HaiKhuu Daily Report - 11/01/2024

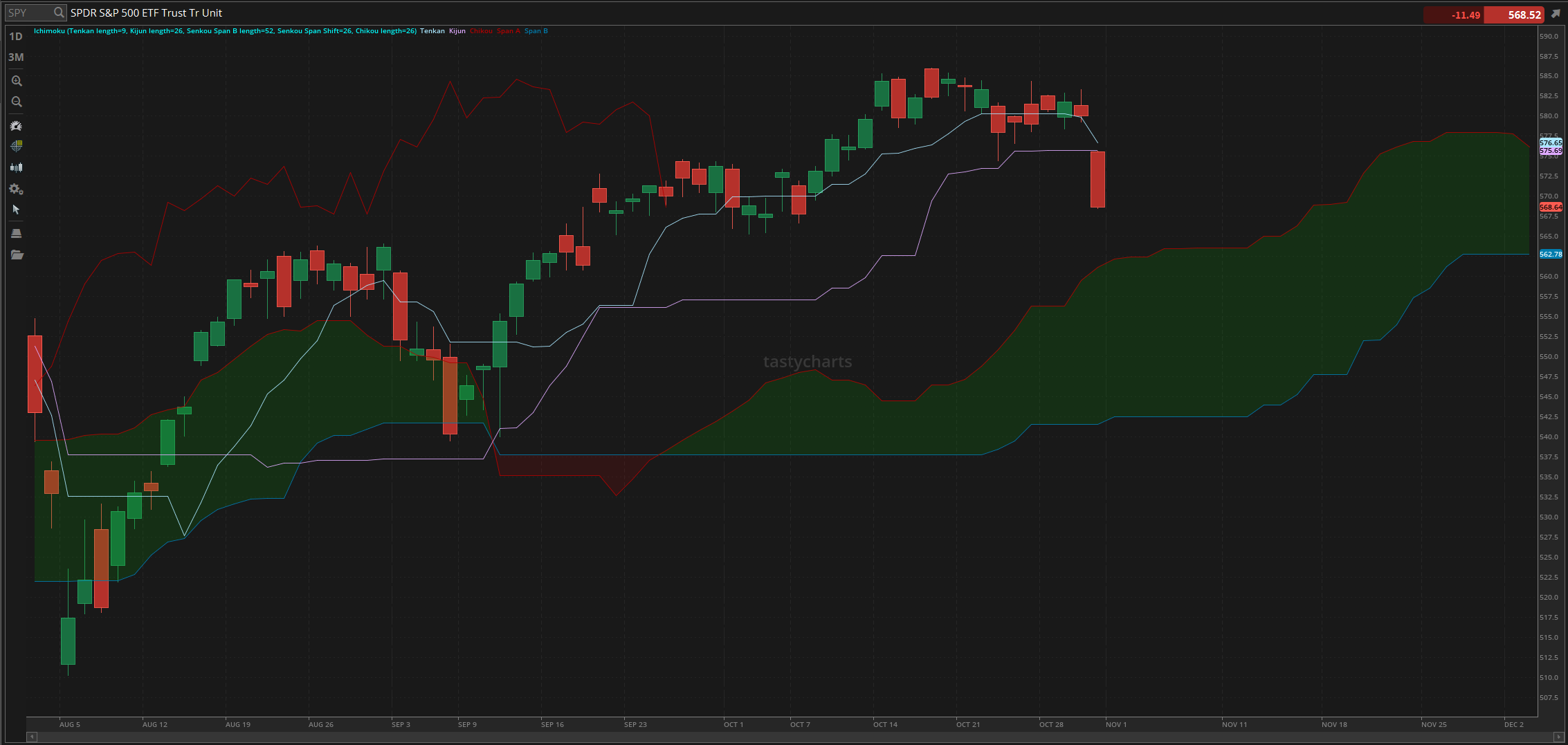

Good morning, and happy Friday!!! Wow, welcome to November. Markets look disgusting, traders are scared, and this will be an amazing time. We have just broken below the daily baseline support and are seeing the first signs of a reversal, which is scary but is going to set us up for what is hopefully an amazing time. Pre-market conditions are looking alright, as $SPY has moved back up above the $570 resistance level, but that does not mean much, as market conditions can change heavily between the time I am writing this report and the time markets close.

This is going to be a volatile day, and many traders have little confidence, so tread lightly. Many traders are going to be emotionally overtrading and realizing losses today. I am not saying this to scare anyone, but I genuinely feel that, unless markets suddenly reverse, many traders are going to over-trade today, attempting to make up for the losses generated yesterday. Please tread lightly and practice safe risk management in these conditions.

I’m excited about trading today, so let’s see what happens. T-3 Trading Days until the election!

Good luck trading today, and let’s end this week STRONG!

