HaiKhuu Daily Report - 10/04/2024

Good morning, and happy Friday! Markets have been insane, but we’ve got the news that the strike has reached a tentative agreement and will be suspended until January. We are kicking the can down the road, but for now, conditions are looking strong, and traders will be optimistic as a result. This could honestly be the catalyst for the reversal that I talked about yesterday. I am very excited to see where the markets go from here and attempt to capitalize on these conditions.

It is obviously not guaranteed that the markets will go up today, but as this news circulates, traders will be more optimistic, and as a result, traders will be more willing to allocate actively, which will result in some beautiful bullish momentum. Please look to follow the trend today, and do NOT fight the market momentum.

I am finally back in Chicago, and will be excited to trade with everyone, so let’s realize some gains today!

Good luck trading today, and let’s realize a significant amount of gains!

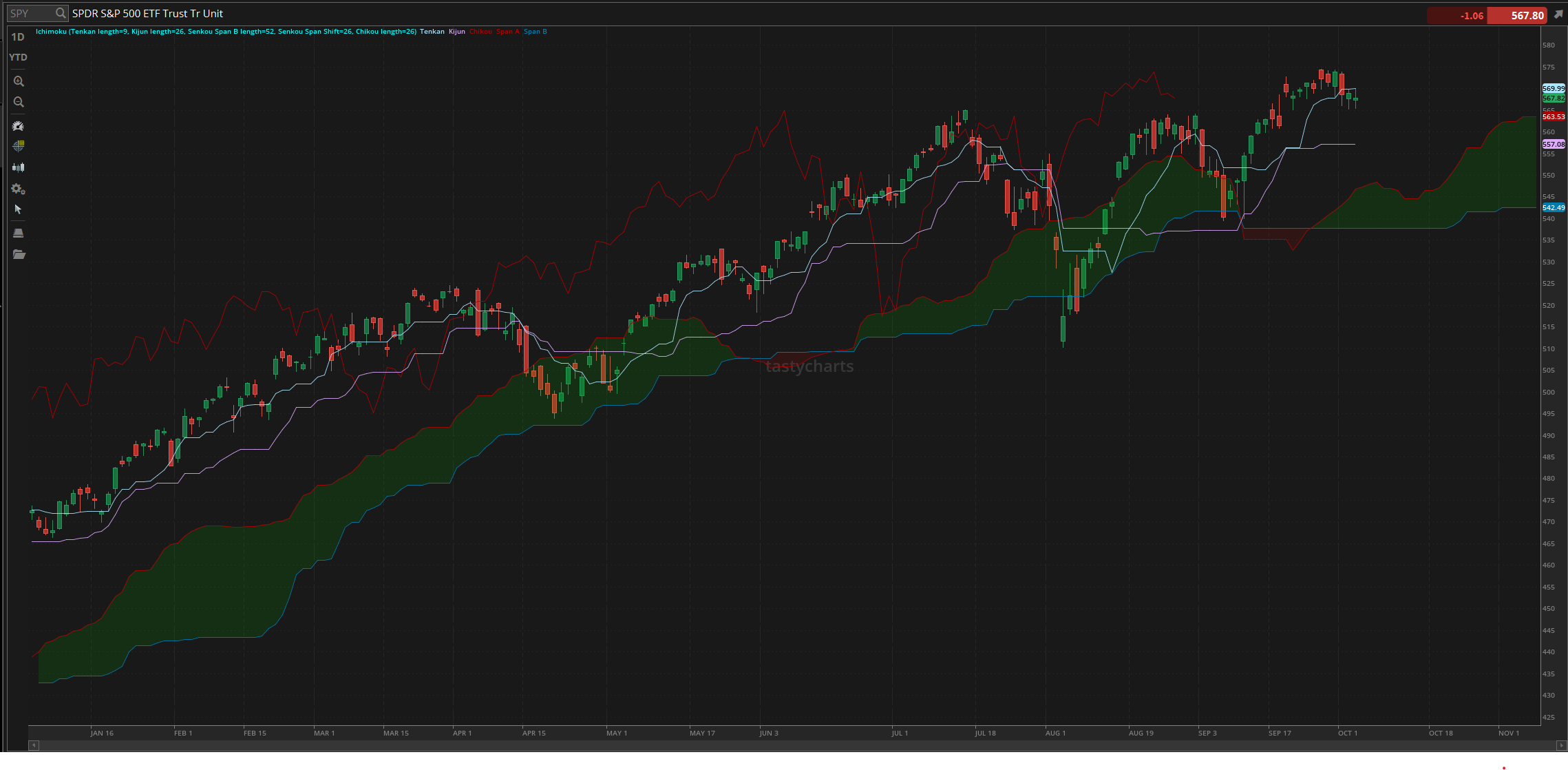

The updated $SPY daily levels are as follows:

Conversion Line Resistance: $569.99

Baseline Support: $557.08

Psychological Support: $570

Daily Cloud Resistance: $546.74

Thoughts & Comments from Yesterday - 10/03/2024

Yesterday was a rather disgusting day for the overall markets. Conditions remained extremely choppy, and extremely uneventful for the majority of the time. People had opportunities to trade, but conditions were volatile, and extremely inconsistent. It was a great day to take off but a rough day to attempt to trade.

