HaiKhuu Daily Report 10/27/2023

Good morning, and happy Friday! This is going to be an exciting day for the markets, so I hope you all are doing well and are prepared for today!

With the way that the markets sit, $SPY is up at the time of writing this report. There is slight confidence going into open, but we are still looking exceptionally weak overall. We are still below the $420 support level and watched as $NVDA tested and broke below $400 for a brief moment and stopped a lot of traders out.

We are testing six-month lows on $SPY, and if we are not able to sustain the momentum in the short term, expect to see a significant amount of selling. This is going to be an extremely interesting time for the markets that will provide us with many opportunities to trade, but it is just a matter of remaining solvent at this time and capitalizing on the opportunities that are presented to us.

This will become an amazing buying opportunity, but it is just a matter of when will we bounce. Will it happen today? Will we drop for another 10% on $SPY before bouncing into the end of the year? Are we going to remain stagnant at this level and bounce only when people lose faith? Who knows what will happen.

Remain solvent at this time and prepare to capitalize on what is going to be an amazing buying opportunity in the markets.

Good luck trading today, and let’s end this week with strength!

The updated $SPY daily levels are as follows:

Conversion Line Resistance: $424.87*

Baseline Resistance: $424.87*

Weak Psychological Resistance: $430

Strong Psychological Support: $420

Daily Cloud Resistance: $441.80

Note - Baseline and conversion line are at the same point

$SPY Daily Candles - Testing 6-Month Lows [10/26/2023]

Thoughts & Comments from Yesterday, 10/26/2023

Yesterday was a bloody day for the overall markets that resulted in a significant amount of difficulty to navigate consistently but provided us with many beautiful opportunities to realize some gains in the process.

$SPY started the day trading at $416.40, down slightly from the previous close of $417.55, but provided us with relative confidence from open, as $SPY quickly popped up to make the official high of the day trading at $417.32 before selling off and being extremely difficult for the rest of the day. $SPY sold off in the morning, making a relative low trading around $415, before bouncing back up during the beginning of the lunchtime lull, and any bullish momentum was quickly snapped back. $SPY popped to trading around $416.50 around the peak leading into the lull and was quickly sold off afterward, breaking new lows of the day and continually selling in the process.

After volume came back into the markets around noon EST, there was an extremely sharp drop in the markets as $NVDA was coming to test $400, where $SPY continued to make new lows of the day, and once $NVDA broke below $400 for a split second to stop everyone out of their long $NVDA positions, we watched as $SPY made the official low of the day trading at $411.63. Market conditions were looking extremely rough, with a significant amount of bearish sentiment in the markets, which was followed by some beautiful bullish momentum in the back half of the afternoon.

We watched as $SPY went from the official low of the day to rally almost 1% from the bottom to come up and test $416 before getting quickly sold back off into the close. $SPY ended the day trading at $412.55, down $5.00 for the day, or down approximately 1.2%, with an intraday bearish movement of -0.91%. It was an extremely tough day for the overall markets that did provide us with opportunities to trade, but more difficulties than anything.

I hope you all were able to capitalize on the opportunities that were presented to us and that you were able to realize some gains in the process. It was definitely an interesting time for the markets, but the day is behind us, and it’s for us to see what will happen here in the near future!

Let’s have some fun trading today and make the most out of everything!

Heatmap - $SPY 10/26/2023

Thoughts & Comments for Today, 10/27/2023

Today is going to be a fun day for the markets. With the way that everything is sitting right now, I believe there to be an amazing opportunity to allocate into the markets, but by doing so, you are taking on a significant amount of risk. After the movement we saw in the markets yesterday, there is going to be so much opportunity in the markets, but it is just a matter of is this time to attempt to capitalize on this opportunity or do we need to continue to wait a little bit longer before attempting to capitalize on it.

One level that I will continually watch over the next couple of days is $NVDA $400 for general sentiment in the markets. We are displaying signs of strength here from the bottom, but that can obviously shift in a matter of minutes. But if/when $NVDA breaks below $400 and retains that level, there is going to be a lot of confidence that will leave the markets, which will go on to negatively impact organizations that, like $NVDA, are higher risk / higher beta positions, like $TSLA, which will ultimately come down, impacting the larger markets.

