HaiKhuu Daily Report 05/21/2024

Good morning, and happy Tuesday!

The markets are beautiful, and $SPY has made a new all-time high! There is strength in these current market conditions, and I hope that you all are having an AMAZING time! Markets were relatively neutral at the time this report was written, but despite the conditions, please tread lightly and practice safe risk management.

$SPY is looking primed for another breakout, but there are many underlying risks in the markets right now, including FOMC and $NVDA earnings tomorrow. If both events go well, expect to see new all-time highs, but it is just a matter of whether the market momentum here is able to last.

Look to maximize the opportunities that are available to us right now, and have a great time!

Good luck trading, and let’s see what $SPY has in store for us today!

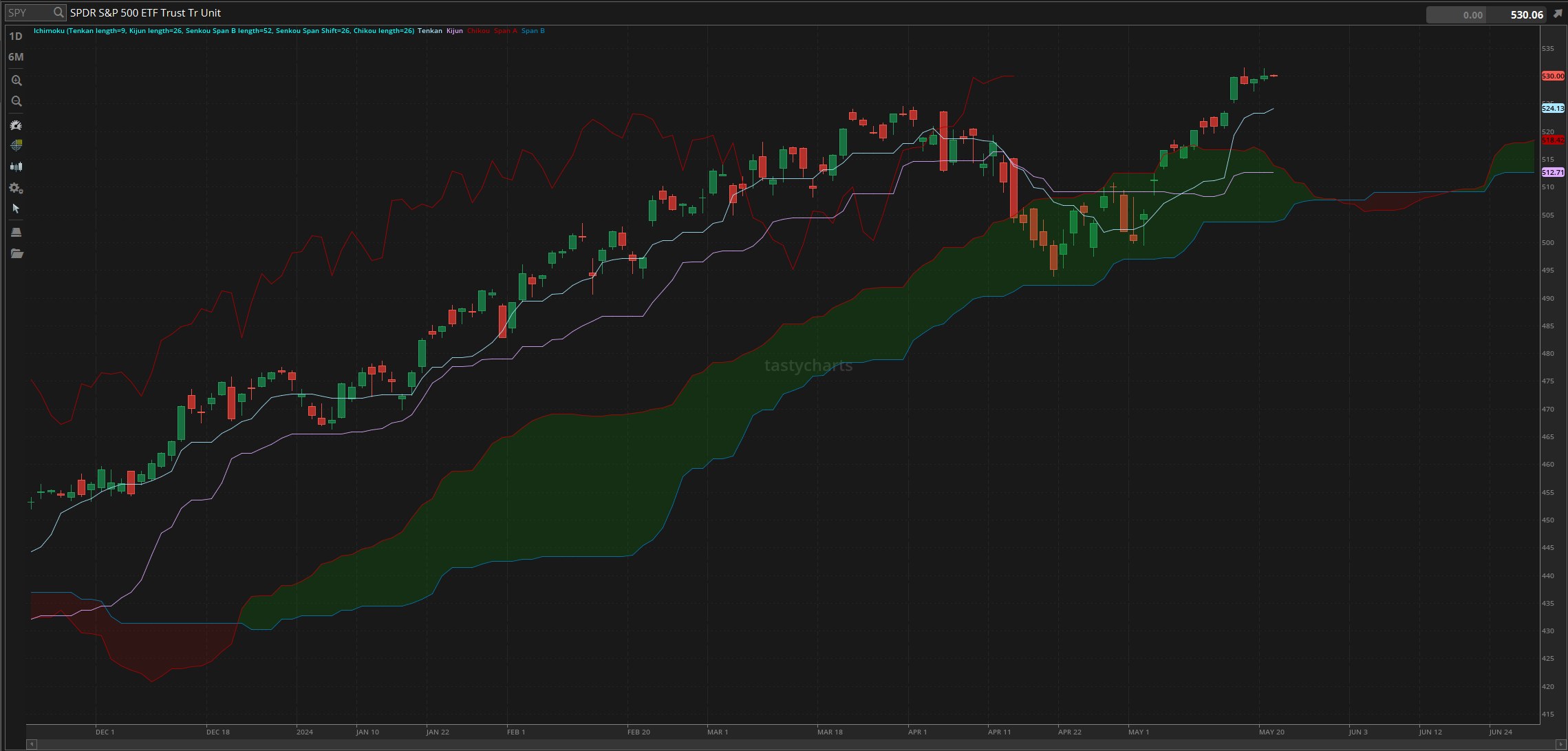

The updated $SPY daily levels are as follows:

Conversion Line Support: $524.13

Baseline Support: $512.71

Psychological Support: $500

Daily Cloud Support: $513.91

$SPY Daily Candles - [05/20/2024]

Thoughts & Comments from Yesterday, 05/20/2024

Yesterday was an extremely interesting day for the markets, filled with confusion, chop, and a new all-time high. Conditions were extremely difficult to navigate, but they presented us with many opportunities to actively trade and realize significant gains in the process.

