HaiKhuu Daily Report 6/28/2022

Good morning and Happy Tuesday everyone. Hope you all are doing amazing, having a phenomenal morning, and are feeling great.

Get ready for today as we should see some heavily increased volume and volatility compared to yesterday.

Markets are up Pre-Market when I am writing this report (5 am EST) and this is looking like we will have many great opportunities to trade!

Things can obviously change in the next four hours, but things are looking extremely optimistic for today. I would not say that I am extremely bullish. But I am excited to be able to actively trade and manage my allocations today.

Thoughts & Comments from 6/27/2022

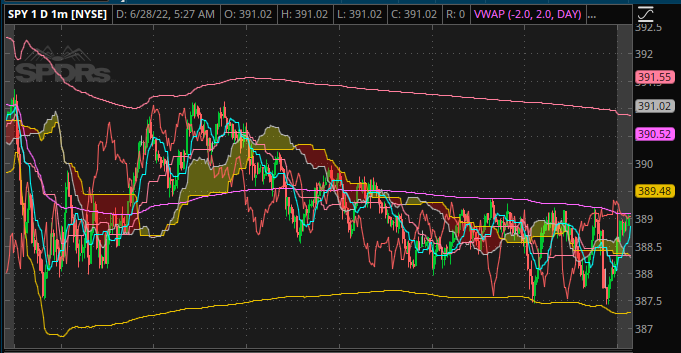

Yesterday was an extremely slow and choppy day for the markets. Everything looked good into open, but it was a terrible day in general for the markets. $SPY closed at 388.59 −$1.49 (0.38%), with an intraday movement of roughly -0.62%. There was a significant amount of chop and it was extremely difficult to actively trade yesterday.

This chop did result in many opportunities to actively trade through the day both to the upside and to the downside, but it meant you had to realize gains extremely fast as well as make sure that your stop losses did not trigger.

It was a tough day to trade, and it was a tough day for anyone with long holdings.

The movement itself was not terrible, just was a drag having to actively watch it happen in real-time.

Hope you were able to capitalize on the volatility and momentum throughout the day and realize some gains.

$SPY 6/27/2022 ONE MINUTE INTRADAY CHART

Thoughts & Comments for Today 6/28/2022

As I said before, today is looking optimistic for the markets. But regardless of this optimism, please just be extremely careful right now. My expectation is that we will see a significant amount of chop and volatility today in the markets, prior to picking a direction. This direction will come from market sentiment wanting to either buy or sell in anticipation of the revised Q1 GDP numbers coming out tomorrow.

Follow the momentum. Don’t do anything stupid and don’t overtrade.

Capitalize on this volatility and momentum. Today will be a great day with many opportunities to trade.

If you do not see an opportunity to trade. Don’t force anything.

If you miss out on an opportunity, don’t FOMO back in or revenge trade. This will cause many traders to lose today.

Please be smart, practice safe risk management, and prepare in anticipation for the GDP numbers coming out tomorrow.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

HaiKhuu Proprietary Algorithm Report:

The algorithms beat the markets beautifully yesterday. The performance of yesterday are as followed:

$SPY Benchmark -0.63%

Our Algorithms

Trading Bot +0.13%

Long Term Portfolio +0.04%

Market Neutral -0.15%

Kokomo -0.17%

Pilot -0.21% (W/ 40% Cash Reserves)

Neural Net -0.35%

Base Algorithm -0.60%

The intraday trading bot and our long-term portfolio both had positive returns yesterday, and it’s great that every single test we ran, outperformed the market.

The one thing that interested me, is watching Kokomo and the Neural Net beat out both the Base Algorithm as well as actively beat out the markets. Those are our live tests to make sure that the systems work properly and for us to build confidence in the system in real-time utilizing real-time live data.

Our market Neutral system worked out perfectly again yesterday being relatively neutral compared to market conditions. This is continuing to build more confidence in the system for us to be able to actively utilize this in the case of a major market downturn for us to be able to actively mitigate most, if not all losses.

Our positions today will be following the same BAOSAC base trading algorithm utilizing roughly 50% of active capital.

All positions will be made and posted prior to market open to assure that everyone has the ability to actively allocate prior to open.

DISCLAIMER - Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. We cannot guarantee success. Take these at your own risk.

Generated entries for 6/28/2022

My Personal Watchlist :

Note, just because something is on my watchlist, does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $BA , $AAPL , $COST , $DIS , $META , $BABA , $MSFT, $HOOD*

Free Equity List:

Safe - $SPY

Risky- $AAPL, $MSFT, $BABA

Swing Opportunities:

Continue to hold cash and stop out of positions you personally don’t have confidence in. Cash is going to be king over the next couple of weeks.

LONG OPPORTUNITIES:

Long Term Dividend - $GAIN

Major Splits - $GOOGL

Relatively Safer Long - $BA

Economic News for 6/28/2022

Richmond Fed President Tom Barkin speaks - 8 AM ET

Trade-in goods (advance) – 8:30 AM ET

S&P Case-Shiller US home price index (year over year) - 9 AM ET

Consumer confidence index - 10 AM ET

San Francisco Fed President Mary Daly speaks - 12:30 PM ET

Notable Earnings for 6/28/2022

Pre-Market Earnings:

TD SYNNEX Corp (SNX)

Roivant Sciences (ROIV)

Enerpac Tool Group (EPAC)

Cognyte Software (CGNT)

After-Market Earnings:

Progress Software (PRGS)

AeroVironment (AVAV)

Beyond Air (XAIR)

Wrap up

Limit the amount of downside exposure you have on the markets. Hedge your positions and actively realize gains when given the opportunity to do so.

Don’t do anything risky and follow the trends that are present.

Be quick with your trades if you’re actively trading and make sure to practice safe risk management.

Good luck trading today everyone and may your stops never be tested on this choppy day.

If you are not a part of our free Discord, click HERE to join