HaiKhuu Daily Report 07/08/2024

Good morning, and happy Monday! I hope you all had a phenomenal weekend and that everyone is remaining safe during this hurricane weather! Chicago was hit with bad rain, so I hope you all stayed dry and that you all are ready for what is going to be an extremely interesting time for the markets. This week is the start of another earnings season, and I am starting to smell more weakness coming from the markets. Please continue to tread lightly on these conditions, as markets are going to be extremely volatile, and we are starting to see signs of weakness in the crypto space. Obviously, I want the markets to rip indefinitely, but we all have to be realistic not only with our sentiments but also in justifying our allocations. With the way the markets are trending right now, continue to ride the strength, but be wary of the risks that are involved with allocating here.

Again, market conditions are strong, there is no reason to be overly bearish until we see a confirmation of a reversal, but know that I think we are getting close to the top, and we can easily start to come down. I’ve said this before, and I’ll say this again. Crypto & Semiconductors, in my opinion, will be the leading indicators that we need to watch out for as a correction to the markets. We are starting to see the weakness forming in crypto, as we are down significantly from the top, and $NVDA, is already down 10% from the top. Many are underwater in their positions, and things are only going to get worse moving forward. So please be smart and safe while attempting to allocate into the markets today, and do what we can to maximize our profit potential.

For the major market-impacting news events you should prepare for this week, there will be a lot of volatility on Tuesday and Wednesday as Jerome Powell testifies to Congress. That will make trading extremely inconsistent but extremely profitable for some and unfortunate and deadly for others. So tread lightly when attempting to trade while Jerome is testifying both days.

Let’s have a lot of fun when attempting to trade, and let’s realize some gains while conditions are still extremely strong!

Good luck trading, and prepare to see some volatility!

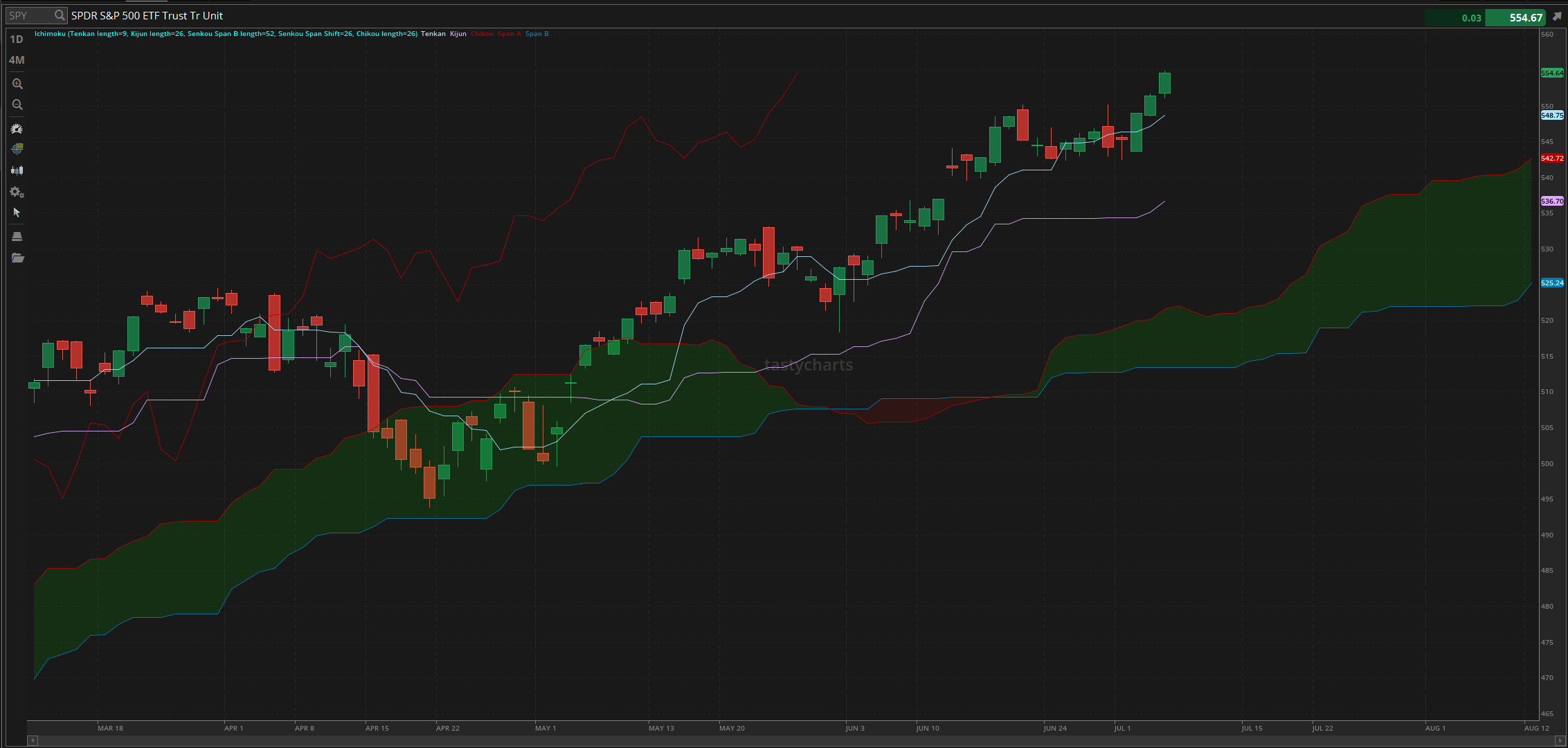

The updated $SPY daily levels are as follows:

Conversion Line Support: $548.75

Baseline Support: $536.70

Psychological Support: $550

Daily Cloud Resistance: $521.57

$SPY Daily Candles - [07/05/2024]

Thoughts & Comments from Last Week

Last week was a rather interesting week for the markets, with a shortened week condensing the volatility across the markets over a couple-day period. Markets were extremely volatile, and opportunities were consistently amongst us. We watched as $SPY and $QQQ made new all-time highs, and traders were provided with opportunity after opportunity to realize a significant amount of gains!

