HaiKhuu Daily Report 7/07/2022

Good morning and Happy Thursday everyone! Hope you guys are all doing well, feeling amazing and are hyped for today!

Yesterday was a beautiful day for the markets and today is feeling like it can be a continuation of this bullish trend.

Please be extremely cautious though, as despite a quick but consistent run up, we can come down just as hard, even quicker than we ran up.

Thoughts & Comments from 7/06/2022

Yesterday like I said before was a beautiful day for the markets.

If you were trading in the morning, we saw two beautiful pumps in the market before selling off relatively as we came down and tested $380 on $SPY. The low of day was $379.60. The first half of the day was relatively slow and not too exciting. It was tough trying to actively trade, but there was many great opportunities to go long at the bottom. After making the low of day, markets slowly trended up into FOMC minutes coming out.

When FOMC minutes came out, we ripped, took a dip and then absolutely exploded.

$SPY made a high of $385.87 prior to selling off into close. $SPY closed at $383.25 +$1.29 (0.34%) with an intraday movement of 0.30%. From low to high, movement was roughly +1.5%.

There were many great opportunities to trade yesterday, hopefully you guys were able to catch some of the rips or even just followed the map I drew out in yesterdays report, it pretty much hit timeframes and direction to a T.

Amazing day for trading and hopefully you all were able to realize a significant amount of gains in the process.

$SPY 7/06/2022 ONE MINUTE INTRADAY CHART

Thoughts & Comments for Today 7/07/2022

Today is looking great going into open. Markets are up during the pre-market session. PWWR $SPY $384.26 +$1.01 (+0.26%).

This can be a continuation of the beautiful bullish momentum that we’ve been having over the past couple days. Despite the optimism in the markets though right now, please be extremely careful trading and investing in these market conditions. As markets have moved up relatively sustainably, we all know at this point that regardless of market conditions, what we believe might happen, markets can come down just as hard, exponentially quicker than it went up.

Please be extremely careful in these current market conditions. Practice safe risk management, have cash on hand ready to purchase equities cheap. We are in the midst of a recession, but this means we will have more great opportunities coming up in the near future. Don’t do anything dumb or over-leverage yourself right now.

If you are trading, be quick, be swift, set stops in guaranteed profit and limit your downside potential.

Capitalize on this bullish momentum in the market while you can, I personally am still skeptical of the current market conditions, but we’ve been in this range for so long that the majority of retail traders have built confidence down at these levels which personally is concerning to me. We’ve come down significantly from the highs of earlier this year. People should be more concerned with the current conditions.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

HaiKhuu Proprietary Algorithm Report:

The algorithms did great yesterday in perspective to the current market conditions.

Results are as followed:

Benchmark

$SPY +0.30%

Our Results:

Base Algorithm +0.56%

Neural Net +0.56%

Market Neutral +0.42%

Trading Bot +0.37%

Long Term Portfolio +0.27%

Kokomo +0.20%

With the markets having a rather intense time yesterday, assuming you were able to buy and hold throughout the day, each algorithm was able to do well and actively beat the market (Outside Kokomo which is a neutral portfolio). But thankfully everything was profitable across the board.

We have implemented new upgrades to the Kokomo algorithm to increase it’s success and will be testing these upgrades over the next couple days. These results are looking promising and will be great to actively utilize while there is turbulence or overly bearish sentiment for any given trading day.

