HaiKhuu Daily Report 9/23/2022

Good morning and happy Friday everyone! Hope you all are doing well and have exciting plans for this weekend. This has been one hell of a week and it’s not over until the bell rings at 4 pm EST today. Get ready because this is going to be one absolutely insane day. $SPY has made a pre-market low of $368.87 and is currently trading at $369.40 at the time of me writing this report. Things are looking terrible but I hope you all have prepared for this. $SPY’s 52-week low is at $362.17 and is seriously looking like we might test it soon.

Continue to prepare for the worst, but expect that here in a little bit towards the end of the month, things will start to get better. Get excited for what is to come with the markets. Things are looking nasty right now, but understand that we will be able to buy equities at a cheap price while people are actively freaking out. Be careful and practice safe risk management today. Don’t do anything stupid and make sure to protect your bottom line.

Thoughts & Comments from 9/22/2022

Yesterday, when I look at the charts it is the textbook definition of chop. Markets consistently went up and down throughout the day, with multiple points in the day actually going green. It’s a disgusting-looking chart and hopefully, you all were able to come out unscathed.

$SPY opened the day at $376.50 and quickly moved down. The low of the day was around 11:30 am EST when $SPY hit $373.44 prior to moving up ever so slightly. Going into power hour, we saw some extreme bullish momentum with the markets moving up .8% from the bottom, and $SPY making an intraday high of $377.65, but in the final 10 minutes the markets came down significantly, to the point where we lost all of that bullish momentum. $SPY closed the day at $374.22, down $3.17 (0.84%) with an intraday movement of -0.63%.

Some notable things that also happened yesterday,

$COST earnings did terribly, $GOOGL broke under $100 and $AMD broke below $70

$SPY ONE MINUTE INTRADAY CHART 9/22

Thoughts & Comments for Today 9/23/2022

Today is not looking that optimistic of a day. There again, is an opportunity for a possible bounce for people to actively realize a significant amount of gains in the process, but at the moment with the markets coming down to where it is right now, please continue to protect your bottom line and be careful. The majority of traders are going to have a tough time trading today, with a significant amount of people having unrealized losses this week, but please do not worry too much. I know it does not sound optimistic of me to say stuff like this, but this is just the beginning of what is going to be a beautiful recovery.

Prepare yourself to start loading up on equities and investing starting next week. When the markets dip like this, and people are starting to panic and sell off their equities, is the time for you to have the confidence to start loading up on those fundamentally solid organizations you personally are comfortable purchasing.

Look to start selling cash secured puts to collect premium today and have cash ready to start purchasing organizations you’d like to hold.

Scale into your positions. Don’t go too heavy too quickly, just sit back and continually add to your favorite organizations over the next week slowly but surely.

If you don’t know where to allocate with confidence, here are two indices to look into:

Safe play: $SPY

Riskier play: $QQQ

Have cash on hand and start investing while there are relatively great opportunities to purchase this dip. You might not be able to time out the bottom perfectly, but by scaling into your positions you will be able to get the best average possible for you.

Practice safe risk management and assure yourself that you are only purchasing solid organizations. Stay away from highly speculative plays.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

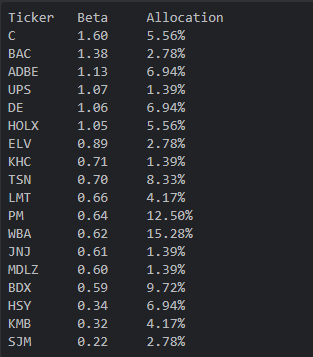

HaiKhuu Proprietary Algorithm Report:

Yesterday was an interesting day for our systems. Everything thankfully beat the market with all of our neutral strategies actually generating profits. The pilot was slightly profitable which was a great sign for our systems. We are expecting bullish momentum in the upcoming week, so once the markets ultimately decide on changing direction, we will be ready and prepared to make an amazing about of realized gains in the process. For now though, we need to remain relatively beta-neutral in this market condition to assure we are actively beating the markets.

$SPY in the past month is down 9.25%, the pilot is up 0.4%. This return may not seem significant, but the results speak for themselves. Any profit in these current market conditions is an absolute WIN.

If you want to read more in-depth about the performance of all of our algorithms, please check out Asher’s report HERE.

The results of yesterday are as followed:

Baseline:

$SPY: -0.63%

Our Results:

Experimental Sector Neutral: +0.3%

Market Neutral: +0.29%

Sector Neutral: +0.24%

Experimental Market Neutral: +0.09%

Long Term Portfolio: -0.09%

Base Algorithm: -0.43%

Today we will be utilizing our automated trading system to enter into our beta-hedged long term portfolio to assure that we minimize risks. Please be extremely careful when attempting to trade any of the bullish algorithm recommendations today. They are all valid from a technical analysis standpoint but you all know the markets could care less about technical analysis at this point.

If you are taking any of these plays, please practice safe risk management and assure that you are setting stop losses and moving them up accordingly when there is an opportunity to do so.

All positions will be disclosed prior to markets opening.

DISCLAIMER - Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. We cannot guarantee success. Take these at your own risk.

Generated entries for 9/23/2022

My Personal Watchlist :

Note, just because something is on my watchlist, does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $AMD , $NVDA , $BABA, $TSLA , $MSFT , $AAPL, $GAIN

Free Equity List:

Safe - $SPY

Swing Opportunities:

Start looking to allocate into long positions while the markets are coming down. Do not go heavy and continue to have cash on hand to average down accordingly

By the time we hit the bottom, you should be 100% allocated and utilizing margin to maximize the amount of exposure you have

Be smart and safe with your positions and only buy fundamentally solid organizations you are confident in holding.

LONG OPPORTUNITIES:

Long Term Dividend - $GAIN

Risky Speculative Play - $BABA

Economic News for 9/23/2022

S&P U.S. manufacturing PMI (flash) - 9:45 AM ET

S&P U.S. services PMI (flash) - 9:45 AM ET

Notable Earnings for 9/23/2022

Pre-Market Earnings:

Huiz Holding (HUIZ)

Wrap up

Overall, please just be careful while actively trading today. Practice safe risk management and look to slowly pick up allocations in these current market conditions. Equities are cheap at the moment so load up slowly and be safe with your positions.

Good luck trading today everyone and have a phenomenal weekend!

If you are not a part of our free Discord, click HERE to join