you all had a wonderful weekend and are excited about another week of trading! Market conditions are extremely strong at the moment, and we have many major catalysts this week for market movement. Be on the lookout as we have PPI pre-market on Tuesday and CPI pre-market on Wednesday. Both of those news events are going to impact market performance will heavily impact the markets, so prepare accordingly. On top of that, we have major earnings coming from Alibaba, Home Depot, and Walmart.

This should be another fun week for the markets with opportunities consistently being presented to us, so tread lightly, but look to take advantage of any opportunities presented to us!

Good luck trading, and let’s have an amazing time this week!

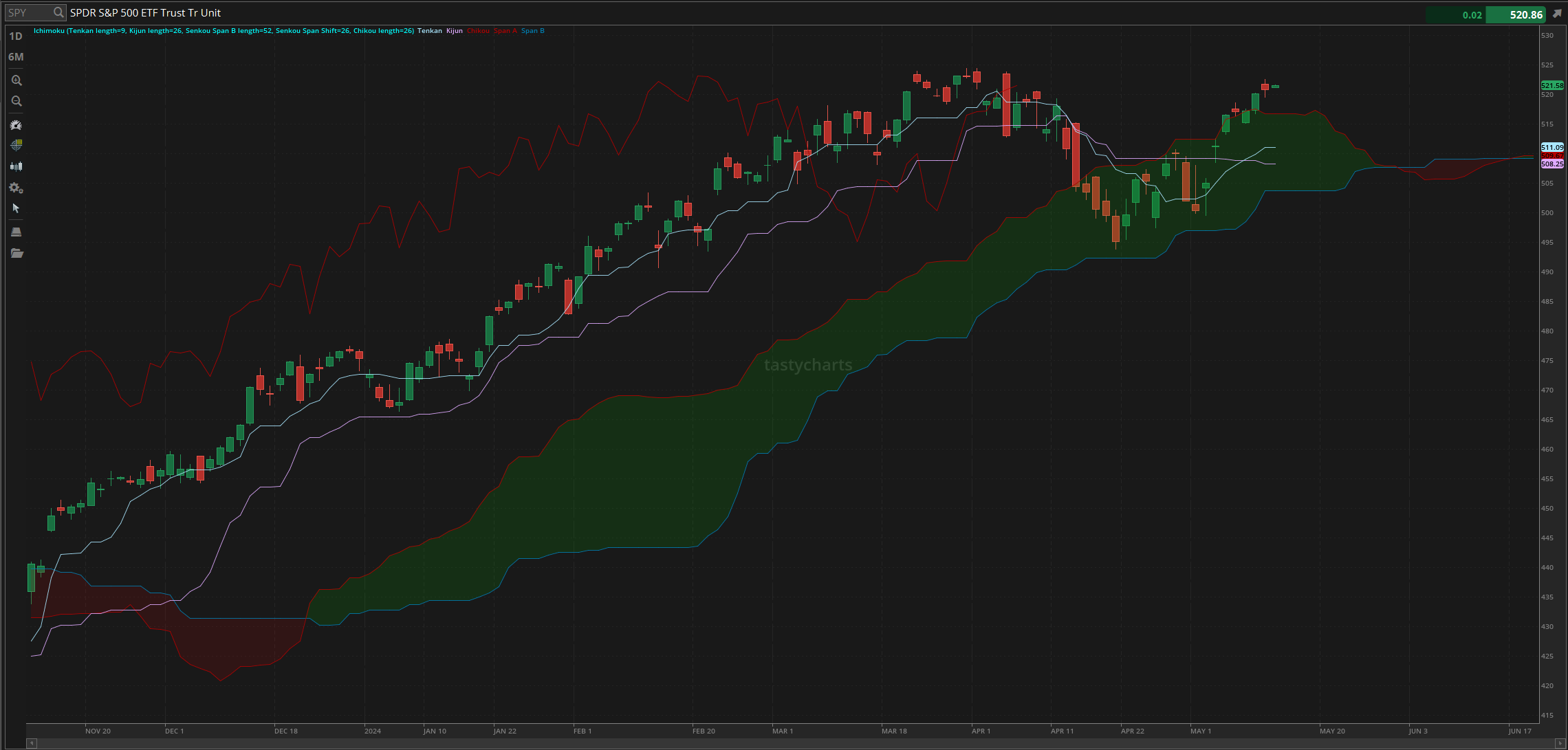

The updated $SPY daily levels are as follows:

Conversion Line Support: $511.09

Baseline Support: $508.25

Psychological Support: $500

Daily Cloud Resistance: $516.72

$SPY Daily Candles - [05/10/2024]

Thoughts & Comments from Last Week

Last week was a genuinely beautiful week for the markets as $SPY had continual bullish momentum with great opportunities to trade, but even better opportunities to ride the market momentum. The momentum in the markets was slow but was extremely consistent, which provided us all with a relatively easier week to navigate. We watched as $SPY was able to break above the cloud resistance, perform a bullish TK-cross over, and have a confirmation of a reversal. I would say the overall movement of last week was not necessarily impactful, but the significance of the movement from a technical analysis standpoint was the biggest feat. It was an amazing week for the markets with great opportunities!

