HaiKhuu Daily Report 06/14/2024

Good morning, and happy Friday! I hope that you all are well-rested and ready for another fun day at the markets. Everything is relatively neutral at the time of writing this report, but at the same time, we are seeing that many opportunities are being presented to us, mostly with the level of confidence that is being displayed at the moment. Please continue to tread lightly but look to take advantage of these market conditions. It would not surprise me to see elevated volatility in the markets as a result of the ongoing market conditions, so protect your bottom line, as I am expecting to see more difficulties with people’s ability to remain consistent in these conditions.

Trading today is going to be more difficult unless we see a large directional move, but I do believe there is a high likelihood that we will see a new all-time high in the process.

So, look to have some fun, but tread lightly. As a result, market conditions will become more favorable.

Good luck trading, and let’s end this week strong!

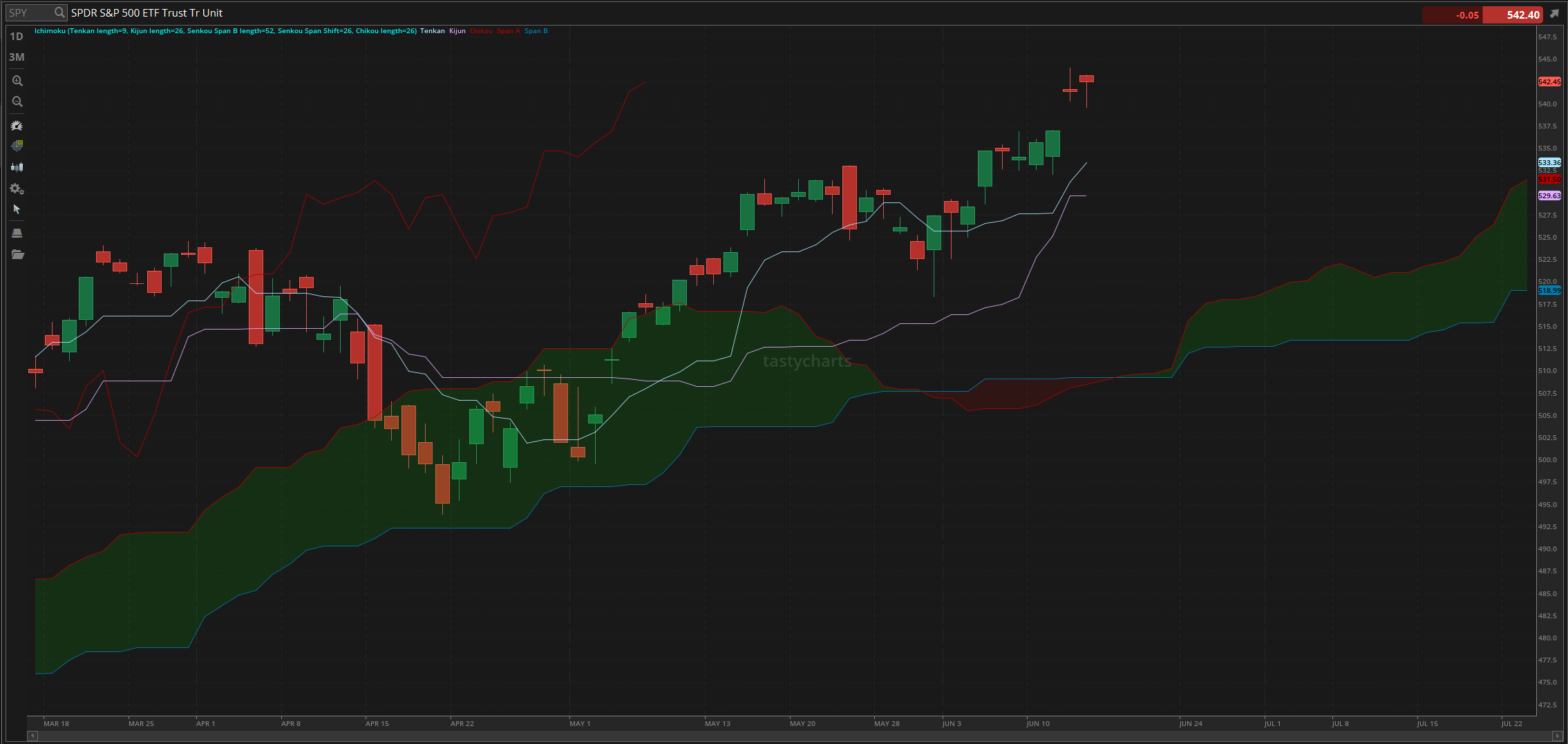

The updated $SPY daily levels are as follows:

Conversion Line Support: $533.36

Baseline Support: $529.63

Psychological Support: $500

Daily Cloud Support: $509.24

$SPY Daily Candles - [06/13/2024]

Thoughts & Comments from Yesterday, 06/13/2024

Yesterday was a relatively rough day for the overall markets. Opportunities were consistent among us, but it was just a matter of remaining consistent in the process. There were many fake-out opportunities where traders generated losses, but at the same time, as opportunities were amongst us, if you were able to remain directional with your positioning, you should have been honestly fine.

