HaiKhuu Daily Report 6/13/2022

Good morning and Happy Monday everyone. Hope you all are doing well, are rested, and prepared both mentally and physically for what is coming up. This is going to be another intense week for the markets.

(5:30 am Note… Welp. Things have changed since I wrote this report. Good luck. We all are going to need it)

Futures are looking rough right now and things are going to only get worst (6:18 pm EST Sunday). Please be extremely careful right now. (Plot twist, things got worst by the morning)

With the discussion of another rate hike and the recession risk is only continuing to grow so I would advise each and every one of you to continue to hold more cash.

Markets are in a sketchy territory and I would highly suggest each and every one of you to be practicing the highest level of risk management, selling off strong equities that you feel are overvalued because you can always purchase them back accordingly.

Cash will be king leading up to a recession and will give you the best leverage for success. Continue to always hold your LONG exposure, IE the plays you anticipate holding for multiple years if not your lifetime, and in the case that the markets do decide to come down heavily, then you are getting a great opportunity to purchase everything at a severely heavily discounted rate.

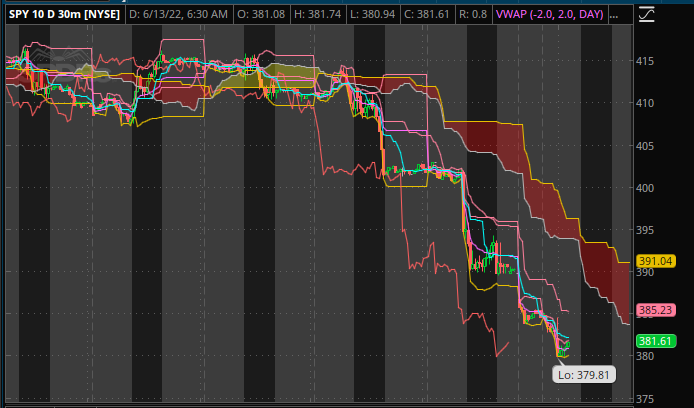

Update; $SPY has made a new low, Cryptocurrencies are tanking, and people are everything is getting decimated at the time of writing this report at about 6 am EST)

Thoughts & Comments from last week.

Last week was a devastating week for the markets. $SPY opened the week at around $415, we were looking optimistic. We wanted to watch $SPY break that $420 level and actively continue to move up, despite this, I actively advised people to take profits while they could, secure gains when given the opportunity, and actively lighten bags.

Turns out, the markets did what the markets do best. Be choppy. Markets started selling off all week and the best opportunity to lighten bags was Monday morning. Things were slow but consistent with the selling, until Thursday when the selling accelerated. Things got so bad that on Friday, $SPY closed at $389.80 -$11.68 (-2.91%), dropping almost 6% from Wednesday.

Trading and investing were tough last week, and things are only going to continue to be tough for the next couple of months. Practice safe risk management and fight for your lives. Be smart, be safe. Don’t try to do anything extremely risky and purchase safe, long-term allocations.

$SPY 30 Minute Weekly Chart (6/6 - 6/13 Pre Market)

Thoughts & Comments for Today 6/13/2022

This week and the upcoming weeks will be the reason why I’ve been advocating heavily to start liquidating and setting stops on allocations that you have to lighten bags. I hope you all have been doing so.

This is going to be another hell of a week for the market, followed by another couple of weeks of uncertainty. Please be extremely careful and tread lightly. We are officially back in bear-market territory.

Markets have made a new official low, PWWR

$SPY 379.81

$AMD 91

$AAPL 132.54

$MSFT 245.10

$BABA 104

$SOFI 5.66

Today will really decide which direction we are going to pick. Either we move up with a beautiful green day for the markets bouncing off these lows

Realistically, I don’t think this pump will happen, but optimistically, I feel there is a chance that we are able to actively navigate the markets by trading in the short term to hedge against losses on long-term plays.

Please continue to be careful, setting those stops to exit positions that are not favorable, and continue to practice safe risk management. Continue holding more cash

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

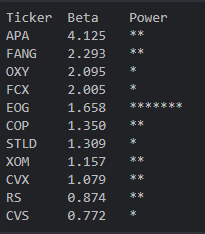

HaiKhuu Proprietary Algorithm Report:

The algorithm has officially swapped portfolios to our stagflation portfolio. we are doing this for both safety and security. Lists of active trades will be smaller and have changed significantly. Please be on the lookout and get familiar with these positions. Don’t trade any positions today. This is one of the few days I will suggest not taking any trades. This is not due to the algorithm or portfolio, but the market condition.

Take this day to sit back and watch what happens.

Performance over the past couple of days for the pilot though has been absolutely insane. With the markets dropping approximately 6% since Wednesday's close (not including this pre-market drop). During this same period, we are profitable. Not profitable an insane amount, but a killer time the fact that we are green, and were able to mitigate all losses that could have been incurred. Total return in this 3-trading day period was +0.05%

Zero positions will be taken on the pilot today with zero anticipation to take ANY positions at all. In the case, I see a good opportunity I’ll take it, if not, C’est la vie. We will move on with our lives and take today a wash. As we are all cash right now. Just beating the market by a lotta bit today going into open, Feels good for the pilot but terrible for my long positions.

DISCLAIMER - Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. We cannot guarantee success. Take these at your own risk.

Generated entries for 6/13/2022

My Personal Watchlist :

Note, just because something is on my watchlist, does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $AMZN , $GOOGL , $TSLA , $AAPL , $MSFT , $BABA

Free Equity List:

Safe - $SPY

Risky - $BABA , $AMZN , $SOFI

Swing Opportunities:

Continue to set stops on positions you have. Hold more cash, don’t buy necessarily yet.

Actively trade and continue to grow your long portfolio with your DCA. This is not the time to actively purchase yet, but continue to grow your long exposure.

LONG OPPORTUNITIES:

Long Term Dividend - $GAIN*

Major Splits - $GOOGL

Relatively Safer Long - $BA, $INTC

Economic News for 6/13/2022

NY Fed 1-year inflation expectations - 11 AM ET

NY Fed 3-year inflation expectations - 11 AM ET

Notable Earnings for 6/13/2022

Pre-Market Earnings:

None

After-Market Earnings:

Oracle (ORCL)

Braze, Inc (BRZE)

Wrap up

Please be extremely careful trading today and wanting to invest in this dip. This is a great opportunity to actively trade, but today is going to be a difficult day. Lots of fake-outs will happen and the market makers will make a lot of money today.

Capitalize on the volatility and momentum while you can, but put your fists up because today will be a fight.

Good luck everyone and let’s make some bank today.

If you are not a part of our free Discord, click HERE to join