Realistically, though, there is a significant amount of confidence, and we are due for a bounce in the markets. I would say there is a high likelihood that we will end the day green from the previous close, but it is just a matter of how high we will go in the process of everything. There are going to be many difficulties going up and being able to retain positions with confidence today, but assuming that the opportunities are presented to us to move up, and there is no sentiment attempting to cause us to go down, we can realistically get back up above $420 in a single trading day, and can easily go back to reclaim and test the daily baseline/conversion line resistance.

As I have been saying, do not attempt to be overly bullish or bearish or to be too optimistic or passive, but this is the time to look to take on some general risk and exposure. Attempting to allocate here, as I have been saying before, has an increase to general risks that are involved, but assuming that you are able to capitalize on the opportunity and limit your downside exposure, you will be in a great spot. Just make sure to continue to limit your downside risk, though, as there are a lot of risks in the current marketplace. Have stops set in place to limit your downside exposure and capitalize on the opportunities for a bounce in the markets.

For myself personally, my plans for today are to simply ride the momentum in the markets. This is one of those days that I personally feel a lot more comfortable and confident in allocating into the markets despite the increased risks that are involved with attempting to allocate right now. I will not increase my exposure a significant amount, but I do believe that this is the time to look to take on some extra risk, as you are going to be able to get some bullish exposure for relatively cheap, as $SPY is at these levels. I am also looking to sell some CSPs in the markets, but I am not certain where I want to enter at this point. It is just a matter of the general sentiment of the markets around open.

Make sure to practice safe risk management and limit your exposure at this time in the markets as a result of the downside potential we are seeing.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

HaiKhuu Proprietary Algorithm Report:

