HaiKhuu Daily Report 10/11/2023

Good morning, and happy Wednesday! Markets are looking beautiful, and I hope you all have been realizing a significant amount of gains as a result of this! There is strength in the markets as we’ve seen five green days on $SPY. The dragonfly doji has worked out beautifully, and there has been great momentum and potential in the markets to realize a significant amount of gains.

I would continue to recommend being cautious in these market conditions as there is a possibility that we reject this daily baseline resistance, but with the strength and momentum we’ve seen from the bottom, we might be getting to the point of decreasing our fears and attempting to capitalize on the opportunities that are presented to us.

Over the previous couple of weeks, I’ve been talking about allocating in value plays into organizations like $DIS and $DG, hopefully you have followed my sentiment and have allocated into strong equities you are comfortable and confident in at the relative bottom, as there has been continued strength that realistically can continue over the next couple of days.

Do not get greedy in these market conditions, but do what you can to maximize your profit potential while there is still fear and uncertainty in the markets.

***ADDITION TO THE REPORT***

WATCH OUT FOR $BIRK, IT IS IPO’ING TODAY. THIS IS BIRKENSTOCK THE JESUS SANDALS AND WILL BE AN AMAZING IPO TO PLAY THE HYPE.

I DIDN’T REALIZE THIS UNTIL AFTER THIS REPORT WAS PUBLISHED, SO BE ON THE WATCHOUT FOR THIS TODAY.

Good luck trading today, and let’s make some BANK!

The updated $SPY daily levels are as follows:

Conversion Line Support: $428.70

Base Line Support/Resistance: $435.63

Strong Psychological Resistance: $440

Weak Psychological Support: $430

Strong Psychological Support: $420

Daily Cloud Resistance: $444.96

$SPY Daily Candles - Bounce & Strength [10/10/2023]

Thoughts & Comments from Yesterday, 10/10/2023

Yesterday was an exciting time for the markets, with a significant amount of strength followed up with relative weakness. It provided us with an amazing opportunity to ride the market momentum and an unfortunate and choppy time for anyone who missed out.

We started the day with $SPY trading relatively neutral, trading at $432.99, up slightly from the previous close of $432.29. There was strength in the markets from open as we took a slight dip to make the official low of the day trading at $432.53, and then displayed a significant amount of strength as we had solid momentum throughout the entire morning.

$SPY quickly took off after making the low of the day and continued to run as we continually made new highs of the day. Market momentum started to slow down around the lunchtime lull as $SPY was testing and holding $435 and displayed a significant amount of strength as we were able to break through that resistance, sustain the movement, and continue to move into the early afternoon.

As people started to come back from lunch, we watched as $SPY continued to move up with relative confidence, going on to make the official high of the day, trading at $437.21. Market momentum at the top was relatively weaker though unfortunately, and as a result, we watched as the markets started to come down and come down quickly afterward. Part was due to the fact that Joe Biden was about to speak about the war, but a large portion of the selling was just quick momentum loss in the markets. We came back down to test the $435 support/resistance level and did not move for the entire half of the afternoon.

Markets were extremely range-bound at the time and stayed within a $1 range for pretty much the entire afternoon session. It was extremely choppy and did not have much momentum or opportunity to trade, but that is fine as there was an extremely significant movement in the early morning.

It’s unfortunate that momentum did slow down for the final hours, and hopefully, no one reading this report had a difficult time trading at that time. We ended the day with $SPY trading at $434.54, up $2.25 for the day, or up approximately 0.52%, with an intraday bullish movement of 0.35%.

It was a great day for the markets with a significant amount of potential early in the morning, and it is just a matter of if this bullish sentiment and the markets are able to sustain themselves at this level. $SPY is looking strong at the moment, but we are at the daily baseline resistance. Let’s see what the markets have in store for us today and see if we reject or break out here at this level!

Heatmap - $SPY 10/11/2023

Thoughts & Comments for Today, 10/11/2023

Today is going to be a great time for the markets that will provide us with opportunities to realize a significant amount of gains. It’s just a matter of following the momentum of the markets. We are at the daily baseline resistance on $SPY. We are either going to break out and see a significant amount of bullish momentum and strength, or we are going to watch as the markets reject this level and come down.

