HaiKhuu Daily Report 6/23/2022

Good morning and happy Thursday everyone. Hope you all are doing well, feeling alright and well-rested.

Today is gonna be a long day for the markets. We have Jerome Powell continuing his testimony to congress. Because of this, I am bullish and optimistic for the day. We will get some great opportunities to actively trade as this should cause us to move up, but with such a heavy movement yesterday and during this pre-market session, I would be very cautious about conditions.

Realize some gains when given an opportunity to do so, and continue to prepare cash for what is coming up. Don’t overtrade but actively capitalize on the volatility and momentum in the market.

Apologizes now for what is going to be a relatively shorter report. I got 72 Oz of Red Bull specifically to get through today. I seriously don’t know what the limit on Red Bull consumption is for the day, but I know I am going to absolutely disregard it.

Thoughts & Comments from 6/22/2022

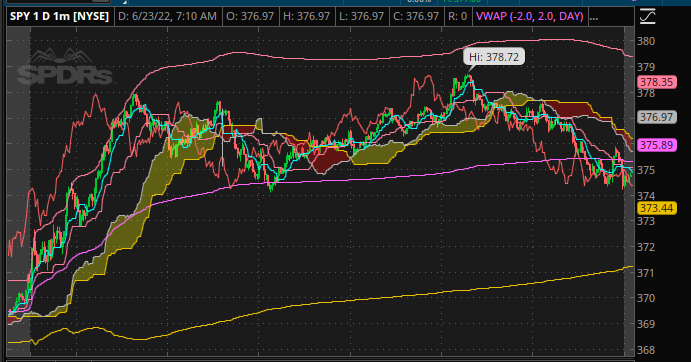

Yesterday was an amazing day for the markets. Things were looking terrible going into open, markets were down heavily but it gave us an amazing opportunity to buy the dip. $SPY opened at $370.68, pumped with Jerome Powell testifying, and made a high of $378.72. Then, we ended up closing the day at $374.39. We went from bloody red, to nicely green, to close the day down -0.18% from the previous close, But the intraday movement from open to close was roughly +1%.

It was difficult actively trading after Jerome Powell finished testifying yesterday, but regardless, the total movement for the day was beautiful with lots of opportunities to actively trade and scalp throughout the day.

$SPY 6/22/2022 ONE MINUTE INTRADAY CHART

Thoughts & Comments for Today 6/23/2022

Today is looking very optimistic going into open unlike yesterday, $SPY is up, currently trading at $377.27 when writing this report. We are beautifully green which is a good sign for the markets but makes me skeptical.

We have JP testifying again today, which should cause more blind bullish traders to the market. Please be extremely careful due to this. In these market conditions, you will see a lot of hype and momentum going into the day, but once that volume starts to die off, and momentum slows down, I am worried we will see an overreaction and a major sell-off. This may happen today after JP is done speaking, or leading into tomorrow. In the case markets move up too quickly, I am interested in getting some $SPY puts (July 15th). I will hold this for a day or so until the markets cool off a little bit after this beautiful movement up.

Realize gains when given an opportunity to do so today, but if you are actively trading, in the case you have some runners. Continue to let them run and let them do their thing. Move your stops up accordingly and assure that you are practicing safe risk management. Don’t do anything stupid.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

HaiKhuu Proprietary Algorithm Report:

The algorithm did alright with market conditions yesterday; the results are as followed:

Market +1.02%

Neural Net +0.76%

Intraday Trading Bot +0.72%

Long Term Portfolio +0.64%

Base Algorithm +0.48%

Market Neutral +0.10%

Great day for the market and trades across the board. Everything in our testing systems was green which continues to provide confidence in our systems. Our market-neutral portfolio is the play that interests me the most moving forward. Even though the portfolio did not move heavily, it is doing as intended and is staying neutral with its performance if/when in the case the markets decide to have a significant downturn.

We will be actively utilizing and testing our Neural Net system in real-time today. Please watch these plays and in the case you are taking any of these alerts, be extremely cautious today. This system has proven success, but with the underlying market conditions and major events that will impact the market, the algorithm unfortunately is not able to account for this.

All entries will be made prior to market open and fully disclosed in the discord.

DISCLAIMER - Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. We cannot guarantee success. Take these at your own risk.

Generated entries for 6/23/2022

My Personal Watchlist :

Note, just because something is on my watchlist, does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $AMZN , $GOOGL , $TSLA , $AAPL , $MSFT , $BABA

Free Equity List:

Safe - $SPY

Risky- $AAPL & $MSFT

Swing Opportunities:

Continue to hold cash and stop out of positions you personally don’t have confidence in. Cash is going to be king over the next couple of weeks.

LONG OPPORTUNITIES:

Long Term Dividend - $GAIN

Major Splits - $GOOGL

Relatively Safer Long - $BA

Economic News for 6/23/2022

Initial jobless claims – 8:30 AM ET

Continuing jobless claims – 8:30 AM ET

Current account deficit - 8:30 AM ET

S&P Global US manufacturing PMI (flash) - 9:45 AM ET

S&P Global US services PMI (flash) - 9:45 AM ET

Fed Chair Jerome Powell testifies on monetary policy at House Financial Services Committee - 10 AM ET

Notable Earnings for 6/23/2022

Pre-Market Earnings:

Accenture (ACN)

Darden Restaurants (DRI)

FactSet Research (FDS)

GMS Inc (GMS)

Methode Electronics (MEI)

Apogee Enterprises (APOG)

Rite Aid Corp (RAD)

View, Inc (VIEW)

After-Market Earnings:

FedEx Corp (FDX)

BlackBerry Limited (BB)

Smith & Wesson Brands (SWBI)

CalAmp (CAMP)

Wrap up

Overall, I am optimistic to see what happens but as always I will advise everyone to tread lightly as conditions are always actively changing. Capitalize on the volatility and momentum. Don’t over trade, Don’t FOMO, and don’t revenge trade today.

Have a great time trading. Good luck trading today everyone, we all will need it for the upcoming weeks.

If you are not a part of our free Discord, click HERE to join

NFT.NYC Yacht Party 6/22/2021