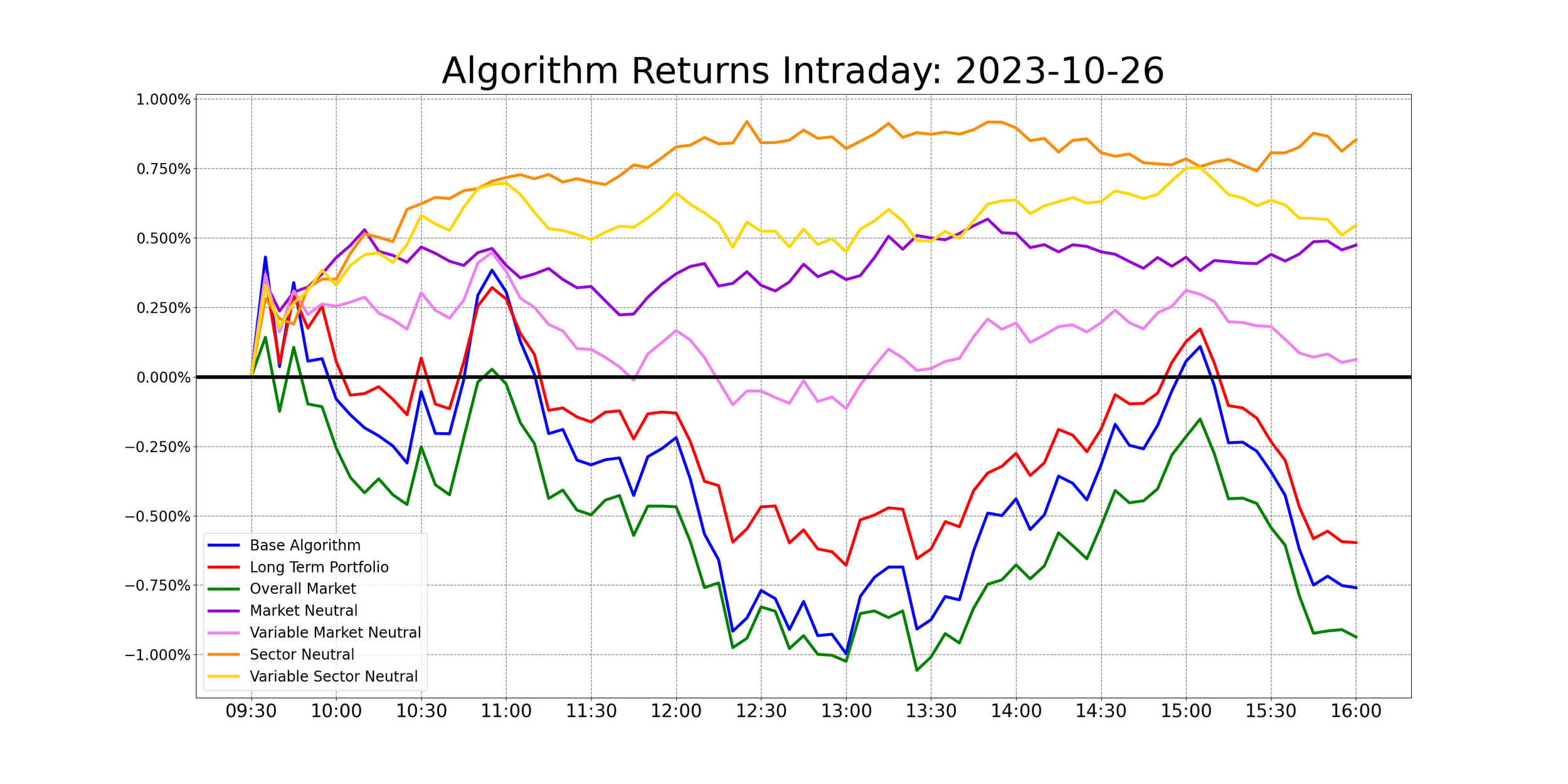

Yesterday was a tough day for the generalized systems. The neutral results worked out beautifully, generating a significant amount of gains while market conditions were not looking optimal, and everything did beat out the markets by a nice margin. It is just unfortunate to see results the way they are, but we take the wins when we can, and it’s great to see that everything outperformed the markets by a nice margin yesterday.

To get an in-depth analysis of our algorithms' performance, check out Asher’s Report!

The results of yesterday are as follows:

Baseline:

$SPY: -0.91%

Our Results:

Sector Neutral: +0.83%

Variable Sector Neutral: +0.53%

Market Neutral: +0.44%

Variable Market Neutral: +0.04%

Long Term Portfolio: -0.6%

Base Algorithm: -0.76%

As I’ve said before, we are running a live beta test with our newest algorithm. These systems outperformed previous systems, and we are excited to see what happens, but at the same time, we are not blindly endorsing entries into any of these positions. This is all still a live beta test, and we cannot guarantee its success or state that we have 100% blind confidence in our processes.

We do recommend you do some due diligence with any of these positions but actively watch and allocate when you personally have confidence that lines up with our systems.

The best way to allocate is to find a beta weight you are comfortable taking on in the short term and find an allocation from the list with a larger allocation %, as that is going to signify more confidence in the position versus a lower % allocation. As always, practice safe risk management and limit your downside risk by setting stops on the positions accordingly.

DISCLAIMER - This is not financial advice. Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. This is not a signal to buy or sell any equities, and we do not guarantee success. Take these at your own risk.

Algorithmic Alerts for 10/27/2023

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY, $F, $GM, $TSLA, $NVDA, $AMZN, $KO, $DIS

Position Opportunities:

Follow the market momentum

Limit your downside risk

Allocate into strong value organizations

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $DIS / $DG / $KO

Long-Term Auto Sector - $F / $GM

Economic News for 10/27/2023

Personal Spending/Income - 8:30 AM ET

PCE Index - 8:30 AM ET

Consumer Sentiment (Final) - 10:00 AM ET

Notable Earnings for 10/27/2023

Pre-Market Earnings:

Exxon Mobil (XOM)

AbbVie (ABBV)

Charter Communications (CHTR)

Chevron (CVX)

Autonation (AN)

Colgate Palmolive (CL)

Phillips 66 (PSX)

Booz Allen Hamilton (BAH)

Stanley Black and Decker (SWK)

AON Plc (AON)

Avantor (AVTR)

Wrap up

Overall, this is going to be a fun way to end the week. Make sure you practice safe risk management and limit your general exposure at this time, but look to continually capitalize on the opportunities that are presented to us. Watch out for downside risk in the markets, and do what you can to capitalize on the momentum in the markets.

Let’s end this week strong, and good luck trading today!