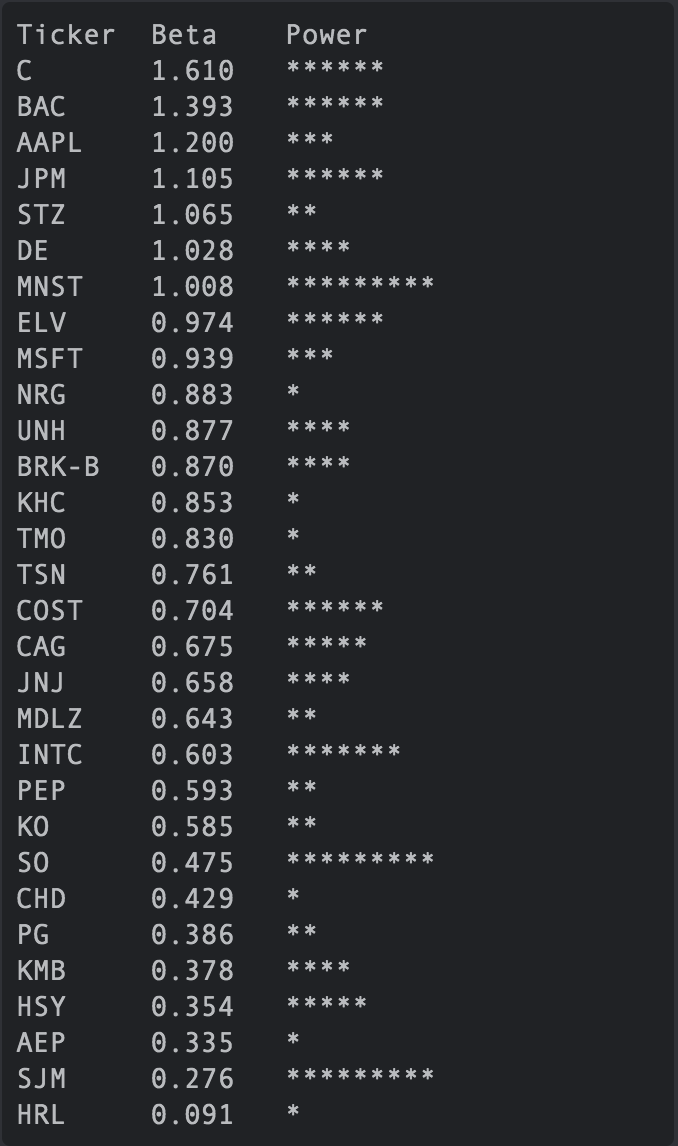

Today, positions will be entered as normal utilizing roughly 75% of our portfolio with our base algorithm. Each position will be posted prior to entry at open and scaled accordingly to our power confidence model.

DISCLAIMER - Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. We cannot guarantee success. Take these at your own risk.

Generated entries for 7/07/2022

My Personal Watchlist :

Note, just because something is on my watchlist, does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $AMZN , $GOOGL , $TSLA , $AAPL , $MSFT , $BABA

Free Equity List:

Safe - $SPY

Risky- $AAPL & $MSFT

Swing Opportunities:

Look to continue selling CSPs and CC’s on equity you already have at a price you are confident selling contracts at. Volatility is not as high as it was over the previous couple days, but there is still increased volatility compared perspectively to just a couple weeks ago. Capitalize on this increased volatility and make some extra money on the cash that you have available.

I would not look into trying to time out any plays right now in the markets while trying to get a swing opportunity, but still continue to DCA on equity and if you are looking to average down on long equities that you don’t have the best average with, make sure to start slowly averaging down as we should see relatively better prices coming up over the next couple weeks.

LONG OPPORTUNITIES:

Long Term Dividend - $GAIN

Major Splits - $GOOGL

Relatively Safer Long - $BA

Economic News for 7/07/2022

Initial jobless claims – 8:30 AM ET

Continuing jobless claims – 8:30 AM ET

Foreign trade balance - 8:30 AM ET

St. Louis Fed President James Bullard speaks - 1 PM ET

Fed Gov. Christopher Waller speaks at NABE conference - 1 PM ET

Notable Earnings for 7/07/2022

Pre-Market Earnings:

Byrna Technologies (BYRN)

Helen of Troy Ltd (HELE)

After-Market Earnings:

Levi Strauss (LEVI)

WD-40 Company (WDFC)

Kura Sushi (KRUS)

Wrap up

Overall, today should be a great day for the markets. Capitalize on the increased volatility and blind bullish momentum right now. We don’t know how long this momentum is going to last, so take advantage of it while you can.

Please be smart, safe and practice safe risk management.

Good luck trading today everyone, we all should be beautifully green by the end of today.

If you are not a part of our free Discord, click HERE to join