It would not surprise me to see a significant amount of chop early in the morning until we ultimately find a direction we want to take, but with the way the markets sit, just continue to keep the daily baseline resistance level in mind. If $SPY is able to hold above $435.63, that is going to be a bullish sign of the markets and provide us with opportunity, but if we are below that level, mostly before open, remain optimistic, but tread lightly.

If you are attempting to trade, I would advise you to not fight the market momentum at all in any way, shape, or form. Simply follow the momentum in the markets and attempt to capitalize on the opportunities that are available to us. Do not fight the trends, and do not get greedy. I feel that today is going to show us extremely clear signs of momentum once we ultimately find the direction we want to move, and as a result, will be extremely predictable. Just be cautious about the chop that I am expecting to see at the baseline. Once we find that direction, follow the momentum and have some fun. Don’t get greedy; exit losing positions and secure your wins when you are satisfied or the markets are showing signs of reversal.

Do not be overly bullish or bearish in these market conditions, but take advantage of the opportunities that are available to us. There is amazing potential in the markets right here, and the safest allocations are going to continue to be in deep-value organizations. Find an organization that is highly undervalued but is fundamentally solid, hold that position, and be confident holding it as there is confusion in the marketplace.

Personally, I do not anticipate actively trading too much today as I am in a solid amount of value organizations that I want to continually hold. If I see opportunities to trade, I will look to take advantage of the market momentum and realize gains in the process, but I am more interested in taking advantage of the value in the markets and continually adding exposure there. It will be nice to capitalize on short-term momentum, but I want to continually scale into organizations I have comfort and confidence in at the moment. $DG has been an amazing watch, and I anticipate watching and adding more to my position today via either equity or leaps, assuming I get an opportunity to enter.

Just make sure to practice safe risk management at this time and look to continually capitalize on the opportunities that are available. Do not get greedy, and limit your downside risk. Assuming you are able to remain consistent at this time, you will do phenomenally until the end of the year.

