HaiKhuu Daily Report - 11/07/2025

Good morning, and happy Friday. Man, this has been a disgusting week for the markets, but thankfully, it is over, and there are going to be opportunities for us here in the short term. I’m excited about these market conditions, but nervous about where they'll take us. If you are attempting to trade today, please practice safe risk management and mitigate as much risk as possible, as many traders will have an extremely difficult time continuing to navigate these conditions. This is not your fault; these market conditions are volatile and tough, but allocating incorrectly at the wrong times is on the individual.

Just keep making smart choices when actively trading, and do what you can to minimize your risk. Traders are going to have an interesting time trading, but this is one of those times when they will be given opportunities to scalp and realize some gains.

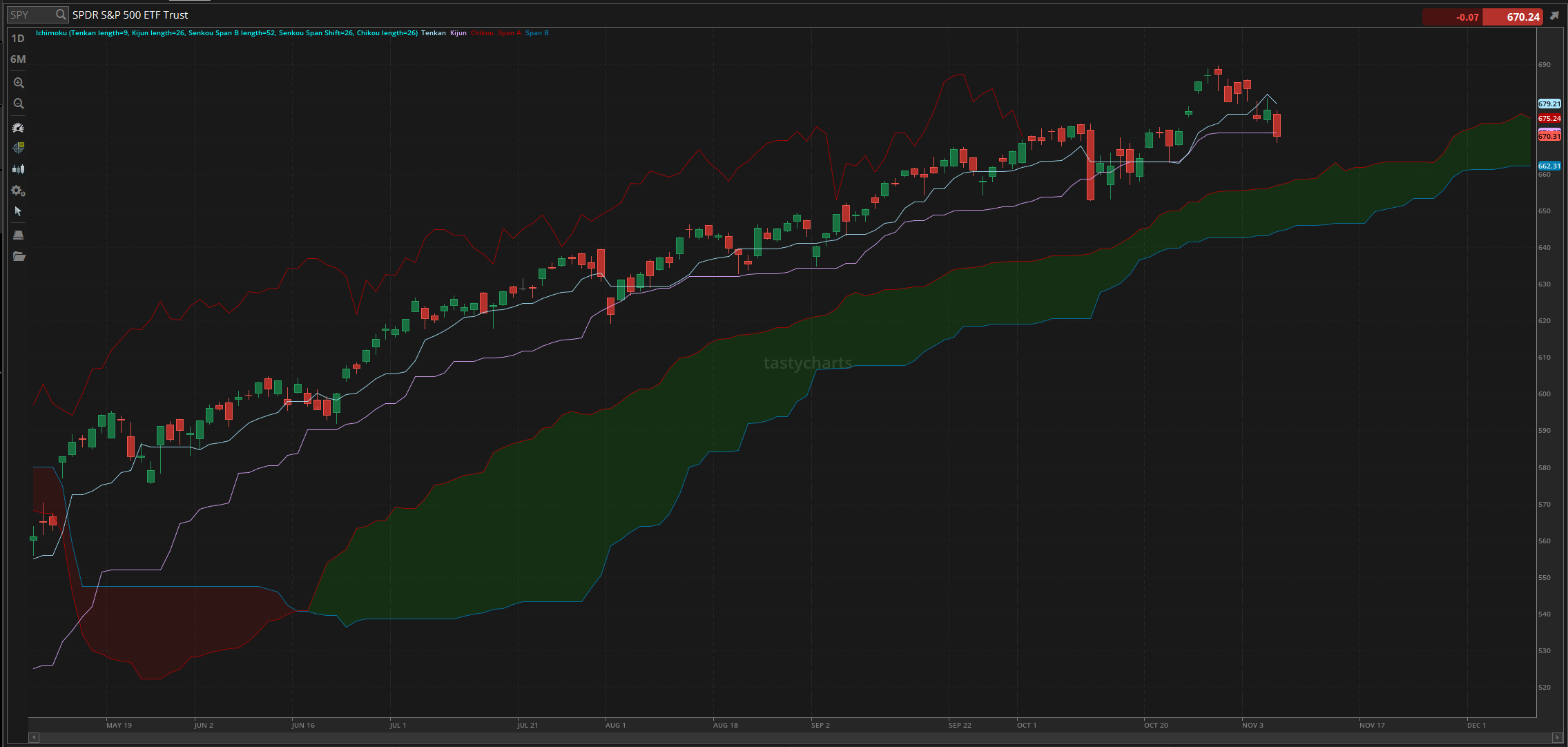

Again, I will state that I still believe we need to see $SPY drop to $660 before we have a genuine breakout in the markets, but that is just my thoughts and two cents.

Regardless of what you do today, please make sure to practice safe risk management and mitigate as many risks as possible. So, let’s have a lot of fun and realize a significant amount of gains while attempting to trade today.

Good luck trading today, and let’s see where $SPY takes us!