We started the week with $SPY trading at $513.76. Conditions were looking great going into Monday as $SPY opened the week green, trading at the daily cloud resistance. However, it was able to break above that resistance for the first time with confidence, and we watched as the markets respected the movement and continually moved up as a result. Conditions were not the most optimal, but despite remaining not optimal, we had great opportunities to allocate with confidence to ride throughout the entire week.

Tuesday and Wednesday were relatively neutral as the daily cloud resistance on $SPY continued to move up accordingly with the markets, making a breakout more difficult, but $SPY respected the level, as we remained neutral against the cloud resistance but still trading with both strength and confidence in the markets. After remaining at the cloud resistance though, we watched as the markets set up beautifully, breaking above the daily cloud resistance on Thursday, and continued the rally.

We ended the trading day on Thursday with $SPY making a high into close, trading at $520.17, above the $520 resistance, officially breaking out on the daily timeframe, which provided us with a significant amount of comfort and confidence.

Friday was not too exciting, as $SPY did come down throughout the day, but we got within striking distance of a new all-time high on $SPY. We opened Friday with $SPY trading at $521.79 and looking relatively strong before breaking out to go on and make the official high of the day trading at $522.63. Conditions were not the most optimal, but we were at least provided with an amazing opportunity to take profit before $SPY started to sell off. $520 did seem like a great support level on Friday, as $SPY did continually bounce at that level for the majority of the day, where despite us selling off for the large majority of the morning, we were able to continue to bounce off of that support with confidence.

We ended the week with $SPY trading at $520.84, up roughly $7 throughout the entire week, or up roughly 1.4%. It was an amazing week for the markets, which provided almost every trader with a phenomenal opportunity to both ride and capitalize on the market momentum! Traders should have had an amazing time, investors should have enjoyed the ride, and unfortunately, the bears only continued to lose. Hopefully, you all were able to have a great week and are ready for what the markets have in store for us this week!

Heatmap - $SPY 05/10/2024

Thoughts & Comments for Today, 05/13/2024

This should be an extremely fun week for the markets. With the way the markets stand at the moment, we are displaying a significant amount of both strength and confidence, so it should be relatively easier to ride the market momentum with both comfort and confidence. Traders may have some difficulties allocating in these market conditions, but this is genuinely going to be an amazing opportunity to ride the market momentum. I talked about this last week, and I will say it again. I am confident in these market conditions but do not advise attempting to trade aggressively. Opportunities are going to be presented to us, but just because you consistently partake. It is easy to continue to ride this market momentum, and it will be easy to trade, but if the markets continue to perform consistently, you can allocate into the markets with both ease and confidence and remain consistent by riding the momentum. Yes, you should look to trade when given an opportunity to do so, but allocating into trending markets and holding strong equities will provide you with consistency.

Look for opportunities to buy value and momentum and ride that momentum. Consistency is key in these market conditions, and anyone who says anything against winning consistently should evaluate their abilities as a trader.

Obviously, you should look for opportunities to take advantage of the short-term momentum in the markets, but making strong allocations in the markets, should be a priority while there is confidence in the markets.

Just continue to make sure that you are practicing safe risk management. Markets are going to continue to perform while there is confidence, but just because there is confidence does not mean you should take on a dumb amount of risk. Despite strong conditions, navigating choppy markets that are inconsistent is not easy for anyone. Taking on a dumb amount of risk while markets are not favorable is a breeding ground for inconsistencies and realizing significant losses. Look to perform and allocate accordingly.

For my allocations today, I will say that I anticipate actively trading when I have an opportunity to take advantage of the short-term momentum in the markets, but at the same time, I am not looking to increase my risk profile at all in any way, shape, or form. With the current momentum in the markets, I am happily allocated long in my portfolio with the majority of my capital, and I anticipate holding those positions while markets are performing up to my expectations. I do not want to take on too much risk, but I personally do not want to miss out on trades that I feel could be extremely profitable. I’ll call out any plays that I see or enter in the HaiKhuu Discord, so be on the lookout for some plays today!

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY, $ULTA, $LULU, $MSFT, $NVDA, $AAPL, $TSLA, $RIVN

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $BA

Confirmed Re-entry - $RIVN, $ULTA, $LULU

Economic News for 05/13/2024

NY Fed Consumer Inflation Expectations - 11:00 AM

3-Month Bill Auction - 11:30 AM

6-Month Bill Auction - 11:30 AM

Notable Earnings for 05/13/2024

Pre-Market Earnings:

Legend Biotech (LEGN)

Bitfarms (BITF)

Tencent Music (TME)

HUYA Inc (HUYA)

Central Puerto S.A. (CEPU)

Dingdong (DDL)

D-Wave Quantum (QBTS)

Fortrea Holdings (FTRE)

After-Market Earnings:

StoneCo (STNE)

Paysafe Group Holdings (PSFE)

TeraWulf (WULF)

QuickLogic (QUIK)

Agilysys (AGYS)

Bioceres Crop (BIOX)

Intercorp Financial (IFS)

American Healthcare (AHR)

Wrap up

This is going to be a great week for the markets, with opportunities being consistently presented to us. Market conditions are optimal, so ride this momentum, generate some realized gains, and enjoy the ride that the markets are providing to us. We should all have a lot of fun attempting to trade, so make the right allocations, practice safe risk management, and realize some gains this week!

Good luck trading, and let’s see what $SPY has in store for us!