The updated $SPY daily levels are as follows:

Conversion Line Resistance: $576.65

Baseline Resistance: $575.69

Psychological Support: $560

Daily Cloud Support: $561.16

Thoughts & Comments from Yesterday - 10/31/2024

Yesterday was a spooky and disgusting way to spend Halloween. Markets were spooky and red, and many losses were generated. It was the worst single-day movement we’ve seen since August, resulting in a gap down in the markets, a lot of confidence lost, and much more fear generated.

We started the day with $SPY looking extremely weak, opening down $4 from the previous close, opening at $575.63, and watched as there was a significant amount of bearish momentum that made trading extremely inconsistent and difficult to do with confidence. We dropped right from the get-go, where the high of the day literally was the open mark, and watched as $SPY continually sold off throughout the entire day. We did watch as $SPY bounced slightly on at $570, but we continued to maintain that level for the majority of the morning, bouncing up slightly during lunch, but watched as we came back down towards the afternoon. Conditions in the early afternoon were not great, but we watched as $SPY continued to maintain $570 but chopped out many traders attempting to catch a breakout.

$SPY literally hit $570 before breaking out ever so slightly into power hour, where conditions continued to get slightly better... but only slightly. It made a relative high right under $572 before selling off again, ending the day with $SPY trading at $568.654, down $11.37 for the day, or down roughly 2%.

I will say again that yesterday was one of the worst days we've seen in a while on $SPY, and it has created a gap on the daily chart. I would love to watch as the markets recover and rally from here, but please continue to tread extremely lightly in these market conditions, as traders are going to have a difficult time trading with confidence. It was a gross day yesterday, so let's see what today has in store for us.

S&P 500 Heat Map - 10/31/2024

Thoughts & Comments for Today - 11/01/2024

Today is setting up to be an extremely confusing time. Conditions are going to be either amazing, as markets complete a full recovery, and that was an amazing buy-the-dip opportunity, or we are about to watch as market conditions weaken and traders get decimated in the process. I genuinely do not know where the markets are headed from here, and I am under the assumption that most other traders are in the exact same boat. There is going to be a lot of confusion in the markets today, resulting in inconsistent price action and volatility across the board. I am assuming that many retail traders are going to be emotional today as a result of the movement we saw in the markets yesterday. So please, just continue to remain level headed and rational right now, as there are going to be many traders that have a difficult time as a result of this sentiment.

I would not be overly aggressive in these market conditions, but I would be looking to take on some start risk and do what you can to make the most of these conditions. I do not know where the bottom is, but all I know is once we find it, that it is going to be an amazing dip-buying opportunity and provide us with some beautiful realized gains!

When you are confident and see signs of a reversal from the bottom, I think this is going to be a great time to attempt to allocate slowly into the markets. Again, I would wait until there are signs of a reversal and a confirmation from the bottom, but adding slowly has never killed anyone. Just make sure to practice safe risk management.

This is obviously not an ideal situation, but I would really love it if $SPY came down and bounced off the daily cloud. This is the first time I’ve made an openly bearish statement like this in a while, but in this case, we are able to watch the markets and judge accurately together in real time! I think there is an extremely low likelihood that $SPY does ultimately drop down to the daily cloud, but that is a place where I personally would be extremely confident and excited to allocate, assuming we get down there today.

For my allocations today, I will say that I do plan on being more passive. I was emotionally over-trading yesterday, and thankfully, no significant realized loss was generated, but I can say with no shame that the markets did cause me to emotionally overtrade. It happens to the best of us, and it is unfortunate, but it is just a part of life and a result of these conditions. I will take advantage of the momentum in the markets, assuming that we will be provided with some great opportunities to trade. Again, I am not attempting to be overly aggressive, but I will do what I can to make the most of these conditions!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY, $INTC, $AAPL, $AMZN, $RIVN, $TSLA, $NVDA, $BA

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $INTC/ $RIVN / $BA

Economic News for 11/01/2024 (ET):

Employment Report - 8:30 AM

Unemployment Rate - 8:30 AM

Hourly Wages - 8:30 AM

Notable Earnings for 11/01/2024

Pre-Market Earnings:

fuboTV (FUBO)

Chevron Corp (CVX)

Exxon Mobil (XOM)

Wayfair (W)

Dominion Energy (D)

Charter Communications (CHTR)

LyondellBassell (LYB)

Cardinal Health (CAH)

Wrap up

Hopefully, market conditions only continue to strengthen today, but you all know that genuinely anything can happen. So please continue to tread lightly and practice safe risk management in these conditions. Many traders are going to have an extremely difficult time realizing gains, while others are going to print money hand over fist. Please protect your bottom line, but at the same time, take on some risk and exposure and make the most out of these conditions!

Good luck trading, and let’s end this week strong!!!