The updated $SPY daily levels are as follows:

Conversion Line Support: $679.21

Baseline Support: $671.27

Psychological Support: $660

Daily Cloud Support: $657.02

Thoughts & Comments from Yesterday - 11/06/2025

Yesterday was another absolutely disgusting day for the overall markets. Overpriced tech plays continued to decline as the broader markets sold off, taking many traders hostage in a very short period of time. I hope that you traders all were able to capitalize on the bearish momentum in the markets yesterday and have been listening to our warnings. It was definitely a tough day yesterday, but life is like that at times. Hopefully, any losses were not significant, and that you all will be able to move forward from this with ease. Regardless, welcome to the markets!

So, we started yesterday with $SPY looking alright. We started the day with $SPY trading at $676.54, looking alright early in the morning only opening down ever so slightly, and watched as from the get go, $SPY essentially fell throughout the entire morning, wiping out $8 on $SPY in the process as $SPY went on to go and make the official low of the day trading at $668.72 during the lunch time session.

Thankfully after bouncing from the bottom, markets started to display more strength going into the afternoon where we watched as $SPY recovered slightly to break back above $673, and held that level for literal moments before we watched as $SPY came back down once again leading into close where we went on to officially end the day with $SPY trading at $670.31, down $7.25 for the day, or just shy of 1.1%.

I am not saying that yesterday was a good day for the markets, nor saying that the markets were favorable (except for the bears). We have warned you about the weakness and confusion in these market conditions, so now is the time when you get to sit back, reflect, and enjoy the confusion, fear, and volatility. Market conditions are going to become better in a short period of time, but the question is will YOU have the solvency to survive to that day. Thats the interesting part.

So, let’s see where the markets take us today and have some fun!

S&P 500 Heat Map - 11/06/2025

Thoughts & Comments for Today - 11/07/2025

This is going to be an interesting way to end the week. Markets have continued to come down in the pre-market session, and as I warned you all, $660 is incoming. Many traders are starting to panic as a result of the selling over the past couple of days, and again, I am here to tell you: you might be right. But I think you are wrong. As I have warned — and as we’ve been predicting —markets have only continued to show signs of weakness, and traders are fearful at this time. This is an amazing time to be a trader, and a terrible time to be a trader. It just comes down to you, your allocations, and how confident you are in those said allocations.

Short-term traders & scalpers are given opportunities to capitalize on short-term moves, while investors watch as their holdings drop from the top. Investors are getting an amazing investment opportunity that also makes sure they don’t have to worry about navigating the short-term confusion and chop in these conditions. I am not saying that these conditions are perfect, nor am I claiming that we should love every aspect of it, but this is me telling you all that people are making money in these market conditions, and opportunities are amongst us. It is just up to you to make strong positions that you are confident in, and hold positions that you are comfortable with.

Many people are going to continue to get caught in this short-term bearish momentum, and many will ultimately end up selling their positions for less gain —or possibly incurring a loss — if they bought at the top. This is why, for the past month or so, I have been against being hyperbullish; traders are getting clapped as many tech companies trade at extreme premiums at all-time highs.

So tread lightly and be careful if you are attempting to buy the dip, as I think you may still be buying too early. At the same time, this is one of those times when I am going to advise people to start buying the dip. Opportunities are amongst us, we are going to continue to see more downside risk, but at the same time, with the way the markets are moving and the confidence that we are starting to see, it would not surprise me in the case that when the markets break out, it will happen extremely fast, take many traders by surprise and leave many people who thought they had more time to buy and average in, to be left in the dust and try to FOMO back in around $SPY $670—680 before we break out towards $700.

Again, I just have to say that my market speculation should not be considered financial advice or a signal to buy or sell any positions. I am just a random person with a tinfoil hat on, predicting where the US equity market is headed. I may be right, I have been right, but just remember, I may be wrong. Be smart, practice safe risk management, and just survive the next couple of days, then we are going to have a lot of fun. So, let’s make the most out of today, and print some cash.

If I see any opportunities or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $ORCL, $TSM, $INTC, $NVDA, $TSLA

Speculative: $PTLO, $RIVN, $KHC, $BUD , $ADT

Long Dividend: $JEPI

Long Investment: $PTLO, $BUD, $STZ, $CMG

Short: $BRK/B

Crypto: SOL

Economic News for 11/07/2025 (ET):

U.S. Employment Report - 8:30 AM

U.S. Unemployment Rate - 8:30 AM

U.S. Hourly Wages - 8:30 AM

Dallas Fed President Lorie Logan Speaks - 9:30 AM

Consumer Credit - 3:00 PM

Notable Earnings for 11/07/2025:

Pre-Market Earnings:

Constellation Energy (CEG)

Canopy Growth (CGC)

American Axle & Manufacturing (AXL)

Fluor (FLR)

Brookfield Asset Management (BAM)

Deleck US Holdings (DK)

Duke Energy (DUK)

AMC Networks (AMCX)

Wrap up

Hopefully, the markets are forgiving and give us some opportunities to capitalize on some confusion before the markets ultimately go crazy and break out or sell off. Agassin, I hate saying this, but I genuinely believe $SPY $660 before we break out. Let’s see where the markets take us. Just tread lightly, practice safe risk management, and make the most out of today! We should have some fun, realize some gains, and have some fun.

Good luck trading, and let’s end this week strong!!!