We started the day with $SPY looking relatively strong, opening at $543.14. Conditions were strong, but we unfortunately had an extremely difficult time in the process, as $SPY did display consistent weakness during that time. We watched as $SPY continually dropped, going on to make the official high right at close before selling off throughout the entirety of the morning. There was a slight bump during the lunchtime lull, but conditions continued to remain weak as $SPY dropped to go on and make the official low of the trading day under the $540 support, at $539.59.

Conditions at the bottom were not ideal in any way, shape, or form, but we did watch as $SPY was able to recover extremely nicely afterward. Markets quickly pumped from the bottom, where after making the low of the day, within half an hour, $SPY went black for the day and continued to move up accordingly.

$SPY continued to push throughout the entirety of the afternoon, going back to make a relative high around $543 again, before ultimately ending the day with $SPY trading at $542.45, up $1.09 for the day, or 0.2%. Conditions were not ideal in any way, shape, or form, but thankfully, all that was lost was recovered, and traders were presented with an opportunity to capitalize on either direction.

This is just one of those moves that ultimately, resulted in volatility and losses to be generated, without any solid positive movement. I hope that you all were able to capitalize on the opportunities, but unfortunately, its tough because I know that many losses were unfortunately generated yesterday. Life moves on, and so do the markets. Let’s see where the markets go from here and do what we can to make the most of it!

Heatmap - $SPY 06/13/2024

Thoughts & Comments for Today, 06/14/2024

Today is setting up to be an interesting way to end the month. With the strength in the markets at the moment, there is almost no reason at all for us to be overly concerned, and realistically, there is an extremely high likelihood that the markets ultimately break out from here and are provided with an opportunity to trade with both comfort and consistencies. Look to trade some higher volatility stocks today, and watch out for a chance that $SPY will make a new all-time high!!!

If you are looking for opportunities in the markets, look to follow the momentum and do what you can to ride the trend. It is hard to attempt to find a position that you are both comfortable holding and confident in, but at the same time, if you are attempting to catch a bottom, that just adds another level of difficulty to the position that people realistically cannot do consistently. It is significantly easier to wait for a sign of a reversal or a confirmation of a reversal prior to entry, and once you enter a winning position, it is very easy to let your winners continue to win, as the reversal is a sign of confidence that works in your favor.

The biggest thing you have to continually do in the markets, though, and many of you already know this, is to practice safe risk management and limit your downside risk. Traders can easily continue to trade despite tough conditions, but it is just a matter of remaining solvent. If you do not limit your risk or set stops to limit your downside, then everyone is going to be in a place that, realistically, is going to generate losses. But, if you are able to allocate accordingly with both comfort and confidence, while practicing risk management. You have a limited downside risk and a great upside potential. Combine both of these with a skilled trader, and you will find someone who is consistent, profitable, and can honestly enjoy the possibilities during that time.

For my allocations today, I am very interested in seeing where the markets will go, but I will unfortunately be MIA today(I myself, as Allen, writing this report). I will be back soon. Thank you all for understanding. I will be back next week and ready to work another 70-80 hour week for you all! Again, we are still pushing out an extremely fun massive upgrade to the discord, and now it is just a matter of finalizing everything and getting everything to work as I expect.

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY, $NVDA, $AAPL, $MSFT, $TSLA, $RIVN

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $BA

Economic News for 06/14/2024

Import/Export Price Index - 8:30 AM

UMich Inflation Expectations - 10:00 AM

Fed Monetary Policy Report - 11:00 AM

Fed’s Goolsbee Speaks - 2:00 PM

Notable Earnings for 06/14/2024

Pre-Market Earnings:

No Earnings Scheduled

Wrap up

This is going to be an extremely fun time to end the week. Let’s end this week strong and realize some gains when given an opportunity to do so. There might be some fun chances to watch some breakouts in the markets and possibly see a new all-time high in the markets. Now is the point to just seize the opportunities and have an amazing time in the process. I believe that many traders are going to be able to realize a significant amount of gains. So, let’s make a couple of great trades today and enjoy some steak this weekend!

Good luck trading, and let’s finish this week strong!!!