We started the day with $SPY trading at $529.61. Conditions were not absolutely perfect, but we started the day slightly green before watching as $SPY went on to rip and rally for the large majority of the morning. $SPY quickly pushed up to $531 and chopped around there before making the official high of the day, trading at $531.56, which was a new all-time high. The conditions were looking beautiful but extremely choppy and tough to navigate with consistency.

$SPY continued to chop around $531 for the majority of the morning, leading into the afternoon. Around 1:30 p.m. EST, the markets quickly started to drop. We went on to make a relative low, breaking below $530, and continuing to chop around that level. Conditions were not great as we rejected the top, but thankfully, conditions remained strong, retaining the confidence from before.

Power hour was really choppy and honestly very uneventful. We ended the day with $SPY closing above the $530 support, trading at $530.06, up $0.61 from the previous close, or up approximately 0.1%.

It was a rough day for the overall markets as a result of the general inconsistencies that were provided to us, but thankfully, there were many great opportunities to both scalp and trade, and $SPY did make a new all-time high in the process. So, there are many things we can complain about with the movement of the markets yesterday, but we should be thankful that $SPY did make a NEW all-time high in the process. Let’s see where the markets end up going this week and navigate accordingly!

Heatmap - $SPY 05/20/2024

Thoughts & Comments for Today, 05/21/2024

Today is going to be a confusing time for the markets. As a result of yesterday, people will be conflicted about how they want to allocate, but thankfully, we are prepared. As I said before, I am expecting to see strength in the general markets but at the same time, I am expecting to see chop that will make trading extremely inconsistent. I believe there is a good chance that we again see another breakout in the markets to make another all-time high, but it is just a matter of how consistent the markets will be both before and after it happens. The largest underlying risk in the markets right now is FOMC and $NVDA earnings tomorrow, so people are going to be more passive today in anticipation of everything that will happen tomorrow, so tread extremely lightly and prepare accordingly.

My advice for people today is to attempt to remain a little bit more passive unless there is a decisive movement in the markets, and in the case that we do get a large directional movement with strength, to simply ride the momentum and hold your positions. Traders can very easily capitalize on these market conditions, but it will be difficult to assume choppy market conditions. despite the conditions not remaining perfectly optimal, the best course of action on a day like today is to not overallocate. Many traders realize losses on choppy days like yesterday, so this is protection against that, assuming that we see continued choppiness in the markets. I am not expecting to see a large directional move today, but the markets do not care about my sentiment. Anything can happen here, mostly as $SPY is setting up for a possible breakout, and we are seeing strength.

Just continue to hold strong equity positions in these conditions and be comfortable and confident with your allocations. Risk management is key to the longevity of your portfolio, so prepare accordingly and do what you can to maximize the amount of realized gains you can generate!

For my allocations today, my sentiment does remain that I want to be more passive in these conditions. I am expecting to see choppy market conditions, and as a result of that, I am not overly ambitious to attempt to aggressively trade. In the case that I am able to find opportunities to allocate with confidence, I will look to day trade, and hold strong positions I am comfortable and confident in. I already have allocations in the markets that I am holding, and I do not anticipate selling anytime soon, but it is, again, just a matter of remaining consistent on days when people are not confident. We will have fun in the markets tomorrow, so there is no reason to die today.

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY, $JPM, $GME, $AMC, $TSLA, $NVDA, $BA, $LULU, $ULTA

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $BA

Confirmed Re-entry - $RIVN, $ULTA, $LULU

Economic News for 05/21/2024 (ET):

Redbook - 8:55 AM

Fed’s Waller Speaks - 9:00 AM

FOMC Member Barkin Speaks - 9:00 AM

Fed’s Williams Speaks - 9:10 AM

FOMC Member Bostic Speaks - 9:10 AM

Fed’s Barr Speaks - 11:45 AM

Notable Earnings for 05/21/2024

Pre-Market Earnings:

ZIM Integrated Shipping (ZIM)

Macy's (M)

AutoZone (AZO)

Lowe's (LOW)

Eagle Materials (EXP)

Eltek (ELTK)

Full Truck Alliance (YMM)

AMER SPORTS (AS)

XPeng (XPEV)

After-Market Earnings:

Modine Manufacturing (MOD)

Toll Brothers (TOL)

ViaSat (VSAT)

Urban Outfitters (URBN)

Alvotech (ALVO)

Skyline (SKY)

Wrap up

Hopefully, there is more consistency in the markets today, but I am expecting to see a repeat of yesterday. Expect to see strength in the markets, with choppy overall conditions and many difficulties remaining consistent. Tread lightly, protect your bottom line, and practice safe risk management. Many traders will have an amazing time, while others will have a lot of difficulties in the process. Do not forget we have FOMC & NVDA earnings tomorrow, so prepare accordingly.

Good luck trading, and let’s see another all-time high on $SPY!!!