HaiKhuu Daily Report - 08/26/2025

Good morning, and happy Tuesday! Wow, these conditions aren’t looking the best, as there has been a slight continuation of the bearish trend that we saw yesterday. Markets are down slightly at the time of writing this report, and we are seeing continued weakness through alternative forms of investments, such as Solana dropping back below major support levels and making a new relative low in this $190~ range.

If you are attempting to trade today, tread extremely lightly. Markets can reccover and rally extremely hard from here, I am not trying to downplayt the opportunities that are being presented to us, but at the same time, just understand that there is a massive fall risk in the markets where in the case that conditions worsen extremely quickly, we need to find ways for traders to be able to capitalize on these market conditions without taking on a significant amount of risk in the process.

It wouldn’t be the worst idea to sit on your hands instead of forcing trades today, mostly in the case that $SPY continues to reject this $640 support range, and watch as the markets come down.

Again, I am not saying to be overly bearish when attempting to trade today, but just understand that going into open, market conditions are weaker, and many traders will have difficulties being able to capitalize on these conditions. So tread lightly and practice safe risk management!!!

Good luck trading today, and just a reminder, we have $NVDA earnings TOMORROW (AH)!!!

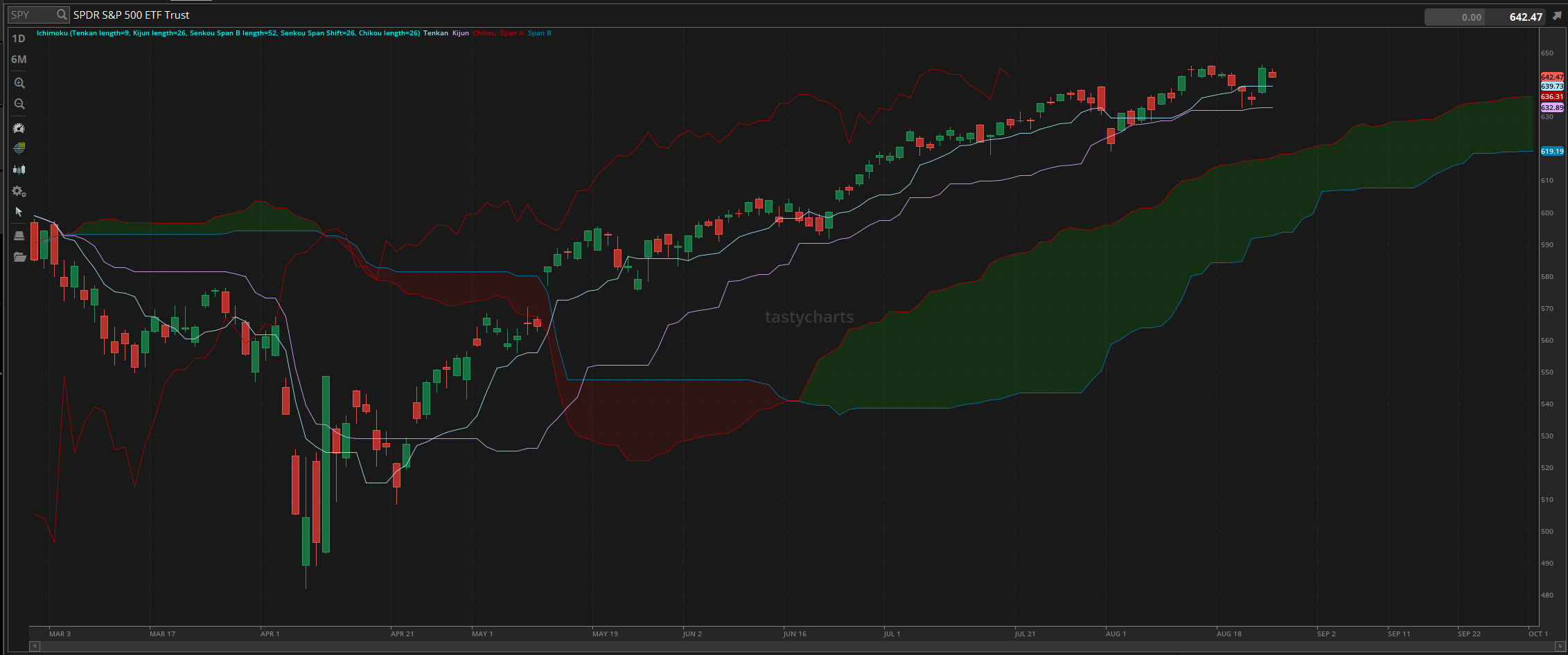

The updated $SPY daily levels are as follows:

Conversion Line Support: $639.73

Baseline Support: $632.89

Psychological Support: $640

Daily Cloud Support: $617.22

Thoughts & Comments from Yesterday 08/25/2026

Yesterday was an absolutely disgusting day for the markets. There were opportunities to trade both directions, but man, oh man, was that a genuinely disgusting time for the markets. Conditions could have been better, momentum could have been presented to us, but regardless, traders had opportunities presented left and right on how they could have realized some sort of gains in the process. So, hopefully you all were able to survive yesterday and had some fun!

