HaiKhuu Daily Report 5/16/2022

Good morning and Happy Monday everyone! Hope you all had an amazing weekend and are ready for what is going to be another intense week for the markets. Things are looking pretty interesting going into open.

We were nicely green when futures opened yesterday. I remember seeing $SPY at $403 and was excited to see how the markets would look when I woke up. Unfortunately, the markets have come down since last night, we broke major support on $SPY at $400 and at the moment of writing this report, is hovering at $400.24. Ideally, by the time you read this report, the markets have moved up and we all have a great time, but if we break this $400 support level again, please continue to tread lightly. I am bullish and optimistic to trade today, but I am prepared to enter with caution only in the case the opportunity presents itself. I don’t want to force any trades or FOMO into anything, mostly in these market conditions.

Also; we are doing a community-wide research survey on what you feel is the most undervalued stock on the market right now. Please fill out this quick form and I’ll publish the results when they are completed

(Takes under 30 seconds to finish the survey)

Click here.

Thoughts & Comments from last week

Last week was an intense week for the stock market. Lots of things happened including us breaking down and making new 52-week lows for the indices. Despite this happening, we were at least able to recover nicely at the end of the week. The week started at $405 on $SPY. We hit a low around $385~ and then closed the week at $402.

There were many opportunities to trade both the bullish and bearish momentum last week, more so the bearish side, but there was a fair bit of opportunity to trade and be bullish throughout the week.

After hitting the lows on Thursday, Friday was an amazing ride.

$SPY 15 MINUTE CHART, 5/9-5/13/2022

Thoughts & Comments for Today 5/16/2022

Like I said before, this week will be a very interesting and hectic day for the markets. There was a lot of turbulence last week with the markets and there will be a lot of turbulence this week.

Please stay mentally and physically prepared for what the market has to bring, as we are currently at major support levels. I believe we will chop around $400 on $SPY prior to picking and confirming the direction that the markets want to go. Ideally, we see a beautiful rebound of the markets and continue to rally, but in the case that we decide to reject this $400 support level, please just be extremely careful and practice safe risk management. This is not the time to take on blind or stupid plays, take any unjustifiable losses and as always, you should practice safe risk management.

This market does present a lot of great opportunities to capitalize on the increased volatility. My personal recommendations for trades today will be to actively open CSPs on organizations you have confidence in, at a strike you are comfortable at. As well as selling 0DTE put spreads on $SPX. I’ve found a significant amount of success selling $SPX spreads while volatility is high. At times it can be stressful when the position is not going my way, but as long as you are outside the range of movement for the day, the contract will naturally decay to zero.

Sell these spreads actively while you are feeling more confident in the market. Ideally, you are selling these so OTM that you have zero worry about getting assigned. In a worst-case scenario, the $SPX 52-week low is 3,858.87. I will be actively opening these 0DTE spreads throughout the day to minimize initial risk on entry, as well as capitalize on the volatility throughout the day.

Only sell these spreads if you are a comfortable and confident trader. This strategy is NOT for newer traders in the market.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

HaiKhuu Proprietary Algorithm Report:

Our trading pilot killed it on Friday. We were able to close out the day beating our daily target returns by 477%. With a mix of active trading, selling positions at the top, and selling 0DTE $SPX spreads, we were able to maximize realized gains for the day.

Since the launch of the pilot, we are currently down a little over 2%. In the same timeframe, /ES has dropped roughly 8.5% and /NQ has dropped 13.5%. It is unfortunate that the pilot is not actively profitable at this moment, but C’est La Vie. We are still beating the markets by a significant margin. One beautiful day on the market or a string of a couple of consistent days will bring us back into the green.

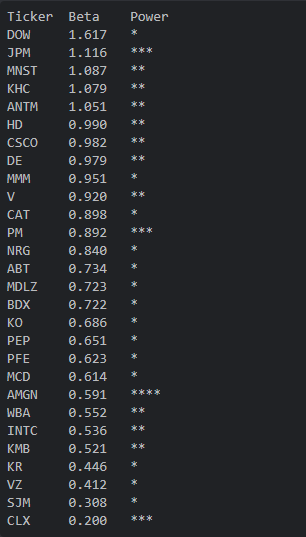

Entries will be made as normal today in the pilot account in accordance with our power confidence model. I personally will be allocating a little bit less of our capital today as I am skeptical as we are right in the 400 support level. In the case the markets decide to turn, they will turn rather quickly and I want to limit our exposure in the case this happens. Ideally, $SPY holds this $400 support level and we continue to rip up all day.

DISCLAIMER - Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. We cannot guarantee success. Take these at your own risk.

Generated entries for 5/16/2022

My Personal Watchlist :

Note, just because something is on my watchlist, does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , AAPL , $BABA , $BA , $MSFT, $SOFI , $TWTR

Free Equity List:

Safe - $SPY

Risky- $AAPL, $BABA , $AMD , $MSFT , $NVDA , $SOFI

Swing Opportunities:

I highly recommend starting to pick up starter positions on equities and averaging down where possible. This is a great time to sell CSPs. Either you’ll get assigned at a price you are happy and comfortable at, or you will collect premium while volatility is high. Either way, a win is a win.

LONG OPPORTUNITIES:

$GAIN - LONG TERM DIVIDEND PLAY

Major Tech Organizations - $AAPL , $MSFT , $GOOGL* , $TSLA*

Major Splits - $GOOGL , $AMZN

Relatively Safer Long - $BA

Under Priced - $PYPL , $SOFI

High Risk - $BABA

Economic News for 5/16/2022

Empire State manufacturing index - 8:30 AM ET

Notable Earnings for 5/16/2022

Pre-Market Earnings:

Monday.com Ltd (MNDY)

Tower Semiconductor Ltd (TSEM)

Warby Parker (WRBY)

Clear Secure (YOU)

Altus Power (AMPS)

Wix.com (WIX)

Sohu.com (SOHU)

S&W Seed Company (SANW)

Noven Pharma (NOVN)

HOOKIPA Pharma (HOOK)

After-Market Earnings:

Nu Holdings (NU)

Take-Two Interactive Software (TTWO)

Tencent Music (TME)

Forge Global Holdings (FRGE)

Global-E Online (GLBE)

HighPeak Energy (HPK)

Rocket Lab (RKLB)

Energy Vault Holdings (NRGV)

Shoals Technologies (SHLS)

BuzzFeed (BZFD)

Wrap up

Good luck trading today, it should be a very exciting day for the market and a great way to start the week. Capitalize on the bullish momentum intraday, limit your downside risk, and capitalize on the increased volatility.

Also; intraday trading alerts will be back in real-time for tomorrow (5/17/22)

Let’s make some bank!

If you are not a part of our free Discord, click HERE to join