HaiKhuu Daily Report 5/25/2022

Good morning and Happy Wednesday everyone! Hope you all are doing amazing, feeling great, and are hyped for today.

We have FOMC minutes coming out at 2 pm EST. These will be the notes from the May 3-4th meeting.

Hope you are excited and optimistic to see what happens today in the markets. Things will be extremely choppy but there should be amazing opportunities to actively capitalize on this volatility and momentum, make some great trades, and realize some short-term gains.

Things are looking alright going into the market open today. We are down from close but things are not looking terrible.

$SPY PWWR $392.27

Thoughts & Comments from 5/24/2022

Yesterday was a terrible day for the markets, but we recovered nicely from the bottom. $SPY opened bloody as an aftermath of $SNAP. $SPYtook a dive and hit a low of $386.96. Intraday, down roughly 1.4% from open.

After hitting a low, Markets moved up into the pre-recorded speech from Jerome Powell at 12:20 pm EST.

Markets came back down to VWAP after the realization the speech really did not have any major significance.

After everything, there was a beautiful rally into close. Markets were still red for the day from the bloodshed the previous night, but we were up almost 2% from the bottom. $SPY closed down -0.76% from the day, but Intraday movement was +0.36%.

Overall, it was a sketchy day, mostly in the morning. But if you were able to short at open and cover at the bottom, or go long at the bottom and ride the wave up. It was a great time for you. There was a lot of intraday chop, I’m sure people had a difficult time trading, but C’est La Vie. It was nice at least recovering from the bottom.

We are not out of the woods yet so continue to tread lightly.

$SPY 5/24/2022 ONE MINUTE INTRADAY CHART

Thoughts & Comments for Today 5/25/2022

Ideally, the markets move up beautifully and things run today. It will all be determined by what was stated in the May 3-4th meeting. Today is a great day to aggressively trade and capitalize on the volatility and momentum, but be careful and tread lightly. I would not recommend actively trading into 2 pm EST but you should play the direction the markets are going after.

Lots of people will get faked out trading today, don’t be one of those traders. Realize your gains quickly, limit your downside risk and practice safe risk management. If you lose a position or lose ON a position. Oh well, move on with your life. Don’t FOMO back in or force a trade that is not optimal. There will be a LOT of chop and it will be extremely difficult to navigate these markets.

Do not revenge trade. Today most traders will lose money and feel the need to overtrade to compensate and make back the losses that they have incurred. Don’t be one of those traders. Opportunities will always continue to present themselves time and time again. No need to do anything rash in the short term as that will only lead to failure.

One of the things you have to remember to be a successful stock trader is in times when you are wrong and your emotions are starting to get to you, don’t let those impact the way you trade, and don’t let those influence your actions. If you need. Go outside, take a breather, and refresh your mind.

A gamble trade I want to take today is a short position on $BOX, they have earnings AH and I personally believe they are going to miss heavily. Another short position is $SNOW. I personally will not be allocated to a short position on $SNOW. Of the two earnings after hours, I have more confidence in a position in $BOX. I might look to short equity just in the case I need to cover after hours, but I will most likely just purchase puts and pay a premium to short the allocation & limit my downside risk.

Please watch out and wait for me to announce any entry on those positions if you are actively looking for either.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

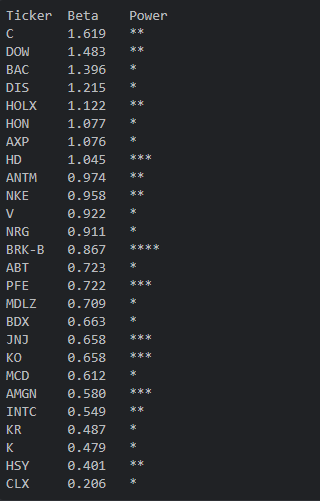

HaiKhuu Proprietary Algorithm Report:

Yesterday, as expected was a great day for the BAOSAC system, but man was it a sketchy day. The system itself was able to generate 1% AUM which is incredible for a day like yesterday. Unfortunately, we did not allocate any capital to the markets due to time constraints but it was still great getting positive data that the systems continuously worked.

Today's allocations will be back to normal. We are looking to have light exposure at 40% AUM for the day and utilize our trading alerts in a new system. These new system allocations are going to be light, but rapid. Ideally, this is able to generate beautiful and consistent returns across the board on the market with relatively the same amount of risk potential on each play.

All positions will be created and published prior to markets opening, and any alerts that are taken will be alerted in real-time.

DISCLAIMER - Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. We cannot guarantee success. Take these at your own risk.

Generated entries for 5/25/2022

My Personal Watchlist :

Note, just because something is on my watchlist, does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $GOOGL , $TSLA , $BABA , $AMD , $SOFI , $FB , $TGT , $BA

Free Equity List:

Safe -$SPY

Risky- $BA , $TGT , $AAPL , $MSFT , $AMD , $SOFI , $BABA

Swing Opportunities:

I highly recommend everyone to continue to tread lightly in the markets. Start to get starter allocations in long positions while equities are cheap and continue to sell CSPs. This is a great time to sell CSPs while volatility is high and equities are cheap. Please only sell positions that you personally are comfortable and confident purchasing.

Organizations I recommend selling CSPs on - $BA , $BABA, $AAPL , $AMD

LONG OPPORTUNITIES:

Long Term Dividend - $GAIN (I added significantly to my gain position yesterday at the bottom)

Major Tech Organizations - $AAPL, $MSFT, $GOOGL, $TSLA

Major Splits - $GOOGL , $AMZN

Relatively Safer Long - $BA

Under Priced - $PYPL , $SOFI

High Risk - $BABA

Economic News for 5/25/2022

Durable goods orders - 8:30 AM ET

Core capital equipment orders - 8:30 AM ET

FOMC minutes - 2 PM ET

Notable Earnings for 5/25/2022

Pre-Market Earnings:

Bank of Montreal (BMO)

Bank of Nova Scotia (BNS)

Baxter International (BAX)

Dick's (DKS)

Dycom (DY)

Express (EXPR)

Photronics (PLAB)

Zhihu (ZH)

After-Market Earnings:

NVIDIA (NVDA)

Snowflake (SNOW)

ZTO Express (ZTO)

Splunk (SPLK)

Amerco (UHAL)

DXC Technology Company (DXC)

Nutanix (NTNX)

Box, Inc (BOX)

Wrap up

Watch out for 2pm EST today on the markets. Be careful trading today, lots of people will get faked out. Be smart with your positions, be reserved with your cash and sit on your hands if necessary. Literally and metaphorically.

Good luck trading today and may the odds be in your favor.

If you are not a part of our free Discord , click HERE to join

Traders after getting their ankles broken today