We started the day with $SPY trading at $567.47. Conditions looked slightly weak as $SPY opened below the previous close and kind of just lingered around that area until we watched the markets pop off approximately 40 minutes after markets opened, to watch as $SPY rejected $570 again, making the official high of the day at $569.80.

After making the high of the day, $SPY decided to take everyone on a rollercoaster, dropping extremely quickly, recovering, and chopping all around before ultimately moving up leading into the lunchtime season. Only to sell off even quicker, going on to make the official low of the day, trading at $565.49.

Thankfully, after making the official low of the day, markets moved back up instead of continually dropping. We ultimately ended the day with $SPY trading at $567.82, recovering roughly $2 from the bottom. The day ended down $1.04, or down roughly 0.2%.

Honestly, it was a terrible day, so congratulations to anyone who was able to capitalize on the large movements we saw early in the day, and congratulations to anyone who was able to generate any sort of realized gains when the markets were relatively neutral and choppy in the afternoon. Hopefully, we will see market conditions improve, but now it is out of our hands, so let’s see what today has in store for us and make the most of it!

S&P 500 Heat Map - 10/03/2024

Thoughts & Comments for Today - 10/04/2024

Today is going to be an extremely fun day for the overall markets. As I stated before, the dock strike is “over” at least for now, and they’ve prolonged their negotiations at least until 2025. This is great for the entire supply chain and general logistics. As I said, unlike something like the Boeing strike, it would end quickly because it is one thing if a company has an issue in the short term, but it is another if you are actively impacting global trade. So, I am happy that this is over, but we still have to continue to tread lightly as we do have all of the employment data coming out during the pre-market session. What I will say is active conditions for employment, at least to me, are looking rough at the moment. Bottom of the totem pole services are still in extremely high demand, but the majority of organizations at the moment are not actively hiring at the same rate that they were in 2022. People are not being laid off from their jobs now, but they are not actively hiring and building out teams. So, hopefully, this economic data will not negatively impact the markets, but I will say that I am not confident or certain about which way economic data will take us.

But opportunities will be presented to us, and conditions will be absolutely amazing. I am genuinely excited to see where the markets take us, and now it is just a matter of capitalizing on the momentum. Please do not fight these market trends, as I think we are about to see an extremely directional day for the overall markets, and I am extremely excited about these conditions. So tread lightly and be smart, but do what you can to maximize your profit potential.

One play that is going to be extremely risky for us to attempt to capitalize on today is shipping and logistics companies. The initial move will already happen before open, and we will not be able to catch that move, but assuming that market conditions continue to remain solvent during this time.

Again, please just make sure to practice safe risk management today and do not fight the trend. I think that we are about to have an amazing day for the markets, and I do not want you to miss out. I especially do not want you to realize losses due to this. So be smart, be safe, and make the most out of today!

For my allocations, I will say that because I am back in Chicago, I am excited to be able to allocate to the markets for the first time in a couple of days. I will try and keep myself grounded today and only attempt to make smart decisions, but just know there is an extremely high likelihood that at market open, I will be looking to buy calls and have some fun. It all just comes back to how economic data impacts the markets during the pre-market session.

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY, $RIVN, $INTC, $BA, $AIFF, $TSLA, $NVDA, $MSFT

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $INTC / $RIVN / $BA

Economic News for 10/04/2024 (ET):

Employment Report - 8:30 AM

Unemployment Rate - 8:30 AM

Hourly Wages - 8:30 AM

Notable Earnings for 10/04/2024

Pre-Market Earnings:

None Scheduled

Wrap up

Hopefully, market conditions will remain strong. I am excited to see where the markets take us and even more excited to capitalize on them. We will see what the markets ultimately do from here and make the most of these opportunities. Please tread lightly and practice risk management, but take on a little more exposure if economic data is strong and causes the markets to take off. Follow the market momentum, and do what you can to maximize your profit potential at this time. This should be a fun day, so make the most of it and realize some gains!

Good luck trading, and let’s end this week strong!!!