HaiKhuu Daily Report - 10/14/2025

Good morning, and happy Tuesday!!!

Wow, I do not even know how to start this report. Markets are down and these conditions are crazy volatile. If you are attempting to trade today, please tread lightly.

I’ve talked about these market conditions before where traders have either an amazing time or an absolutely terrible time, and that is going to remain the case.

Watch out for chop at $660, as that right now is the current $SPY magnet.

This is going to be a little bit shorter of a report, but don’t worry, I will be traveling back in my office and trading with you all before the lunchtime lull!

Good luck trading today, and let’s see where $SPY takes us!

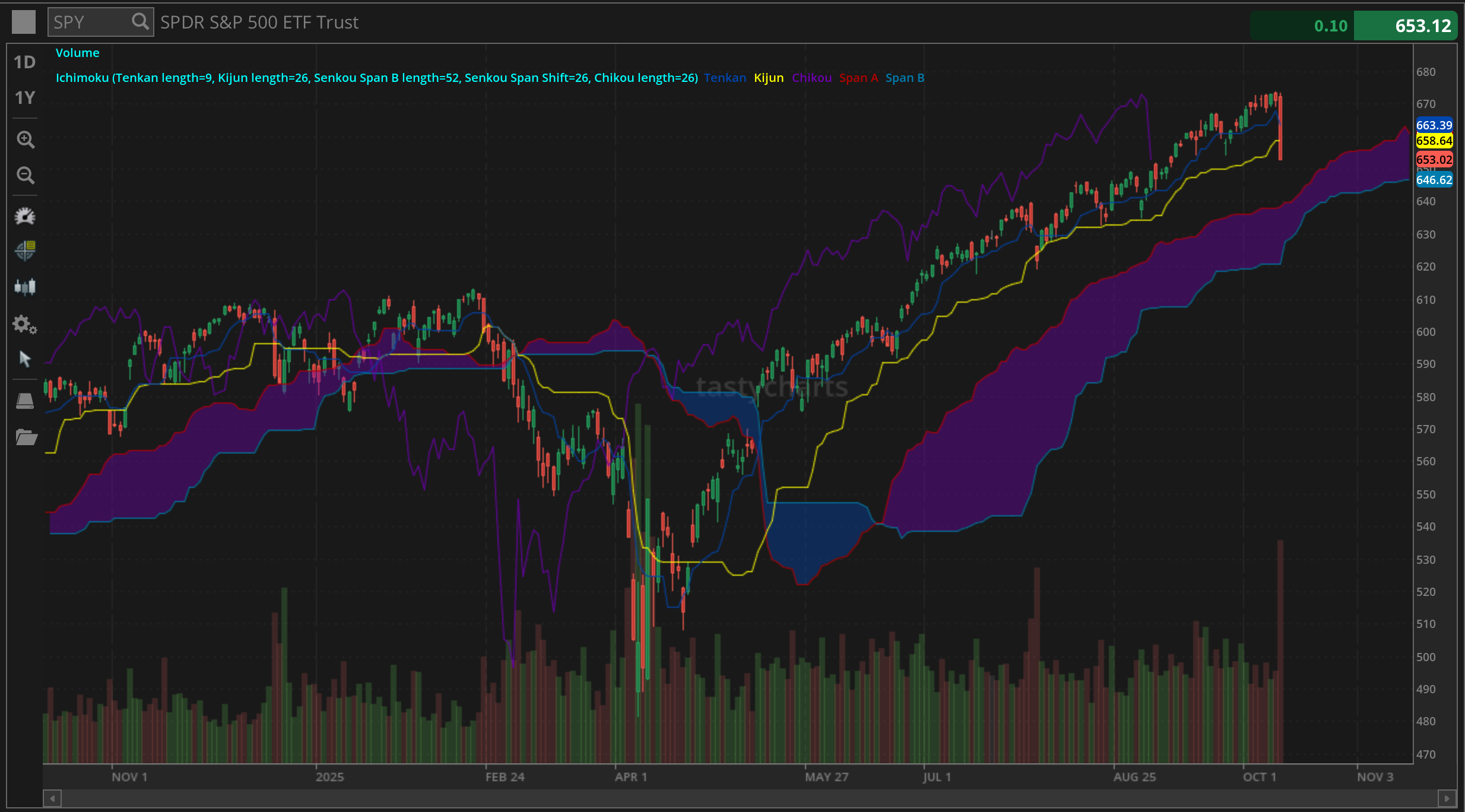

The updated $SPY daily levels are as follows:

Conversion Line Support: $663.39

Baseline Support: $660.59

Psychological Support: $660

Daily Cloud Support: $639.66

Thoughts & Comments from Yesterday - 10/13/2025

Yesterday looked like an absolutely INSANE day for the overall markets. There was continued strength, opportunity, and momentum. This honestly looking in hindsight has to be one of the easiest days for anyone that followed any of our human psychology trading strategies.

