HaiKhuu Daily Report 6/10/2022

Good morning and Happy Friday everyone! It’s been quite the week for the market, hope you all are prepared for the day.

Just as a reminder, we have CPI data coming out at 8:30 am EST. Futures were flat and things are coming down slowly towards major support levels. $SPY PWWR $400.75

This data will determine where we start the day and as a result, today will be an absolutely insane day with lots of opportunities to trade and capitalize on the volatility & momentum. I wish you all the best of fills and to never have your stops tested. Good luck today.

I do want to say though, a lot of people will ultimately end up losing by trying to catch the movement today. Please be smart when it comes to any plays. Have stops set on allocations you have that you want to get rid of, start lightening bags that you are in, and prepare to get into more cash.

Continue to hold positions that you are INVESTING in for the next 2-3-5 years, you’ll be able to average down and get more equity cheap relatively soon. Short-term turbulence means nothing over the course of a lifetime.

If you are actively trading or trying to time these movements with a swing. Please be extremely careful not only today but moving forward for the next two months.

Thoughts & Comments from 6/09/2022

Yesterday was a terrible day for the markets and the charts below show it. $SPY was looking okay in the morning being slightly red from the close on Wednesday. The first half-hour played out we even went green at one point, but as the day continued being slow and mild, but going into power hour, after touching lower VWAP, we broke all major support levels as we watched a nasty sell-off. $SPY closed for the day at $401.44 -9.78 (2.38%).

It was an alright day for anyone actively trading up into power hour. There were many opportunities where you were able to scalp with confidence. Hopefully, you were able to get out of all of your plays accordingly in profit and were shorting the downside.

Like I said yesterday, there will be a lot of fake opportunities to buy and we would continue to have a nasty slow bleed. Too bad we had to wait until power hour to watch it play out. But I am glad that we all were able to dodge that bullet.

$SPY 6/09/2022 ONE MINUTE INTRADAY CHART

Thoughts & Comments for Today 6/10/2022

Today should be another intense day for the markets. Data coming out at 8:30 am EST will really signal the direction the markets will start off. Ideally, the markets move up but, in the case that things come down. Make sure to tread lightly and be careful. Watch out for the $400 support level on $SPY. If we break that major support, we are back into some murky waters with the market.

Be extremely careful if you are actively trying to trade or make any short-term plays right now. Like I’ve been saying for the past couple of weeks, this has and still is a good opportunity to take some cash off the table if necessary.

Have stops set to exit positions you don’t want full allocations in and prepare for what is coming up, both mentally and physically.

It should be a drag of a day on the market in the case that things do decide to come down, but it never hurts scalping and day trading when you have opportunities to do so. Capitalize on the volatility and momentum and realize gains while you can. This is not the time to get greedy.

If you want to watch any of my trades or plays today, they will be posted live in the HaiKhuu Discord.

HaiKhuu Proprietary Algorithm Report:

The algorithm did alright with market conditions yesterday.

For a baseline, both $SPY & $QQQ moved roughly -2% yesterday. Our performance was as followed:

BAOSAC -1.7%

Alert Bot -0.54%

Pilot +0.017%

It is unfortunate that the BAOSAC and the Alert bot were not profitable yesterday, but it was a win for both being able to beat the market.

The true winner of yesterday was the Pilot. I was able to exit most of the positions at the top, holding some other light allocations during the downtrend. I cut all positions towards the end of the day as I saw the sell-off start to minimize all losses and be able to generate a miniature, but still profitable return for the day.

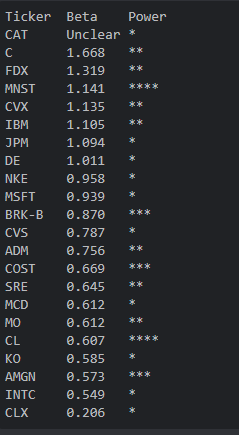

Due to CPI data coming out today pre-market, we will not be allocating to ANYTHING BAOSAC from the alerts below. Just because we are not entering into any positions, does not mean that the alerts below are not valid. But they just are not able to take into account news. From a pure technical standpoint, they are all still valid.

I personally would recommend staying away from BAOSAC today, but watch for our intraday trading alerts on those allocations. I would rather be biting my tongue and wishing that we had full allocations for the day as the markets rip, that be upset watching losses accumulate due to negligence of financial news.

We will still be purchasing some $SPY at open for general market exposure and average down on the positions accordingly.

We also will be watching for the intraday alerts and actively utilizing those positions to be the active allocations for the day.

DISCLAIMER - Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. We cannot guarantee success. Take these at your own risk.

Generated entries for 6/10/2022

My Personal Watchlist :

Note, just because something is on my watchlist, does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $AMZN, $GOOGL , $BABA, $BA, $TSLA , $AAPL , $MSFT , $AMD

Free Equity List:

Safe -$SPY

Risky- $AMZN, $AAPL , $BA, $BABA , $SOFI

Swing Opportunities:

Continue to set stops on positions you have. Continue allocating more into cash and holding for opportunities to come up.

Be extremely careful trying to get any sort of swing play right now. Short-term swings are sketchy, but if you want an interesting play, you could grab a couple of shares of $AMZN.

LONG OPPORTUNITIES:

Long Term Dividend - $GAIN (I added significantly to my gain position yesterday at the bottom)

Major Tech Organizations - $AAPL, $MSFT

Major Splits - $GOOGL , $AMZN

Relatively Safer Long - $BA, $INTC

Under Priced - $PYPL , $SOFI

High Risk - $BABA

Economic News for 6/10/2022

Consumer price index (monthly) - 8:30 AM ET

Core CPI (monthly) - 8:30 AM ET

CPI (year-over-year) - 8:30 AM ET

Core CPI (year-over-year) - 8:30 AM ET

UMich consumer sentiment index (preliminary) - 10 AM ET

5-year inflation expectations (preliminary) - 10 AM ET

Federal budget balance - 2 PM ET

Notable Earnings for 6/10/2022

Pre-Market Earnings:

UP Fintech Holding (TIGR)

Wrap up

Overall, it was an intense week for the markets. We have come down significantly and all we can do is continue to prepare for what is coming up. Make sure to practice safe risk management and make sure to continue allocating more into cash now and over the next couple of weeks.

Good luck trading everyone we are going to need it. Have a phenomenal weekend and stay hydrated!

If you are not a part of our free Discord, click HERE to join