Consistency is key.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

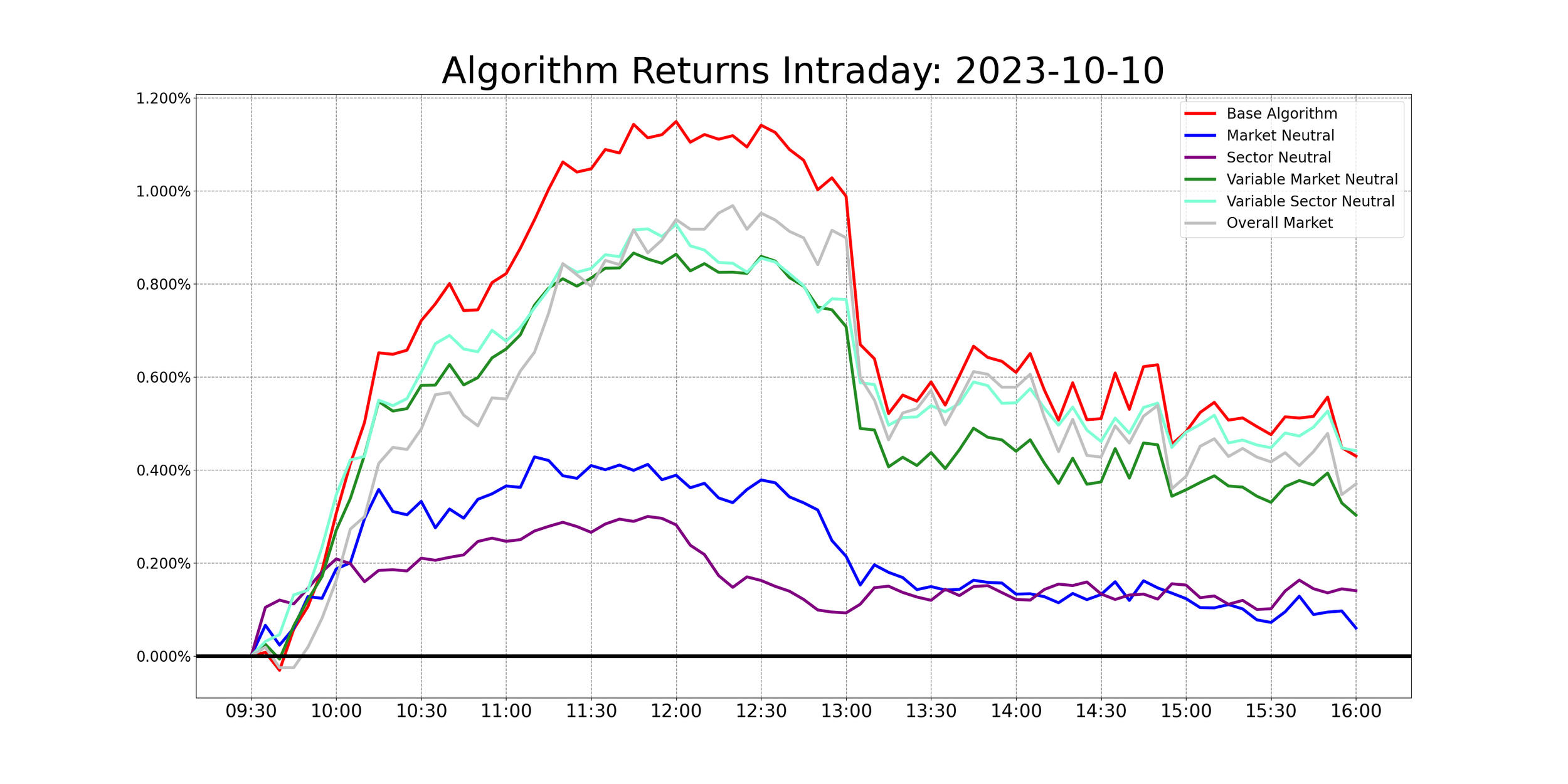

HaiKhuu Proprietary Algorithm Report:

Yesterday was an amazing launch of our live beta test of the newest algorithm we have been working on. This system outperformed both the fundamental analysis of the new long-term portfolio that we have built as well as outperformed $SPY. Both the portfolio and the algorithm outperformed, which is a great sign for our systems, but one day’s performance is not indicative of continued success, so we will continue to monitor this over time to ensure the continued success of this system.

We will be consistently adjusting the algorithm and working on improvements in the meantime, but are excited to see that launch day was a success.

To get an in-depth analysis of our algorithms' performance, check out Asher’s Report!

The results of yesterday are as follows:

Baseline:

$SPY: +0.35%

Our Results:

Variable Sector Neutral: +0.44%

Base Algorithm: +0.43%

Long Term Portfolio: +0.39%

Variable Market Neutral: +0.31%

Sector Neutral: +0.14%

Market Neutral: +0.08%

This is all part of our active live beta test of our newest algorithm. If you are attempting to allocate into any of these positions, we highly recommend you do your own due diligence prior to entry. We have confidence in this system but are not guaranteeing its success.

This is a live beta test and is not an officially published algorithm yet. We are still working on upgrading this system in the meantime and recommend you take these positions with a grain of salt. Practice safe risk management if you are attempting to find an allocation with this system.

Look for a position that has a beta you are comfortable taking on, and understand that larger allocations signify that the algorithm has more confidence in the allocation. For higher-risk individuals, look to trade $ABNB today as there is roughly an 8% allocation of the portfolio with a 1.22 beta, and if you are looking for a safer overall position, look to allocate into either $LLY or $SO today as they both are weighted heavily in the portfolio while having low betas.

DISCLAIMER - This is not financial advice. Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. This is not a signal to buy or sell any equities, and we do not guarantee success. Take these at your own risk.

Algorithmic Alerts for 10/11/2023

My Personal Watchlist :

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $BIRK*, $DIS , $DG , $NVDA , $TSLA , $MSFT , $BA , $RTX , $NOC

Position Opportunities:

Follow the market momentum

Limit your downside risk

Allocate into strong value positions you have confidence in

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $DIS / $DG

Economic News for 10/11/2023

Producer Price Index - 8:30 AM ET

September FOMC Fed Minutes - 2:00 PM ET

Notable Earnings for 10/11/2023

Pre-Market Earnings:

None Scheduled

After-Market Earnings:

None Scheduled

Wrap up

Overall, this should be an interesting time for the markets. Watch out for the daily baseline resistance and look to capitalize on any and all of the opportunities that are available to us. Practice safe risk management and look to realize gains throughout the day. This should be a fun time for us that provides us with many opportunities to trade. Make some smart decisions, and let’s have a great time.

Good luck trading, and let’s make some BANK!