So, we started the day with $SPY opening slightly down, trading at $644. Market conditions were relatively neutral and remained around that point for the first hour and a half before the markets started to move up during that lunchtime lull. Market conditions at that time were looking alright as there was a continuation of slight bullish momentum throughout the lunchtime session, which resulted in significantly more bearish sentiment being driven in the afternoon.

During the afternoon, there was only bearish momentum. Yes, bulls could have traded and realized gains at one of four different chop points. Still, in reality, markets just continued to slowly chop and burn, continually making new lows leading into close, where we went on and made the official low of the day in the final minute trading at $632.35, before snapping back up and recovering ever so slightly to end the day officially with $SPY trading at $642.47.

We ended the day with $SPY down $2.84, or down roughly 0.44%. I am not saying that conditions yesterday were ideal in any way, shape, or form. Still, in the same manner, we had many opportunities to trade and capitalize on both sides of the momentum with relative ease. I hope you all were able to come out of yesterday unscathed, because man…. $INTC was a disgusting ride.

But hey, regardless. It is simply life and the markets, so let’s make the most out of today, and pray the markets don’t crash on us!

S&P 500 Heat Map - 08/25/2025

Thoughts & Comments for Today - 08/26/2025

Today should be a relatively fun morning for the markets, but given the current confusion and difficulties, it wouldn't surprise me if we saw a continuation of this bearish momentum. It would not normally impact my sentiment this heavily when it comes to slight bearish momentum, but at this level, we are at a point where I need to realistically voice to you all about the bearish possibilities and the reason why I am not comfortable taking on a significant amount of risk here.

So, before I say any of this, I need to legally say this is not financial advice nor a signal to buy or sell any positions, I am not your financial advisor, nor am I a registered financial advisor. This is me talking about my thoughts in the markets, and how I personally will attempt to trade these conditions.

However, given the current circumstances, I plan to maintain a “cash” position and continue holding long equity exposure, with no intention of adding to it or purchasing cryptocurrencies going forward. Things will shift when market sentiment shifts into a stronger condition, but I personally am in a neutral stance in the markets where I do not intend to make any positions, nor adjust anything, until I have more comfort and confidence.

It is never fun having to be smart and neutral with both my sentiment and positions, but that is, unfortunately, just a part of being a trader. You have to know when to put pressure on a play, but at the same time, know when to back off. This is one of those times that I am not backing down, but I am not putting pressure. I am maintaining my position that we should stay in the strong US equities we purchased months ago and only add to our long-term dividends & DCA plans.

Do not look to take on blind risk at this point; do not look to allocate heavily at this time.

Again, I am not saying that you should be bearish the markets and assume that everyone is about to die, but keep your fists up because you know that regardless of everything, this is going to be a fight.

I hope that the markets break out on $NVDA earnings, and I pray that we do not drop heavily in the process. I also maintain the sentiment that these market conditions are strong as we confidently make new all-time highs. Just tread lightly, do not overtrade, and be smart with where you want to allocate. Many traders have, will, and are going to continue to get burnt in less than favorable market conditions, so remain level headed while there is confusion and fear, and take advantage of the uncertainty.

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $INTC, $TSLA, $NVDA

Speculative: $RIVN, $PTLO, $ARTL, $AIFF

Long Dividend: $JEPI

Long Investment: $INTC

Short: $BRK/B

Crypto: Sol

Economic News for 08/26/2025 (ET):

Durable-Goods Orders - 8:30 AM

Consumer Confidence - 10:00 AM

Notable Earnings for 08/26/2025:

Pre-Market Earnings:

Bank of Novia Scotia (BNS)

KE Holdings (BEKE)

Bank of Montreal (BMO)

Super Hi (HDL)

Daqo New Energy (DQ)

Atour Lifestyle Holdings (ATAT)

After Market Earnings:

Okta (OKTA)

MongoDB (MDB)

Box (BOX)

nCino (NCNO)

PVH (PVH)

Ooma (OOMA)

Tuya (TUYA)

Electromed (ELMD)

Wrap up

Hopefully, the markets are able to recover from this point. Market conditions are looking less than ideal with continued weakness across the board, but traders are genuinely going to see many opportunities to trade and realize gains as long as they remain consistent with doing what they can to maximize their profit potential. Just please, be smart, and practice safe risk management as I am genuinely concerned of a fall risk at the moment. Be smart, be safe, and let’s have a great time today!

Good luck trading, and let’s hope that the markets recover!