We started last week with $SPY opening at $545.63. We were trending right under the daily conversion line resistance and dropped from the get-go to make the official low of the week trading at $542.52. Conditions lightened up as we ended Monday relatively black, down roughly $0.30 from the previous close, only to rally for the rest of the week.

Tuesday was a beautiful day, breaking above the daily resistance level, looking strong, and making conditions extremely optimistic. We watched as $SPY continued to move up, displaying relative strength leading into Wednesday, which is one of the few half days we have every year. On Wednesday, we watched as $SPY pushed to a new all-time high, and watched as conditions were beautiful for organizations like $TSLA and $AAPL. Everything was beautiful, and there was an explosion in the markets before $SPY closed on the 4th of July.

Picking this back up on Friday, $SPY continued to rally like it was nobody’s business, going on to make new all-time highs in the process, making the all-time high at $555.05 and officially ending the week trading at $554.64. Conditions were beautiful as many traders were provided with some phenomenal opportunities to realize a significant amount of gains. Congratulations to everyone who has been trading with us during this time and realizing a significant amount of gains with us in the process. We’ve been calling out a significant amount of positions that all have been doing phenomenally, so I hope you all had an amazing time with us last week, and let’s see what this week has in store for us!

Heatmap - $SPY 07/05/2024

Thoughts & Comments for Today, 07/08/2024

Today should be a lot of fun for the markets. As I said before, there is going to be a lot of confusion this week with the direction of the markets, but regardless of where the markets ultimately go, we are displaying a significant amount of strength right now, and there is no reason to fight this trend. Just please be wary of the current market conditions and understand that, realistically, the markets can and will display weakness in the near future. It is just a matter of time, and with many major market-moving catalysts, including economic news, Jerome Powell testifying, and earnings season, all we need is one failure across the board before things start to go south.

My advice for the large majority of traders who are reading this report is to start looking to hold more cash, taking profit on positions you are up nicely on, and hedging your positions. It never hurts to take profit on a position, mostly if we are starting to see some weakness develop in the markets. Many traders are up nicely at the moment, there is no reason to lose out on an amazing opportunity because you got greedy and did not want to take profit on a position. Please be smart and rational while attempting to trade in these market conditions. Continue to be smart, be safe, and do what you can to maximize your profit potential. There is no reason at all that you should not be prepared for the upcoming volatility in the markets. This will be an amazing time to load up on equity positions and buy the dip; it’s just a matter of when the market will start to fall and when it the markets will recover afterward.

I still am a firm believer that market conditions are extremely strong right now, and there is no reason why I shouldn’t be, but it is one of those situations that, realistically, will need to come to a stop eventually, and if it does not, people are going to be extremely conflicted on how to allocate, mostly as conditions start to display more weakness in the short term. So please tread lightly and realize gains while there is still strength in the markets.

The best way to capitalize on the strength in the markets, without having much overall exposure, in my opinion, is by actively day trading. By day trading in these market conditions, you are going to be able to capitalize on short-term movements in the markets while there is strength, without having to take on the general risks of allocating into the markets in these conditions. Please tread lightly, do what you can to maximize your profits, and limit your downside risk.

If you are not attempting to take profit on your positions, I would highly advise you look into selling covered calls on your positions, and look into hedging. Hedging a great position will impact your upside potential, but making smart hedges limits your downside risk. Covered calls and purchasing puts against the positions you are holding will be a great opportunity to retain your position, while being able to consistently realize gains.

Let’s just see where the markets take us, mostly as earnings season is amongst us!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY, $TSLA, $NVDA, $MSFT, $AAPL, BTC, ETH, XRP

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $BA

Confirmed Re-entry - $RIVN, $ULTA, $LULU

Economic News for 07/08/2024 (ET):

CB Employment Trends - 10:00 AM

NY Fed 1-Year Inflation Expectations - 11:00 AM

3&6 Month Bill Auctions - 11:30 AM

May Consumer Credit - 3:00 PM

Notable Earnings for 07/08/2024

Pre-Market Earnings:

Greenbrier Companies (GBX)

After-Market Earnings:

No Earnings Scheduled

Wrap up

This is going to be an interesting week for the markets with a significant amount of impactful events to the markets, as well as earnings season starting. Please continue to tread lightly and do what you can to maximize your profit while limiting your downside risk. Many traders are going to do phenomenally, so capitalize on the strength in the markets while it remains, as it seems that the symphony is starting to come to an end. Let’s have some fun, and let’s realize some gains together!

Good luck trading, and let’s some new all-time highs on $SPY this week!