So, we started the day with $SPY trading at $660.68. Conditions were looking great at open as $SPY was up roughly $10 and we watched as$SPY quickly rallied after open, remaining strong for the first hour or so before $SPY started to come down and sell off leading into the lunchtime lull.

During that time, $SPY went and sold off, going on to make the official low of the day at $659.78 before bouncing back up and quickly displaying strength again.

That would have been an absolutely amazing buy the dip opportunity, but such is simply life. Markets thankfully rallied from the “bottom” and went on to make the official high of the day at $664.61, before coming down slightly to officially end the day at $663.04, up $10 for the day, or up 1.5%.

The conditions of yesterday were absolutely insane, hopefully you all were able to enjoy the crazy volatility of yesterday, and were able to realize a significant amount of gains as you are preparing for today! So let’s see where the markets take us from here, and have an amazing time!

S&P 500 Heat Map - 10/13/2025

Thoughts & Comments for Today - 10/14/2025

Today is gonna be a hectic day for the markets, mostly with the way that everything is trending. We are seeing stupid large volatile movements in the markets, which is also followed by uncertainty and confusion being driven by the majority of traders.

Everyone WANTS to be bullish and optimistic, people are blindly allocating, but they are not 100% convinced that the short term confusion and volatility is over just yet. So, if you are attempting to trade today, mostly with the fact that the markets are down, my recommendation to you is to continue to follow the trends, and wait for a reversal sign to enter long on an intraday basis that you are confident in.

I am amusing by the time markets open and there is news that conditions are going to shift, so I do not know what is going to happen by open. But, one of two things will happen realistically from here

1) Markets rip from the get go, this is ideal, this is sexy, this is a great time. Markets only continue to move up, people will miss out on an entry, people will FOMO and only those who FOMO will lose ultimately when the markets reverse and come down

2) Markets continue to drop from open, we see some sort of consolidation at the bottom, and we get a tough, but beautiful buy the dip opportunity. In my perfect world, this is what we see. We get a little bit of selling on the front end, consolidation and chop at the bottom, and a perfect beautiful reversal after stopping out a bunch of kids early in the morning.

I want scenario 2 to happen. That is going to be the most profitable scenario for the markets, coming at the expense of newer traders. So, just please, be careful, be cautious and tread extremely lightly, mostly around open.

Do not fight trends, practice safe risk management and just enjoy the comfort knowing there is discomfort at this level.

As I said before $660 is going to be a magnet zone. Please expect large volatile movements around that price level that is specifically made to chop traders out and print money for the market makers and option sellers. So please be careful attempting to trade zeros.

I will say, this is a terrible and great time to trade 0-dte contracts. Anyone who buys and holds 0’s right now are most likely going to lose money. Statistically that is the reality of if you hold. BUT, due to these extremely large volatile movements in the markets, if you are an efficient and effective trader, know that 0-dte’s are going to be amazing and print for those successfully SCALPING quick movements.

If you are going to trade zero today, stick to scalping and taking profits quickly. A lot of people are going to get hurt if we remain neutral overall, despite the fact that they are going to be paying too much premium in the process.

So rule of thumb for the day: Practice safe risk management, do not fight trends, do not get caught bag holding 0-dte’s, and just have a fun time trading today!

Side note from Allen:

Apologies again for not being around to give this report; I’ll be back in the office by the lunch time lull. Just want to say thank you again to Liquid for covering this report for me while i’m out!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $INTC, $TSLA, $NVDA, $ORCL , $TSM

Speculative: $PTLO, $RIVN, $ADT, $ALLE, $KHC, $BUD

Long Dividend: $JEPI

Long Investment: $PTLO, $BUD

Short: $BRK/B

Crypto: SOL

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $INTC

Economic News for 10/14/2025 (ET):

NFIB Optimism Index - 6:00 AM

Fed Governor Michelle Bowman speaks - 8:45 AM

Fed Governor Christopher Waller speaks - 3:25 PM

Boston Fed President Susan Collins speaks - 3:30 PM

Notable Earnings for 10/14/2025:

Pre-Market Earnings:

BlackRock (BLK)

JPMorgan Chase & Co (JPM)

Goldman Sachs Group (GS)

Citigroup (C)

Domino's Pizza (DPZ)

Johnson & Johnson (JNJ)

Wells Fargo (WFC)

Ericsson (ERIC)

After Market Earnings:

Equity Bancshares (EQBK)

Hancock Whitney Corporation (HWC)

Wrap up

This should be a fun day for the markets with opportunities to consistently scalp throughout the day. Please be extremely careful and cautious as these market conditions are not for the light hearted, but it will genuinely be a great time as opportunities will be left and right.

Good luck trading, and let’s make the most outta today!!!